Pan-European marketplace for savings products, Raisin has become the poster child of Fintech disruption as it managed to convince 75,000 investors to put more than €3 billion into savings accounts held at foreign banks. We spoke with Tamaz Georgadze, co-founder and CEO, who explained to us why consumers like Raisin’s proposition and how the company will continue to thrive as an independent marketplace.

Not long ago, the accepted wisdom was that banking was as local a trade as perishable food distribution. Even if a German consumer from Stuttgart knew, which was most probably not the case, that a Polish bank could give him a better rate for his savings, he would never have thought of opening a deposit account there, not at a distance, not with the language barriers and the paper trail.

It’s one thing to walk into the local branch of a well-known international bank like Citibank or HSBC, it’s another thing altogether to send €20,000 of your savings online to a Bulgarian bank or the Portuguese subsidiary of a Chinese Bank you never heard of before and will never visit! Yet, this is exactly what Raisin’s customer are doing.

Raising Interest

Raisin, which stands for “raising interest” was founded in 2013 by three former McKinsey consultants, Frank Freund, Michael Stephan, and Tamaz Georgadze (the latter a partner) who are now respectively the CFO, COO and CEO of the company. The company started as SavingsGlobal in Germany with a German-speaking site Weltsparen.de which allows German consumers to open deposit accounts at foreign banks offering a higher interest rates than those available in Germany.

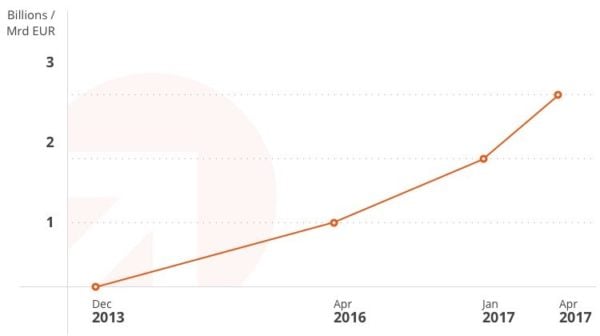

Within a little more than two years, the marketplace won over 35,000 customers who deposited more than €1 billion into foreign accounts through the platform. Comforted by this success, the founders decided to open the scheme to all European consumers.

In April 2016, they launched an English speaking Pan-European platform, Raisin.com, followed shortly thereafter by a French localized site, Raisin.fr, and in December by a Spanish localized site Raisin.es. In April 2017, the company passed the €3 billion mark.

To fuel its expansion, Raisin raised $64 million in three rounds of equity funding from investors such as Thrive Capital, Index Ventures and Ribbit Capital.

Cross-Border Open Banking. Raisin is two steps ahead of the game.

Firstly, it is an Open Finance marketplace which enables customers to choose among nearly 150 saving products from more than 30 banks in 15 countries. Unlike a comparison site, the platform is not a simple lead generator who sends customers elsewhere. Using application programming interfaces (APIs), Raisin offers a single account opening and management interface to each of the banks it partners with.

“Register once, transfer the funds to your free Raisin Account, then open and manage your term deposits with our partner banks through a single Online Banking System.”

Secondly, it does that internationally. Raisin is one those Fintechs like Transferwise, N26, LendIt, Younited Credit, and before them PayPal, which create a global market where there were only fragmented local markets. Doing this, Raisin exposes the strong discrepancies that persist in Europe, despite the European Union, and helps European consumers take advantage of them. The upside is big, as explained in Raisin’s Interest Radar:

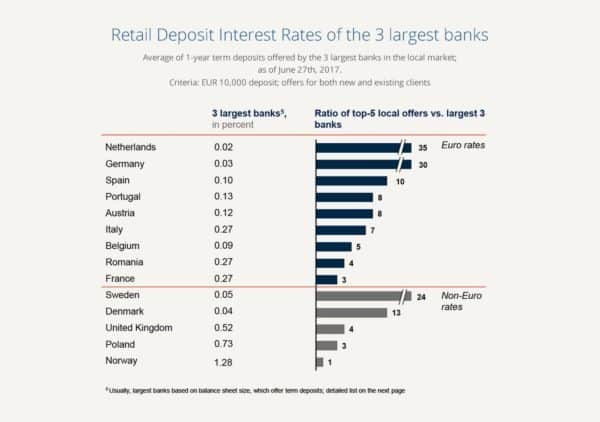

“Data shows that banks from Italy (1.89%), Portugal (1.08%) and France (0.98%) offered the best term deposits with a maturity of one year in the euro zone. The most attractive term deposits with maturities of three years were available in Italy (2.44%), France (1.22%) and Austria (1.14%)… The largest banks from the Netherlands (0.02%) and Germany (0.03%) offered by far the worst interest rates in the euro zone. By doing so, they also created the largest gaps between their offers and those of their top 5 local counterparts. On the other hand, major banks from Italy and France still offered average interest rates of 0.27%.”

We spoke with Tamaz Georgadze, the founder & CEO of Raisin

We spoke with Tamaz Georgadze, the founder & CEO of Raisin

Tamaz Georgadze has an impressive résumé. He was only 12 years old when he graduated from high school, which gave him time to study to his heart’s content and explains why he holds degrees in law and International Economics, as well as a PhD in agricultural economics.

Tamaz gained a unique understanding of the banking industry during his 10-year tenure at global strategic consultancy McKinsey, where he advised some of the largest retail, universal, and wholesale banks of Europe and Asia.

Tamaz, your company received many distinctions and Raisin is talked about in the industry as potentially the next Fintech unicorn, how do you explain this success?

We have been quite ahead of the curve. We started the topics of partnership between banks and non-banks and API integration. The topic is very popular now, but very few people actually do it. There are very few use case. Only a few personal finance management app providers such as the French Linxo and Bankin and challenger banks like N26 and Fido.

We started it long before it became in vogue. We’re still ahead. We heard from many banks who are themselves digital banks that we have the cleanest API on the market.

If you look at our volumes and traction, we are growing faster than Wealthfront in their time. We just passed the €3.5 billion mark.

Our customer success comes from the fact that we’re leveraging bank trust. We are giving to customers access to banks which fall within the scope of the EU deposit guarantee scheme which protect savings up to €100,00. At the same time, we also give consumers choice, the opportunity to shop around. We can grow faster than other Fintechs because our offering is more familiar to consumers.

Also, our success is “made in Germany,” meaning our business model is not a copy-cat from a US model. It is based on seizing an actual opportunity.

Lastly, I would say that we’re good people. People know us, we’re well connected.

How do you recruit new customers? Doesn’t Germany remain your main market by far?

Indeed, Germany still represents 90% of our business. Our customer acquisition in Germany has 3.5 years of history, whereas our Spanish site is only 6 months old.

The deposit business in itself is more favorable for us in Germany. German consumers love deposits and love to compare rates. The additional liquidity created by the European quantitative easing program has landed in specific geographies and large banks instead of peripheries and small banks. As a result, German large banks are overliquid and cannot pay a positive savings rate. This opens a huge window of opportunity for us. Germany is a €2 trillion savings market!

The deposit business in itself is more favorable for us in Germany. German consumers love deposits and love to compare rates. The additional liquidity created by the European quantitative easing program has landed in specific geographies and large banks instead of peripheries and small banks. As a result, German large banks are overliquid and cannot pay a positive savings rate. This opens a huge window of opportunity for us. Germany is a €2 trillion savings market!

Other markets are tougher, due for example to the competition from specific products such as the French tax-exempted savings account Livret A, but there still is demand for deposits.

Our main channel of customer acquisition in new markets is online affiliation and comparison sites. But the older the market, the more organic traffic we have. In Germany, customer referral is our main channel of acquisition and the bulk of our traffic is organic.

How can you hold your position as a marketplace in the face of competition from banks? Will you be one of those non-banks that ends up absorbed by a traditional bank?

We very much believe in our B2C proposition, in the meaningful combination of choice and trust. We need to create a nice shopping experience, a curated shopping experience with information, guidance, and simplicity.

This is the way we are going. We believe that we are the only ones who can do it because we are a marketplace ‒ a position that is difficult for a bank to hold. We do not have any incentive to promote any offer from a particular supplier. It is a challenge as we build more volume. But we carefully monitor ourselves.

We do a lot of quantitative research. Our Net Promoter Score lies between 43% and 45%. Customer reviews on third-party site Trustpilot gives us a rating of 9.2 out of 10. Our model only survives if we do that.

To give you one example: Our call center wanted to be measured in terms of productivity such as time spent by call, number of tickets solved by day, etc. We said: “No. Take all the time you need for each customer.” It is the sum of very simple things, a lot of attention to the customer experience that creates the word of mouth, the 93% recommendation rate we get from nearly 100,000 customers.

What are your development plans?

We want to broaden our API solution, close more partnerships with small and large banks, and reach the number of 45 partner banks by year end. We also want to offer SME products. We want to enhance the guided part of shopping by offering simple investment products, simple and low cost. We don’t want to offer only new instruments but also themed propositions that create a broad yet simple offering and good value for money.

It is a lot of work. Including consolidation and regulatory work such as AML. Not trivial. Automation of the interface is not automation of the process.

Therese Torris, PhD, is a Senior Contributing Editor to Crowdfund Insider. She is an entrepreneur and consultant in eFinance and eCommerce based in Paris. She has covered crowdfunding and P2P lending since the early days when Zopa was created in the United Kingdom. She was a director of research and consulting at Gartner Group Europe, Senior VP at Forrester Research and Content VP at Twenga. She publishes a French personal finance blog, Le Blog Finance Pratique.

Therese Torris, PhD, is a Senior Contributing Editor to Crowdfund Insider. She is an entrepreneur and consultant in eFinance and eCommerce based in Paris. She has covered crowdfunding and P2P lending since the early days when Zopa was created in the United Kingdom. She was a director of research and consulting at Gartner Group Europe, Senior VP at Forrester Research and Content VP at Twenga. She publishes a French personal finance blog, Le Blog Finance Pratique.

We spoke with Tamaz Georgadze, the founder & CEO of Raisin

We spoke with Tamaz Georgadze, the founder & CEO of Raisin