Earlier this month the Office of Comptroller of the Currency (OCC) fired off a counter salvo in the legal battle regarding the OCC Fintech Charter. The Conference of State Bank Supervisors (CSBS) launched an attack against the OCC this past spring. Many Fintech industry participants viewed the proposed OCC Fintech Charter as a first step, not the last word.

CSBS President and CEO John Ryan commented at that time;

“If the OCC is allowed to proceed with the creation of a special purpose nonbank charter, it will set a dangerous precedent that any federal agency can act beyond the legal limits of its authority. We are confident that we will prevail on the merits.”

As one may expect, the OCC and acting Comptroller Keith Noreika, are fighting back. In a motion to dismiss the lawsuit, the OCC states;

As one may expect, the OCC and acting Comptroller Keith Noreika, are fighting back. In a motion to dismiss the lawsuit, the OCC states;

“The Complaint by the Conference of State Bank Supervisors represents a fatally premature attempt to invoke the jurisdiction of this Court to remedy a speculative harm that CSBS alleges may arise from future action by the Office of the Comptroller of the Currency – action that the OCC may never take. The CSBS Complaint challenges:

(1) provisions of an OCC regulation amended in 2003 to authorize special purpose charters that have, to date, never been used to charter a bank; and

(2) a series of public OCC statements as part of an ongoing policy initiative that CSBS alleges to be a final decision by the OCC to make charters available to “nonbank” financial technology (“fintech”) companies.

CSBS’s denomination of these public statements as a “Nonbank Charter Decision,” Compl. ¶ 52, is wrong in two fundamental respects: it ignores that the proposal contemplates a form of national bank charter and that no final decision has been reached.”

The Motion continues to explain that the CSBS draws upon White Papers and speeches and states the OCC has not yet reached any decision as to whether or not it will offer a Special Purpose National Bank (SPNB) charter tfor an entity that may not take deposits and provides other financial services. The OCC concedes it is investigating a national charter to “allow the banking sector to take advantage of new ideas and new technology.”

So where does this all go?

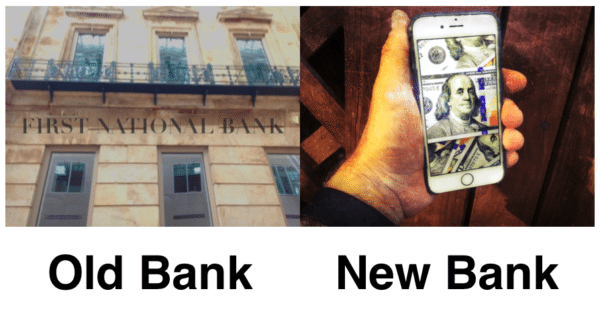

First, there must be a vehicle for Fintech’s to provide services nationally without having to kiss the ring of each and every state regulator. The current approach is anachronistic and undermines the needs of consumers and businesses. Everyone (should) understand this truism. The action by the CSBS is more about a group of public officials attempting to maintain their analog relevance in a digital universe. If the OCC does not provide an appropriate vehicle for Fintech’s to thrive then Congress must act. (Yeah, I know. Good luck with the pols doing anything beyond naming a post office.)

As for the Courts, it is hard to see them pursuing a case where nothing has yet occurred with an argument based on what the OCC may do in the future. Not exactly a good use of tax dollars either.