Elio Motors, Inc. (OTC QX:ELIO), the first Reg A+ issuer to list on a public marketplace following a crowdfunded offering, has filed a Form S-1 with the SEC indicating its intent to sell additional shares in the company. Elio also revealed its intent to list its common stock on the NASDAQ Global Market under the ticker symbol “ELIO.”

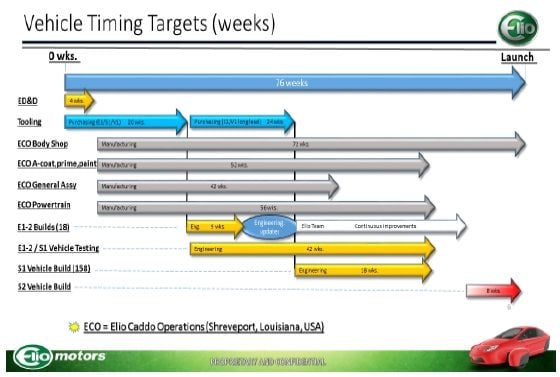

Elio is a company that proposes to manufacture a three wheel gas vehicle that is inexpensive to buy and use. While the company has created several prototypes it has missed multiple deadlines to launch a full scale manufacturing operation. Elio has also been challenged by local authorities regarding the proposed manufacturing facility in Louisiana.

In its most recent financial update, Elio revealed it was in dire need of more money to be able to fulfill its vision of a new form of transportation. Elio’s most recent update indicates:

In its most recent financial update, Elio revealed it was in dire need of more money to be able to fulfill its vision of a new form of transportation. Elio’s most recent update indicates:

“With much of the vehicle engineering completed, our engineering simulations suggest that the important vehicle performance milestones can be achieved. As of June 30, 2017, $62.3 million has been invested in vehicle engineering and development, of which $26.3 million was in the form of shares of common stock granted and the assumption of liabilities of Elio Engineering, Inc. dba ESG Engineering. Our prior Reg A+ offering raised funds of approximately $16.0 million which were used to further design and build initial engineering prototypes. At this point, we currently estimate we need to raise approximately $376.6 million of new investment (of a total budget of $531.2 million) to fund production activities through cashflow positive. This amount is exclusive of (a) $110.5 million which we assume will be obtained through additional reservation deposits, (b) sales margin of $44.1 million which we assume will result from our initial customer deliveries of the Elio. We note that as we are in the prototype build stage of development, the amount that we need to raise may change.” [Emphasis added]

The share offering will most likely dilute existing shareholders. Investors who purchased shares during the Reg A+ IPO and continue to hold shares have experienced a dramatic decline in share value.

The number of shares to be offered and the price range for the proposed offering have not yet been determined. Drexel Hamilton LLC will serve as lead manager in the offering.

Have a crowdfunding offering you'd like to share? Submit an offering for consideration using our Submit a Tip form and we may share it on our site!