Just days after launching its equity crowdfunding campaign on Seedrs, UK-based insurtech Wrisk has successfully secured its initial £500,000 funding target from more than 300 investors.

As previously reported, Wrisk wants to shake up the antiquated insurance industry with their smartphone app that makes purchasing insurance and filing claims a breeze. The company stated it has already secured partnerships with global brands such as Munich RE, BMW, and Hiscox. Early investors include Oxford Capital, QIC, Hiscox and multiple angel investors. Last year, it was also selected to join the 2016 BMW Innovation Lab – the first ever Fintech business incubator in the automotive sector. Co-founders Niall Barton and Darius Kumana recently revealed:

As previously reported, Wrisk wants to shake up the antiquated insurance industry with their smartphone app that makes purchasing insurance and filing claims a breeze. The company stated it has already secured partnerships with global brands such as Munich RE, BMW, and Hiscox. Early investors include Oxford Capital, QIC, Hiscox and multiple angel investors. Last year, it was also selected to join the 2016 BMW Innovation Lab – the first ever Fintech business incubator in the automotive sector. Co-founders Niall Barton and Darius Kumana recently revealed:

“Insurance – the idea of sharing the loss of one against many – is a great idea, but frankly it’s embarrassing how badly it’s executed. We believe that consumers deserve better, so we’re giving insurance a much-needed digital upgrade. Wrisk will truly transform the user’s experience of buying, updating and claiming on their insurance. And while it’s no easy task, we’re delighted that household names such as Munich Re, Hiscox and BMW are willing to lend their support and help us realise our vision. We are also extremely excited to offer our future customers the opportunity to own shares in Wrisk through Seedrs, and to play a part in shaping our ambitious future.”

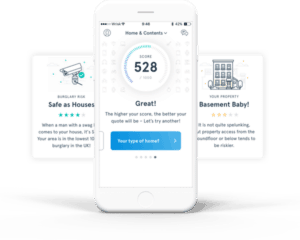

The Wrisk team is currently working on an app for consumers to buy different types of insurance, which includes motor vehicles, travel, home, and health insurances.

“Wrisk is about more than just buying insurance – it’s about managing and understanding your risk. Developed using advanced data science and actuarial techniques, our unique Wrisk Score is like a credit score for personal risk, enabling better, more transparent pricing. By gathering data from connected tech, we stay accurate without being annoying. By giving customers control of what they share, we can be clever without being creepy.”

Funds from the campaign will be used to continue the app’s development. The app will be launched in the first quarter of 2018 starting with content insurance and then followed by motor insurance later in the year. The campaign is set to close later this fall.

Have a crowdfunding offering you'd like to share? Submit an offering for consideration using our Submit a Tip form and we may share it on our site!