The UK can no longer rely on “feeble” warnings to consumers from its securities regulator and should swiftly extend existing legislation to govern the cryptocurrency and digital asset sector in country, says a Parliament Treasury Committee established in February to examine the matter.

After doing its own study of risks and opportunities in the sector, the committee considered 53 written submissions and held three “oral evidence sessions” to arrive at its conclusions published in an online report.

Presenters of oral evidence included:

- Ryan Zagone, Director of Regulatory Relations, Ripple

- Dr Grammateia Kotsialou, Researcher, King’s College London

- Marco Santori, President and Chief Legal Officer, Blockchain

- Iqbal Gandham, Managing Director, eToro and Chairman, Crypto UK

- Obi Nwosu, Chief Executive Officer, Coinfloor

- Izabella Kaminska, Editor, The Financial Times Alphaville.

- David Geale, Director of Policy, Financial Conduct Authority (FCA)

- Martin Etheridge, Head of Notes Operations, Bank of England

- David Raw, Deputy Director of Banking and Credit, HM Treasury

The Parliament Committee found that, so far, “well-functioning cryptocurrencies currently exist only as a theoretical concept,” because of slow processing speeds and limited merchant adoption.

The Committee advised use of the term “crypto-assets” as more accurate and, “more helpful and meaningful in describing Bitcoin, and the many hundreds of other ‘altcoins’ that have emerged over the past decade.”

The Committee called arguments that “crypto-assets” will extend financial inclusion “unconvincing,” and does not believe crypto assets can meaningfully replace banking infrastructure:

“Efforts to further financial inclusion are best focused on reducing the number of people without access to bank accounts, rather than increasing the numbers with access to crypto-assets.”

While acknowledging that blockchain tech may help enhance trust in data systems, the committee was also skeptical of the ‘industrial-panacea’ hype surrounding blockchain:

“(B)lockchain should not be pursued for its own sake… (A)lthough small scale uses for blockchain may exist—the Committee has not been presented with any evidence to suggest that universal applications of the technology are currently reliably operational.”

Risks to investors, especially retail, were found to be significant because:

- “Crypto-assets have no inherent value.”

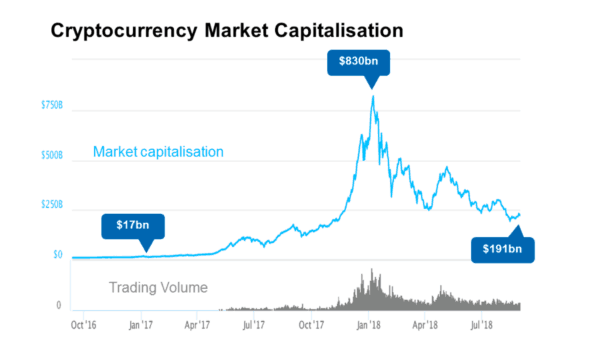

- “In the absence of any market fundamentals, their prices fluctuate according to sentiment….causing far higher volatility than other asset classes, exposing investors to larger potential gains, but correspondingly greater risk of loss.”

- exchanges are often hacked

- there is no deposit insurance at exchanges

- investors who have lost control their private keys have lost their funds

- risky and unregulated ICOs are accessing investors by claiming they are a “utility” product and not investments

- “Crypto-asset markets are particularly vulnerable to manipulation, and they fall outside the scope of market abuse rules.”

Nonetheless, “Crypto-assets have been embedded in certain pockets of society and industry,” and are, “likely…here to stay,” meaning the industry can no longer be properly guided by “feeble” warnings to consumers from the Financial Conduct Authority (FCA):

“The FCA’s consumer warnings are a feeble corrective to advertisements—on social media, billboards, trains and taxis—that only emphasise the upside opportunities of crypto-asset investing. The advertisements for crypto-asset investing are clearly misleading to consumers…The FCA needs more power to control how crypto-exchanges and ICO issuers market their services, by bringing the activities they perform into the regulatory perimeter.”

The committee then called UK policymakers’ wait-and-see approach “not sustainable”:

“The UK Government and financial services regulators appear to be deciding whether they will allow the current ‘wild west’ situation to continue, or whether they are going to introduce regulation. The current ambiguity surrounding the Government’s and the regulators’ positions is clearly not sustainable.”

In the committee’s eyes, the most efficient way to regulate would be to extend current Regulated Activities Orders to encompass the crypto sector. Legislating from scratch at this point would only increase the risk to consumers and compromise market integrity:

“…(G)iven the growing risks surrounding crypto-assets and subsequent consumer detriment, the introduction of regulation should be treated as a matter of urgency.”

You may download the UK Parliament Treasury Committee report on crypto-assets here.