Bank of England and HM Treasury Release Response to Consultation on Digital Pound

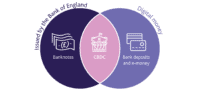

The Bank of England and HM Treasury have published their response to the consultation on a digital pound that was launched in February 2023. No final decision has been made “to pursue a digital pound – also called a central bank digital currency (CBDC).” Work… Read More

Read more in: Blockchain & Digital Assets, Global, Politics, Legal & Regulation | Tagged bank of england, consultation, digital pound, europe, feedback, hm treasury, uk, united kingdom