According to Innovate Finance‘s new report 2018 FinTech VC Investment Landscape, investment in UK Fintech rose by 18% to $3.3 billion in 2018. Some additional highlights from the report include:

- Growth private equity investment rose 57% to $1.6 billion, while venture capital dipped to $1.7 billion as the UK FinTech sector enters a new stage of its growth journey, ahead of its peers in Europe.

- The UK kept its position as a world leader, but ranked third globally in VC investment behind China and the US.

“It is very encouraging to see that investment continues to grow in the UK FinTech sector, reaffirming its position as a leading global financial and technology centre,” stated Innovate Finance CEO Charlotte Crosswell regarding the new report. “The UK has a unique position across financial services, technological innovation, regulators and government which all play a crucial role in this impressive growth journey. However, we should not be complacent as new challenges lie ahead; we must focus on growing our talent and capital pipeline across the UK, to ensure sustainable and inclusive growth in the future.”

“It is very encouraging to see that investment continues to grow in the UK FinTech sector, reaffirming its position as a leading global financial and technology centre,” stated Innovate Finance CEO Charlotte Crosswell regarding the new report. “The UK has a unique position across financial services, technological innovation, regulators and government which all play a crucial role in this impressive growth journey. However, we should not be complacent as new challenges lie ahead; we must focus on growing our talent and capital pipeline across the UK, to ensure sustainable and inclusive growth in the future.”

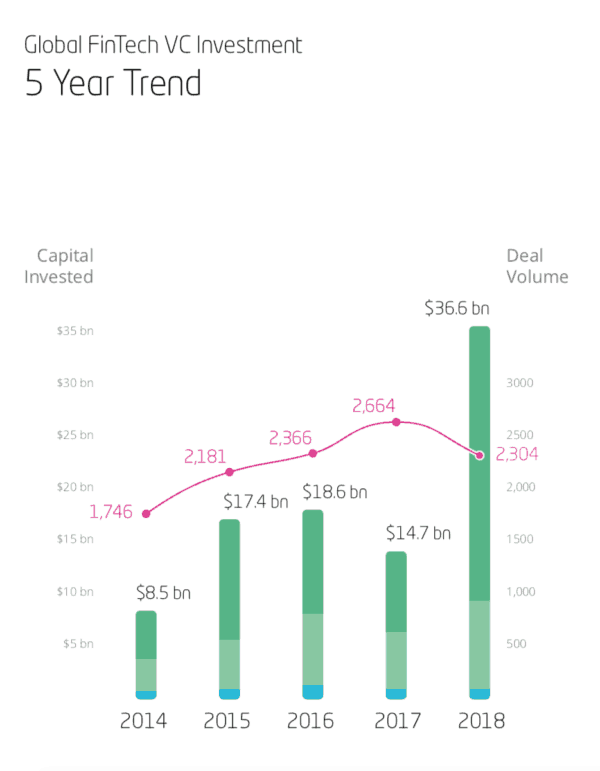

Global VC investment in FinTech in 2018 reached a record $36.6 billion across 2,304 deals, a 148% or 2.5x increase year over year, according to the new report. VC and private equity investment in the UK FinTech sector rose to a record $3.3 billion in 2018, up 18% year-on-year, the Innovate Finance report shows. Below please see one of the several informative graphs included in the report.

Growth private equity investment rose 57% to $1.6 billion, while venture capital dipped to $1.7 billion as the UK FinTech sector enters a new stage of its growth journey, ahead of its peers in Europe, said the report.

The UK ranked third globally in terms of venture capital invested behind China and the US. Within Europe, the UK continues to dominate followed by Germany ($716 million and 48 deals) and Switzerland ($328 million and 40 deals).

Which FinTechers secured the most during their funding rounds? Chinese Ant Financial $14 billion fundraise was a record in VC investment, representing 38% of all FinTech VC investment in 2018. China and the US dominate with the largest deals of the year. JD Digits came in second with $1.938B raise, followed by US tech platforms Dataminr ($392M), Oscar ($375M) and Robinhood ($363M).

“The most prominent verticals include payments (Ant Financial, JD Digits and Stripe), lending and financing (Ant Financial, Dianrong, Ribbon, and Tradeshift) as well as insurance (Oscar, Wefox and PolicyBazaar),” noted the report. “Deal sizes continue to increase, with the median deal size at $290 million in 2018 compared to $203 million in 2017.”

“The most prominent verticals include payments (Ant Financial, JD Digits and Stripe), lending and financing (Ant Financial, Dianrong, Ribbon, and Tradeshift) as well as insurance (Oscar, Wefox and PolicyBazaar),” noted the report. “Deal sizes continue to increase, with the median deal size at $290 million in 2018 compared to $203 million in 2017.”

Revolut’s $250M fundraise ranked among the top ten largest global VC deals of 2018. Monzo, EToro, Liberis, and BitFury were also among the UK’s top five deals, each raising over $80 million. Challenger Banks reportedly took the lion’s share of VC investment at 27% of the total, followed by Personal Finance and Wealth Management (19%), Alternative Lending and Financing (18%) and Blockchain and Digital Currencies (10%).

The UK remains a competitive investment destination with 50% of investment flowing in from overseas, largely from North America (25%) and Europe (18%).

“Within Europe, over half of the top fifteen venture capital deals in2017 and 2018 occurred in the United Kingdom,” according to the report. “2018 also saw a record amount of capital fundraised by challengers and banking platforms (Revolut, N26, Monzo, SolarisBank, and Monese) as well as in blockchain and digital currencies (SEBA Crypto, Dfinity, BitFury and Paxos).”

Is there light in the Dark Ages for women?

Is there light in the Dark Ages for women?

Just 6% of deals had a female founder, representing only 3% of the total capital invested in 2018. These findings emphasize the strong need for greater diversity and fairer access to investment. More needs to be done to ensure the sector has access to the widest pool of talent and capital to grow sustainably and inclusively in the future, and across the entire UK economy.

London continues to be the center for UK FinTech, with over 80% of FinTech startups receiving venture capital headquartered in London, claiming over 90% of capital invested. The sector will need to consider how to increase its reach across the UK to tap into the competitive advantage of the wider UK economy.

Founded in 2014 and supported by the City of London and Broadgate, not-for-profit Innovate Finance aims to accelerate the country’s leading position in the financial services sector by directly supporting the next generation of technology- led financial services innovators. More than 200 global members have joined the Innovate Finance ecosystem to date, ranging from seed stage startups to global financial institutions and professional services firms.