UK-based Fintech TransferWise says its partnership with digital bank N26 continues to grow, with the money transfer service now helping the challenger’s customers to send funds to even more countries, including Brazil, Mexico, Singapore, the Philippines, among others.

UK-based Fintech TransferWise says its partnership with digital bank N26 continues to grow, with the money transfer service now helping the challenger’s customers to send funds to even more countries, including Brazil, Mexico, Singapore, the Philippines, among others.

As mentioned on the Fintech firm’s website:

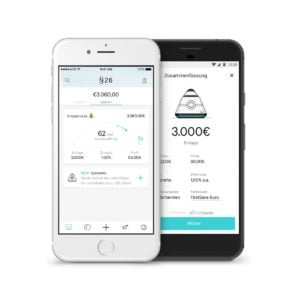

“Since 2016, TransferWise for Banks and N26 have partnered to offer fast, low-cost and transparent international transfers to customers, straight from within the N26 app.”

A lot of progress has been made in the past few years, with around 7 million customers now using TransferWise – which the company claims is helping people save over £3 million a day in hidden fees. Meanwhile, N26 offers 5 million customers an intuitive, secure and seamless way to manage their funds in real-time.

TransferWise’s services can be accessed (via an API integration) through the N26 app, so users may conduct cross-border transactions directly from their mobile devices.

As noted in a blog post by TransferWise:

“There’s no separate app to download and customers won’t be redirected anywhere else to complete the transfer, so sending transfers directly from an N26 account is even easier than doing it through TransferWise.”

TransferWise says that N26 shares its vision for transparency. Both service providers aim to ensure that customers always get the mid-market exchange rate without additional fees or charges.

TransferWise for Banks has teamed up with banks and other service providers in 3 continents including Monzo in the United Kingdom, bunq in the Netherlands, N26 and Mambu in Germany, Activo Bank in Portugal, among others.

(Note: For more details on how to sign up with N26 and use international money transfer services, click here.)

Nick Catino, head of policy and campaigns (Americas) at Fintech firm TranserWise, recently discussed how the remittance rule affects the company’s pricing model.

Catino also revealed that consumers are losing billions of dollars in hidden remittance payments costs.