Founded in 2017, Anchorage has emerged as a top digital asset platform serving institutions investing in the crypto sector. Big money demands robust protocols and tech stacks and Anchorage is providing all of this in a full-service financial platform for the future of finance. Co-founded by Diogo Mónica and Nathan McCauley, both early Square employees, the duo has engineered software that now manages over $100 billion dollars in transactions annually.

Investors include big-name VCs like Andreessen Horowitz, Visa, Blockchain Capital, and more. The list of Anchorage advisors is pretty prominent too as Max Levchin is helping out along with Stanley Druckenmiller and others.

While crypto may have started as a niche sector of finance catering to individual investors, the entry of institutional money, and the support of publicly traded firms, have solidified the asset class as mainstream. And it is growing rather rapidly.

Fast and secure, (Anchorage recently successfully completed a SOC 1 Type 1 assessment) Anchorage is well-positioned to lead the confluence of old finance and the new world of digital finance. As Bitcoin recently neared new highs, and firms like PayPal, Square, and others announced initiatives to support crypto, Crowdfund Insider had a conversation with Diogo Mónica to hear his perspective on the crypto markets.

In your opinion, what is driving the recent increase in Bitcoin? Is this a hedge against geopolitical uncertainties? Is BTC the new gold?

Diogo Mónica: 2017’s record rise was largely driven by retail FOMO—hence its spectacular crash. This time around is different.

A lot of private companies are seeing crypto as a hedge against inflation in a world of seemingly endless monetary stimulus, with institutions like Square and Microstrategy taking significant digital asset positions with their corporate treasuries. We’re seeing banks enter the space in earnest, we’re seeing an increased appetite for exposure to digital assets among institutions and professional traders, and we’re seeing payments platforms like PayPal lower the barrier to entry for huge numbers of people.

All of these have the effect of driving demand for crypto in a way that’s far more sustainable than past booms.

It has taken a good amount of time for crypto to generate broad institutional interest. Have we reached a turning point?

Diogo Mónica: Institutions have always been here in some capacity, but today we’re seeing institutional interest on an unprecedented scale. With household names like Paul Tudor Jones and others throwing their weight behind Bitcoin, crypto as an asset class has become hard to ignore. In our view, the institutions are here to stay.

What’s truly remarkable is the sophistication we’re beginning to see on the part of institutions in the space.

We’ve gone from, in the early days, very basic conversations about simply buying and holding Bitcoin, to conversations now around how to best support very specific, very detailed strategies. As a full-service digital asset platform and infrastructure provider, Anchorage really facilitates a broad range of institutional participation in the ecosystem.

Was the slow uptake by institutions due to missing infrastructure? A lack of regulatory clarity? All of the above?

Diogo Mónica: Until fairly recently, there were entire portions of the ecosystem that institutions simply could not participate in for a lack of secure options. With players like Anchorage building that infrastructure, supporting active participation in terms of staking and governance, facilitating participation in the DeFi ecosystem, institutions finally have a way to get into digital assets in the way they want to.

From a regulatory perspective, OCC Interpretive Letter #1170, which made clear that federally chartered banks can custody crypto and provide banking services to companies in the digital asset space, was truly significant. For many banks, uncertainty around crypto has been replaced with excitement. Now, we’re hearing from banks looking to us for sub-custody on a daily basis. They want sub-custody from regulated entities that have managed billions of dollars, have insurance, have received SOC 1 Type 1 attestation, all things that Anchorage has.

Most banks simply don’t have the knowledge and tools to support digital assets, and look to providers like Anchorage to provide this service seamlessly to banking customers.

What about algorithmic trading. How active are the algos? And what about derivative markets? Is this more about speculation than investing?

Diogo Mónica: Back in 2015 and 2016, the industry was churning out highly specialized use cases and trading features before the liquidity and investors were there. Over the last couple of years, we’ve seen a trend of consolidation, where acquisitions and long winters have driven larger platforms to grow and provide advanced trading features in house. At Anchorage, in particular, we’ve seen quantitative hedge funds move onto our platform, and expect more advanced traders to enter as tools and infrastructure improve.

We’re forward-looking on tools and infrastructure improvements, we expect to see HFT quant trading improve and already have some quants using Anchorage.

What about other digital assets like XRP, ETH, etc. – beyond BTC – are you seeing more interest in other cryptos?

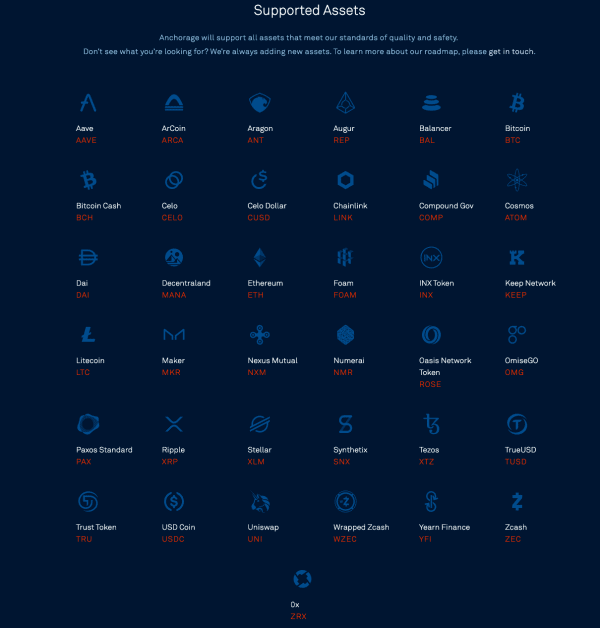

Diogo Mónica: At Anchorage, we’ve made it part of our mission to support every asset type that meets a very high bar for quality and security.

Since our inception, we’ve seen sophisticated crypto funds with highly diversified portfolios on our platform. The last six months have been especially big for Ethereum and DeFi. DeFi’s grown to over $14B since July, and it’s still early.

One of the challenges of the space, though, is cross-chain interoperability. Institutions want to be able to use their assets in the DeFi space, while still maintaining exposure to the underlying asset. To feed this need, Anchorage has partnered with Tokensoft on a service to wrap layer one protocols for use in the DeFi ecosystem. That means that now institutions can use their Zcash, their Filecoin, and other assets on decentralized exchanges. This also has the effect of improving liquidity across DeFi overall.

We constantly read about BTC price expectations for 2021. Would you like to throw your hat into the ring?

Diogo Mónica: Get used to talking about all-time highs, because the institutions are here to stay.

So what about 2021. Will this be the year of rapid growth and acceptance by both Retail and big money? Will crypto become just another asset class sitting alongside equity/debt/cash. etc.?

Diogo Mónica: 2021 will be about broadened participation. We anticipate a huge increase in traditional banks building crypto into their offerings, improvements to infrastructure, and continued growth of the DeFi ecosystem.