Everything, a UK-based Fintech firm focused on reinventing premium bonds with a social spin, has secured €2 million from angel investors.

Everything, a UK-based Fintech firm focused on reinventing premium bonds with a social spin, has secured €2 million from angel investors.

Merama CEO Sujay Tyle, Frontier Car Group founders Peter Lindholm and Ricardo Donoso, along with Axel Arigato co-founder Albin Johansson have all reportedly joined Everything’s investment round.

Everything, which is free to join and use, confirmed that it will be offering a debit Mastercard in the United Kingdom, which will aim to target Gen-Zs as well as young Millennials, where consumers may receive instant cash rewards each time they spend or decide to save money.

The product is considered to be an evolution of the United Kingdom’s most popular or widely-used savings method, Premium Bonds, with a social spin. In order to increase the odds of winning, clients may also choose to invite their friends and family members to their own “Squads” and have an opportunity to win each time they *tap* or save too.

The Fintech firm explains that it pools together a part of its revenue and channels it towards various reward buckets ranging anywhere from £1 up to £1 million. Whenever a reward threshold has been funded, the next client who carries out a payment then becomes the winner. They will be informed in real-time via the Everything Fintech app and their rewards are deposited directly into their account.

Michael Wilkinson, COO at Everything, stated:

“We want to reinvent Premium Bonds to make them more accessible for younger generations and inject the excitement of winning into everyday finances like spending and saving without the risk of losing.”

As noted by the Fintech firm:

“Money should be exciting and rewarding shouldn’t it? But how often do you get that feeling from your everyday finances? We were uninspired with the options out there and curious about what younger generations actually wanted from their everyday finances. So, in the summer of 2021, EVERYTHING was born.”

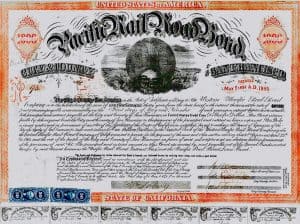

Inspired by a 160+-year-old, government-backed savings product known as Premium Bonds, the team kicked off their journey to build a financial experience for younger generations that is “actually rewarding, exciting and social.”

As with many new ventures, “serendipity and timing play their part.” The team at EVERYTHING with their varied backgrounds and experience, “noticed some fascinating trends from previous ventures.”

They claim that the fusion of these trends “sets the context for EVERYTHING.”

They added that there is “no doubt that everyday finance has progressed tenfold since the emergence of neo-banks, which set the path towards vastly improved customer experience for everyday customers.”

Despite this digital revolution, everyday finance is a “single-player game”, it’s individual, transactional and “not particularly exciting or rewarding.”

You spend, you save and it “looks pretty and works well, but you don’t get much back, and you do it alone.” Looking past the neo-banks to the UK’s most popular savings method, Premium Bonds, where 21 million people in the UK save £114 billion, “you get a thrill, some excitement if you’re drawn as a monthly winner but it’s analogue, very slow (you receive cheques in the post) and far from being social.”

According to the Fintech firm, this outdated financial experience is just “not aligned with a digital world.” The third, vital ingredient in this mix is “the underserved Gen Z and young millennial populations.”

Gen Z now makes up “a large proportion of our global population, with a big chunk of them in the US or UK.”

They are, and will continue to “be increasingly important to the global economy, yet no financial experiences are explicitly made for them.”

Now, there is the “social+” phenomenon “shifting the way businesses are built.”

The company added:

“We are not building an untried and untested new business category. We are simply layering on top of what already works. The brilliant customer experience you get from neo-banks, the excitement of winning from Premium Bonds and an integrated social layer within the product. A rewarding, exciting and social financial experience that younger generations actually want.”