S&P Global has published a report on digital assets entitled the State of Consumer Cryptocurrency Adoption. According to S&Ps research, 20% of surveyed individuals have either purchased traded or received crypto – a solid percentage of the population.

While awareness is growing, S&P adds that most of the individuals who have purchased crypto have never moved these digital assets outside of the exchange or platform where they purchased them.

The report shares:

- Gen Z (33%) and Millennials (35%), trailing off into the single digits for Baby Boomers and The Greatest Generation. (No mention of Gen X).

- Crypto adoption showed different demographics, including gender (28% male vs. 12% female), residence (31% urban vs. 15% rural and suburban, and annual household income (18% <$100,000 vs. 27% >$100,000).

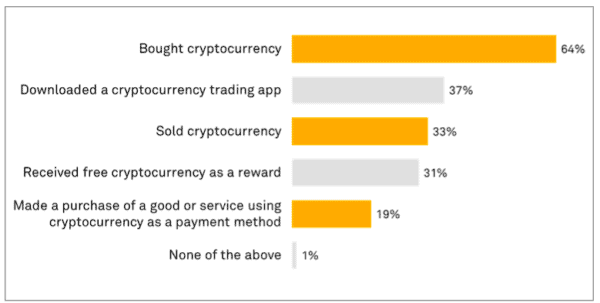

- While most have bought cryptocurrencies (64%), a much smaller percentage are selling them (33%), and an even smaller percentage are using cryptocurrency as a payment method (19%).

- Most consumers are treating crypto as an asset – similar to a traditional security like stocks.

- More users have bought cryptocurrency than used it as a payment method, the common theme driving adoption is investment.

- More than one-third (36%) who trade cryptocurrency do so as a general investment to increase their wealth, 27% do so to diversify their investment portfolio, and 25% use it as a tool for retirement savings.

- For the 80% of respondents who have not engaged in crypto markets, the three biggest crypto adoption inhibitors included a lack of understanding of the blockchain (32%), lack of investing in general (30%), and the overall complication of purchasing cryptocurrency (26%).

Factors that undermine crypto consumer-to-business payments, include:

- Usability problems associated with cryptocurrency wallets. Most cryptocurrency wallets are not intuitively designed for the average consumer. Another challenge is that if a user misplaces their private key or seed phrase, they’re locked out of their wallet for good.

- Chargebacks and disputes. If a problem arises with a cryptocurrency transaction there is no central intermediary manage the dispute process and enforce consumer protections.

- Limited merchant acceptance is another hurdle.

Several paths to encourage utilization of crypto that could be utilized by legacy firms include:

- Card-issuing entities that offer cash-back rewards should consider allowing cardholders to exchange their rewards for cryptocurrency

- Receiving cryptocurrency in place of credit or debit card rewards points

- Linking debit cards to cryptocurrency balances

You may download the report here.