The Federal Deposit Insurance Corporation (FDIC) has issued a unique Cease and Desist statement telling five crypto firms to stop making misleading claims regarding deposit insurance.

According to the FDIC, these five firms were each the recipient of a C&D letter:

- Cryponews.com

- Cryptosec.info

- SmartAsset.com

- FTX.US

- FDICCrypto.com

Probably the best known of the lot is FTX and its US subsidiary. To quote the letter to FTX:

“It appears that on July 20, 2022, Mr. Harrison [President of FTX US] published a tweet on the Twitter account “@Brett_FTX” which stated, among other things, “direct deposits from employers to FTX US are stored in individually FDIC-insured accounts in the users’ names,” and “stocks are held in FDIC-insured and SIPC- insured brokerage accounts.” FTX is also identified as an FDIC-insured” cryptocurrency exchange on the SmartAsset website, https://smartasset.com/investing/list-of-fdic-insured-cryptocurrency-exchanges and the CryptoSEC.info website, https://cryptosec.fdic.

These statements appear to contain false and misleading representations that uninsured products are insured by the FDIC…”

Cryptonews lists names of crypto exchanges that are said to be FDIC insured, including Coinbase, Gemini, and eToro. The FDIC tells Cryptonews this is inaccurate information. Cryptosec, and SmartAsset apparently made similar statements.

FDICcrypto runs afoul of the agency simply due to its name.

All misleading statements must be removed, and no future misleading statements should take place. Each firm is required to respond, in writing, within 15 days, that appropriate actions have been taken.

The FDIC points out that the Federal Deposit Insurance Act (FDI Act) prohibits any person from representing or implying that an uninsured product is FDIC–insured or from knowingly misrepresenting the extent and manner of deposit insurance. The FDI Act further prohibits companies from implying that their products are FDIC–insured by using “FDIC” in the company’s name, advertisements, or other documents. The FDIC is authorized by the FDI Act to enforce this prohibition against any person.

As was previously reported, the FDIC has posted a Fact Sheet on Crypto firms and insurance noting that it only guarantees deposits in the unlikely event of a bank failure.

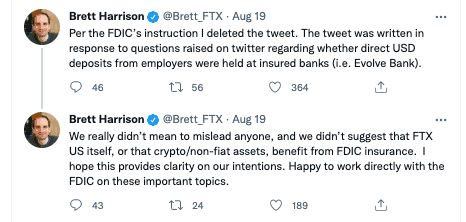

Harrison has responded via twitter that per the FDIC’s request the tweet has been deleted and they did not suggest that FTX benefitted from FDIC insurance – just that deposits were held in an FDIC insured bank.

“Happy to work directly with the FDIC on therse important topics,” said Harrison.