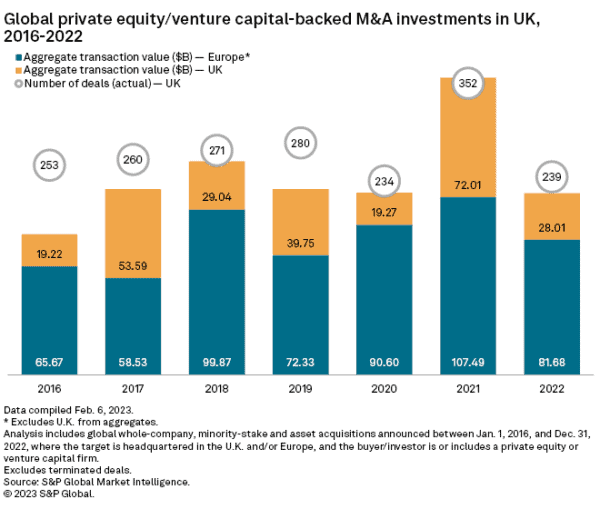

Reports continue to filter out regarding the tepid market for private transactions. A recent report indicates that private equity and venture capital investments cratered in the UK by a whopping 61% in 2022.

According to S&P Global Markets, aggregate transactions in the UK topped $72 billion in 2021, in 2022, investments delivered around $28 billion.

When you look at Europe (ex-UK), PE/VC deals went from $107.49 billion to $81.68 billion in 2022.

Of course, 2021 was a gangbuster year for private markets as cheap capital was abundant and valuations soared. When you look at transaction values in 2020, the difference is not that shocking.

In 2020, UK PE/VC investments were around $19.27 billion, and Europe at $90.6 billion. Still, this was in the midst of COVID, a volatile time period for all markets.

The report by S&P shares that there were 239 private equity and venture capital-backed M&A deals in the U.K. in 2022, compared to 352 transactions in 2021.

Only nine deals in 2022 were valued at more than $1 billion, reportedly the lowest level in five years.

S&P anticipates that transactions in the UK will remain muted during the first quarter – due to “a gap in pricing.”

Private equity sponsors will most likely be looking at other ways to bridge the funding gap through higher vendor rollovers, earn-outs and/or more equity funding.

But after Q1, things are expected to perk up a bit.

Overall, the number of deals is expected to be similar to 2022, but valuations have declined from previous lofty levels. No telling when higher valuations will return.