SoFi’s Lantern Paycheck Protection Program Offering Sees 43% of Applicants Matched With Network of Lenders & 24% Receive Approve From SBA

Fintech unicorn SoFi announced on Monday it has helped funnel more than $75 million in loan applications to lenders for the Paycheck Protection Program (PPP) established by the CARES Act, through its extensive network of lenders and Lantern, the product comparison site operated by SoFi…. Read More

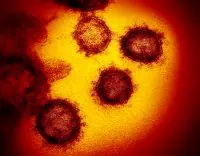

Read more in: Fintech, General News, Politics, Legal & Regulation | Tagged coronavirus, covid-19, lantern, online lending, paycheck protection program, ppp, sba, sofi, u.s., united states