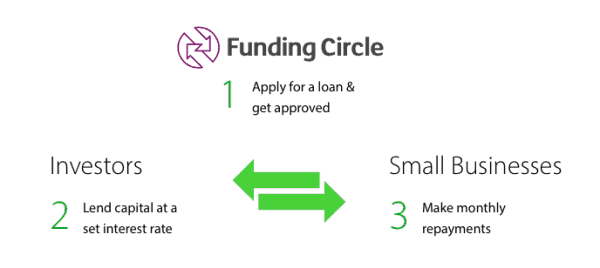

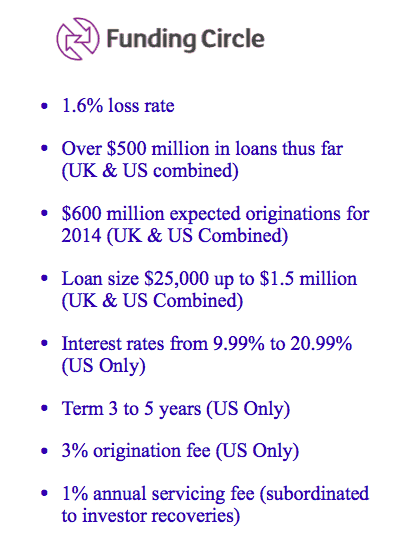

In the wake of Dodd-Frank and the financial crisis, peer-to-business lending or “P2B” is stepping up to fill the funding gap for small and startup businesses. What is P2B you may ask and how does it differ from P2P lending? Well, pretty simply, P2B is what it sounds like, people (now interpreted broadly to include institutions) lending to businesses as opposed to individual people, which is P2P lending. One of the leading players in this space is Funding Circle, a UK transplant, who is applying its successful model from across the pond to the US market.

The US initiative is being led by co-founder and managing director Sam Hodges and team. I had the chance to discuss Funding Circle, marketplace lending and crowdfunding with Sam while in San Francisco.

The US initiative is being led by co-founder and managing director Sam Hodges and team. I had the chance to discuss Funding Circle, marketplace lending and crowdfunding with Sam while in San Francisco.

Sam’s background is in financial technology and as an entrepreneur. Sam has experienced the funding gap first hand as a partner in gym franchise with five locations generating significant revenue, which could not get financing. Sam knew the system was broken. He then set out to fix this problem with Endurance Lending Network, which merged with Funding Circle, a prominent UK platform in 2013.

P2P vs. P2B

Before we dive in, it is important to distinguish what Funding Circle is doing from the other lending platforms out there. While Lending Club and Prosper focus mostly on lending to individuals, Funding Circle is devoted to lending to businesses. Business lenders generally face more challenges when analyzing credit risks, because in addition to the personal credit of the entrepreneur (which usually provides a guaranty), they also must make an assessment of the business itself, which unlike a person doesn’t have a neat and tidy credit score backed up by a lot of statistical data and often has no credit history. However, as far as I am concerned regardless of the higher degree of difficulty, P2B is an important step to helping small and startup businesses thrive in this country.

Before we dive in, it is important to distinguish what Funding Circle is doing from the other lending platforms out there. While Lending Club and Prosper focus mostly on lending to individuals, Funding Circle is devoted to lending to businesses. Business lenders generally face more challenges when analyzing credit risks, because in addition to the personal credit of the entrepreneur (which usually provides a guaranty), they also must make an assessment of the business itself, which unlike a person doesn’t have a neat and tidy credit score backed up by a lot of statistical data and often has no credit history. However, as far as I am concerned regardless of the higher degree of difficulty, P2B is an important step to helping small and startup businesses thrive in this country.

Underwriting process

Funding Circle utilizes the following underwriting criteria to determine the risk profile of a business:

- Cash flow (quality and amount)

- Assets (quality and amount)

- Alternative data (Yelp score, etc.)

- Stability (of management, business and industry)

The underwriting process begins with a simple six question screening process and then moves to a longer credit profile analysis. If the borrower passes the first two levels then the manual underwriting process, as Sam refers to it, begins, and a team of commercial bank lending professionals that Funding Circle has assembled conducts their procedures. All loans are secured by the assets of the company and receive a personal guarantee from the owner.

Invest in something you can kick

Invest in something you can kick

A common theme in investing is to keep it simple, and P2B allows for a fairly direct investment of capital into a business that needs it. Funding Circle is not providing investors with a synthetic product that is keyed to some underlying, but is simply providing resources to a company so that it can hire employees, purchase new equipment or open a new location. This is a very transparent marketplace, which I feel is essential to its livelihood and to ensure that the financial sins of the past do not haunt our future.

Institutions – no adverse selection

When it comes to just who is investing in these small business loans, currently Funding Circle can only target accredited investors and institutional investors as it is operating under Regulation D of the Securities Act. Eventually, they do want to capture retail investors and will have to file some sort of registration to do so. One thing very important to Sam (and me) is that institutional and more powerful investors are not allowed to “cherry pick” the best loans available on the platform leaving the retail and even accredited investors with the poorer performing loans. Sam stated that fairness is a fundamental element of their platform and “whether it is a bank, large asset manager, hedge fund or grandma, we don’t want to adversely select anyone.”

P2B vs Equity crowdfunding

On the subject of investors, I want to take a minute to point out the differences between P2B investments and equity crowdfunding investment as asset classes. P2B provides a fixed income product with a certain amount of liquidity from amortization and interest payments and a knowable outside maturity date while equity crowdfunding provides an ownership interest, which provides unlimited upside but is illiquid and has no knowable exit horizon. Furthermore, in the P2B space the products are primarily secured by the assets of the company and receive a personal guaranty from the owner unlike equity instruments. This discussion is not intended to tout one investment over the other but merely to remind you that these are entirely different assets classes with different risk profiles which should be viewed quite distinctly, even though we often refer to them in the same breath.

Platform setup – legal structure

Now to the nitty-gritty. As mentioned earlier, Funding Circle conducts its offerings to investors under Regulation D as private placements unlike Lending Club and Prosper which have filed registration statements with the SEC. Also, unlike those platforms, Funding Circle is a licensed commercial lender and does not need to partner with a traditional bank to originate the loans. Once the loans are originated, a bankruptcy remote vehicle purchases the loan and issues the securities to the investors. One of the risks this can create, since all the securities for all of the loans made are issued by a single issuer off of a Regulation D shelf, is that in a bankruptcy scenario, all of the issuer’s liabilities could be consolidated leaving investors in performing loans subject to losses due to nonperforming loans. In other words, the investor bears the credit risk of both the underlying borrowing business and the issuer, which has issues securities not only dependent on the loan specific to the investor but also to a multitude of others.

Another risk facing marketplace lending in general is interest rate fluctuation. Sam feels that if interest rates rise that means the economy is doing better which is a good thing. Also, because of the shorter term nature of these loans, Funding Circle can adjust their rates in tandem. Sam noted that there is currently a lot of appetite on the horizon for the type of investments offered on Funding Circle and doesn’t see that going away.

Regulatory wish list

When asked about a regulatory wish list, Sam (like me) would like to see a separate and clear regulatory regime tailored to the marketplace lending space and clarification and guidance around the Investment Company Act of 1940, blue sky laws and broker-dealer regulations to harmonize these burgeoning capital markets.

Outlook for future

- Sam’s outlook for the future is bright and is as follows:

- Marketplace lending platforms have proven the viability of the asset class and investor base and are here to stay.

- Large financial institutions will partner with the platforms – as this is NOT an existential threat to traditional banks.

- A significant part of the public’s fixed income portfolio will shift to marketplace lending products.

_____________________

Shameless plug

If you would like to hear from Sam in person, make sure to sign up for the American Banker websem on P2P Lending titled Traditional Lenders and P2P Platforms: Friend, Foe or Fad? (which I will also be participating in)

_____________________

Georgia P. Quinn, a senior associate in Seyfarth Shaw LLP’s Corporate department, has spent her career representing public and private companies and investment banks in a wide range of capital markets transactions, including registered offerings and private placements of debt, equity, and hybrid securities. Over the last year, Ms. Quinn has led Seyfarth’s Crowdfunding Initiative, helping clients stay at the forefront of the enacted and proposed SEC regulations. Georgia has conducted webinars, presented to the New York State Bar Association’s Securities Law Section and the Business Law and International Sections, has been featured on Crowdfund Insider and has been invited to chair a panel on Crowdfunding for the American Bar Association in April. All views and comments above are strictly her own views and do not reflect the opinion or position of Seyfarth Shaw.

Georgia P. Quinn, a senior associate in Seyfarth Shaw LLP’s Corporate department, has spent her career representing public and private companies and investment banks in a wide range of capital markets transactions, including registered offerings and private placements of debt, equity, and hybrid securities. Over the last year, Ms. Quinn has led Seyfarth’s Crowdfunding Initiative, helping clients stay at the forefront of the enacted and proposed SEC regulations. Georgia has conducted webinars, presented to the New York State Bar Association’s Securities Law Section and the Business Law and International Sections, has been featured on Crowdfund Insider and has been invited to chair a panel on Crowdfunding for the American Bar Association in April. All views and comments above are strictly her own views and do not reflect the opinion or position of Seyfarth Shaw.