SeedInvest co-founders Ryan Feit and James Han always knew they wanted to start a business, even as they both found themselves working in New York private equity firms. That entrepreneurial drive took them back to Wharton to pursue their MBAs.

While at Wharton, Feit read about Sherwood “Woodie” Neiss and Jason Best of Startup Exemption (and now Crowdfund Capital Advisors), who at the time were lobbying congress on behalf of investment crowdfunding. A few days later he would be on the phone with Woodie asking how he could help.

While at Wharton, Feit read about Sherwood “Woodie” Neiss and Jason Best of Startup Exemption (and now Crowdfund Capital Advisors), who at the time were lobbying congress on behalf of investment crowdfunding. A few days later he would be on the phone with Woodie asking how he could help.

Feit launched legalizecrowdfunding.org to visually display what type of impact investment crowdfunding could potentially have on the US economy. By polling potential investors and business owners, he was able to estimate that this new form of capital formation would create over 35,000 jobs in short order. The possibilities proved intriguing enough to entice congress to do something many thought would never happen; they changed 80-year-old securities laws.

Both Feit and Han knew the difficulties entrepreneurs faced in raising capital from their time at New York PE firms. They were entrepreneurs with a newly-minted Wharton pedigree, and they now had advisory access to those responsible for getting the JOBS Act through a fiercely partisan and dysfunctional congress. In Feit’s words, launching a crowdfunding platform “was a no-brainer.”

For SeedInvest, one of the most important aspects of the crowdfunding experience is how investors participate after the completed raise. “We firmly believe that our entrepreneurs and our investors on our platform are our customers,” Feit said. “If they make an investment and then have a terrible experience after they are off the platform, we are going to fail because our customers won’t be happy.”

Entrepreneurs that turn to crowdfunding may find a challenge in communicating with a newly-formed, distributed group of investors. SeedInvest takes the social aspect of a typical growth-stage company and offers tools to facilitate that communication.

“Once a deal closes, the founders of that company and the investors are funneled to a virtual board room that allows founders to interact with investors. It provides a pretty streamlined and efficient way to manage investor relations, to report quarterly updates or financials to their investors.”

Feit doesn’t want communication to stop at the tedious bits of the business. He thinks that this approach can help company founders tap into the intelligence of the crowd, providing a value add that entrepreneurs may not find from some more traditional funding sources.

Feit doesn’t want communication to stop at the tedious bits of the business. He thinks that this approach can help company founders tap into the intelligence of the crowd, providing a value add that entrepreneurs may not find from some more traditional funding sources.

“One of the most important things about crowdfunding is that instead of one venture firm you’re getting a number of investors that are hopefully going to provide more value to you than just capital. That could be through advice, through connections or it could literally just be through them being brand ambassadors and telling people about your company. It allows you, as a company, to tap those investors and see how they may be able to help you.”

SeedInvest plans on bringing this same type of interactivity to the process of actually raising funds, too. They will facilitate live due diligence sessions and demos to help investors decide whether or not a company is right for them. It all adds up to a very socially-driven and highly curated vision of what crowdfunding can and should be.

Han and Feit hope their dual experience as professional investors and as entrepreneurs will place them in a unique position to provide thought leadership on how to better connect all parties participating in crowdfunding offerings.

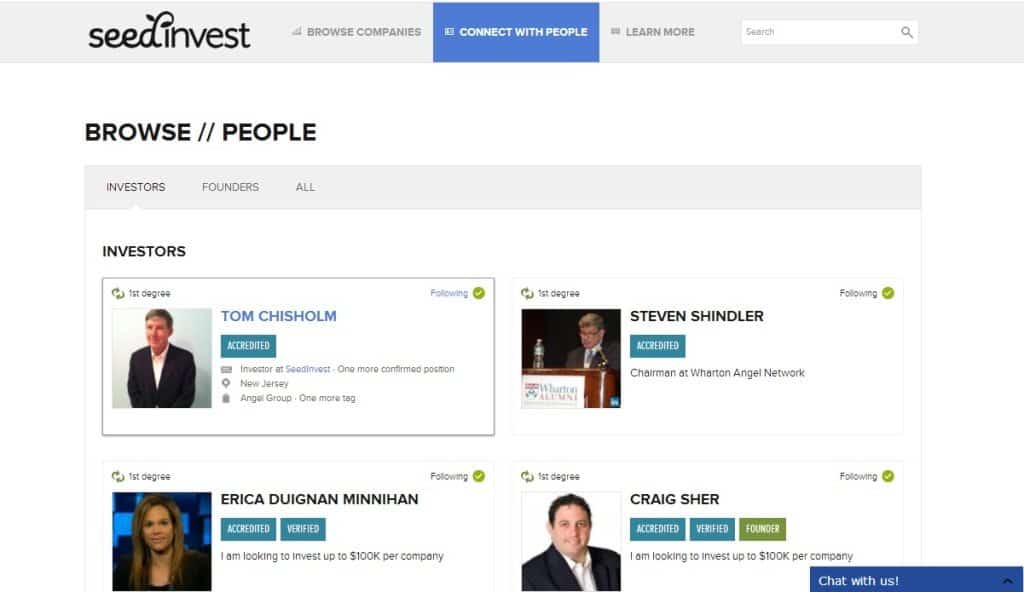

Accredited investors can now register on SeedInvest’s site, and a handful of offerings are available for consideration.

Full press release below:

SeedInvest Launch Press Release by