Allegations by the Ohio Division of Securities reverberate through the entrepreneurial class & the crowdfunding industry

Allegations by the Ohio Division of Securities reverberate through the entrepreneurial class & the crowdfunding industry

Candace Klein has been an extremely visible figure in the world of crowdfunding. Beyond her role as CEO of lending-based platform SoMoLend, she is also the former chair and one of the cofounders of the Crowdfund Intermediary Regulatory Advocates (CfIRA) and a cofounder of the Crowdfunding Professional Association (CfPA).

As we’ve previously reported, the State of Ohio Division of Securities has delivered a notice outlining allegations of fraud toward Candace Klein acting on behalf of SoMoLend, which is based in Cincinnati. The charges levied against Klein on behalf of the State of Ohio sent shock waves through the crowdfunding industry.

Allegations include improper use of general solicitation, fraudulent projections, material omissions and a myriad of other charges. All charges involve her actively seeking funding under Rule 506(b) of Regulation D, which specifies a framework under which entrepreneurs can seek funding from unlimited accredited investors and up to 35 non-accredited investors without the use of general solicitation. (The full document by the state and a brief breakdown is available on our website here.)

We recently reached out to two people who have worked with Klein in an effort to provide their perspective on these allegations and the associated ramifications for Klein, SoMoLend and the impact on entrepreneurship in Ohio – a state that has recently prided itself on being friendly to small businesses and entrepreneurs.

On Character

Carlin Stamm is an early investor in SoMoLend. I asked Stamm about his view of Candace Klein as a person and as a businesswoman.

Carlin Stamm is an early investor in SoMoLend. I asked Stamm about his view of Candace Klein as a person and as a businesswoman.

“I know Candace Klein to be a person with a good heart, a person who wants to do well by doing good,” Stamm told Crowdfund Insider. “That was the original concept of the enterprise. She saw a need from her past experience to help with funding for small business and that was the beginning of her concept with SoMoLend. Also, she had done some research on crowdfunding, Kiva and other crowdfunding sites that had been operating for some time successfully.”

DJ Paul is Chief Strategy Officer at GATE Impact and has worked with Klein extensively on regulatory efforts, and he highlighted her work to advance crowdfunding as a means of capital formation in America.

“I have worked with her as a fellow citizen and fellow advocate for crowdfunding since the beginning of 2012. I cofounded with her – and several others – both the CfPA and CFIRA. Candace has been a tireless advocate for crowdfunding, both debt-based and equity-based, so in other words not just on her own behalf but on the behalf of portions of the industry that have no direct relevance to her,” Paul said. “She has been as involved as anyone has been with the Securities and Exchange Commission and the ongoing dialogue between industry representatives, including CFIRA, and the SEC. But for her, certainly CFIRA would not exist and I dare say crowdfunding would not be as imminently close to being actionable as it is. She has been an incredible asset to the industry and to entrepreneurs that would seek to raise capital in this manner.”

“I have worked with her as a fellow citizen and fellow advocate for crowdfunding since the beginning of 2012. I cofounded with her – and several others – both the CfPA and CFIRA. Candace has been a tireless advocate for crowdfunding, both debt-based and equity-based, so in other words not just on her own behalf but on the behalf of portions of the industry that have no direct relevance to her,” Paul said. “She has been as involved as anyone has been with the Securities and Exchange Commission and the ongoing dialogue between industry representatives, including CFIRA, and the SEC. But for her, certainly CFIRA would not exist and I dare say crowdfunding would not be as imminently close to being actionable as it is. She has been an incredible asset to the industry and to entrepreneurs that would seek to raise capital in this manner.”

Gray Matters: Pitch Events & Projections

The notice sent on behalf of the State included verbiage outlining an allegation of general solicitation on behalf of SoMoLend by Candace Klein.

…if the possibility of being prosecuted for fraud would exist if you have optimistic projections in your offering documents, then I dare to say the vast majority of companies that have sought to raise money would be susceptible to allegations of fraud. That’s kind of scary.DJ Paul

Beginning on or around April 9, 2011, up to and including the date of this Notice Order, Respondents have offered SoMoLend Securities for sale through general solicitation and general advertising in Ohio and other states. Said solicitation and advertising have occurred through Respondents’ own actions: as well as through the actions of others on Respondents’ behalf through numerous investor presentations and investor pitch events, videotaped recordings of investor presentations and investor pitch events posted to the internet, content and links on Respondents’ websites and- social media sites, and press releases and other communications published in newspapers, magazines, and other broadcast media; [Notice]

There are also allegations that Klein provided misleading projections on behalf of her company in offering materials.

By way of example, on April 19, 2011 during the GCVA Presentation, Respondent Klein projected annual revenues of $1.5.million in 2012, $10.2 million in 2013, $15.5 million in 2014, and $45.5 million in 2015. Respondent Klein projected that Respondent SoMoLend would “breakeven,” commonly understood to mean the first point at which revenues would equal expenses, in the third quarter of 2012. At the time of the GCVA Presentation, Respondents had not conducted a single loan transaction or obtained licensure or registration necessary to conduct their proposed business activities; [Notice]

These two points present concerns for entrepreneurs that participate in pitch events and demo days, where interfacing with accredited investors for the first time can be the norm.

Projections are also often requested or included as part of offering materials. Any able entrepreneur knows that often times projecting revenues years into the future within months of starting a company can be an exercise in futility. Lofty idealism is part of the entrepreneurial spirit, and it sometimes does make its way into projections for better or for worse.

I asked DJ Paul if these two particular aspects of the charges against Klein warrant further clarification on behalf of state or federal securities regulators.

“To the extent that the SEC can offer some additional guidance about certain common practices that have existed for the better part of the last 20 years regarding, say, pitch events, pitch contests and other types of what are now 506 activity to determine whether or not those constitute general solicitation, yes. I think that the public would like some clarification, both issuers and potential intermediaries, around what constitutes general solicitation and what doesn’t,” Paul said.

He continued, “With respect to projections, part of what I personally – again, I’m speaking on behalf of someone who is involved in the industry – part of what I find most chilling about some of the State of Ohio’s allegations is the suggestion that projections that all startups put in their offering documents… that if they are not accurate or if the State of Ohio deems them to be overly optimistic, that that somehow constitutes fraud.

He continued, “With respect to projections, part of what I personally – again, I’m speaking on behalf of someone who is involved in the industry – part of what I find most chilling about some of the State of Ohio’s allegations is the suggestion that projections that all startups put in their offering documents… that if they are not accurate or if the State of Ohio deems them to be overly optimistic, that that somehow constitutes fraud.

“If that’s the case… if that’s proven… that would have a stultifyingly dramatic impact on new companies’ and startups’ abilities… not just crowdfunding intermediaries, crowdfunding sites, but all entrepreneurs… if the possibility of being prosecuted for fraud would exist if you have optimistic projections in your offering documents, then I dare to say the vast majority of companies that have sought to raise money would be susceptible to allegations of fraud. That’s kind of scary.”

The sentiment about clarity on behalf of regulators was echoed by Carlin Stamm, who clarified that he was not seeking any ridiculously exorbitant returns despite any potential returns referenced by Klein herself.

“I think there needs to be more clarity because it is difficult for me to see the difference between any pitch in an accelerator type format. They’re generally technology oriented and have the potential for rapid growth… these are the types of companies that appeal to venture capitalists, and they are openly soliciting funds,” Stamm told Crowdfund Insider. “They’re projecting big returns, they may not be asking for a specific amount but often they do. Often someone says I’m looking for $200,000 or $500,000 in funds, and to me that is a solicitation.

“If we’re talking about venture-type investors or accredited investors, I think that… I hate to have a bureaucrat making recommendations about what the projections should be, because I think a person has to use some intelligence when they look at projections. The Cincinnati Enquirer mentioned, I believe, that the projections were something like an 8,000% return on investment, which is ludicrous. No one looks for that kind of return on investment. We were hoping when we invested to see 8 or 9 times. We felt that that would be a reasonable rate for an investment with some risk.”

“If we’re talking about venture-type investors or accredited investors, I think that… I hate to have a bureaucrat making recommendations about what the projections should be, because I think a person has to use some intelligence when they look at projections. The Cincinnati Enquirer mentioned, I believe, that the projections were something like an 8,000% return on investment, which is ludicrous. No one looks for that kind of return on investment. We were hoping when we invested to see 8 or 9 times. We felt that that would be a reasonable rate for an investment with some risk.”

Entrepreneurship And Capital Formation In Ohio

DJ Paul points out that the State of Ohio has historically taken a stance that is critical of the JOBS Act and Title III crowdfunding. This stance was encapsulated in a letter published as comment on the JOBS Act in January of 2013.

“I would note that many aspects of their concerns and complaints seem to parallel some of the complaints against SoMoLend. The recent legal action that the State of Ohio has taken against SoMoLend,” Paul told me in the interview. “And it would appear that perhaps the State of Ohio is using its case against SoMoLend in order to bear in a different forum some of the very same complaints that the State of Ohio expressed in its January newsletter to the Securities and Exchange Commission.”

The document is embedded at the bottom of this article for reference, or alternatively it is available for viewing on our Scribd page.

Carlin Stamm expressed dismay at the fact that the allegations against SoMoLend and Candace Klein hurt SoMoLend’s investors, a majority of which live in the State of Ohio – the very state that brought the charges to light. He is also concerned that CincyTech and the North Coast Angel Fund were caught up by proxy. Both early-stage investment funds are funded in part with state money, and according to Stamm both were invested in SoMoLend.

“I guess the ironic thing about this is that the state is hurting its own investments by going after SoMoLend for to me a mythical or illusionary act of fraud,” he said.

As for the overarching state of support for early stage endeavors in the state of Ohio, Stamm’s take was simple.

“Lots of talk, very little action.”

In Search Of A Victim

As an early investor in the company, Stamm is left wondering who the victim is in SoMoLend’s allegedly fraudulent activities. He said, “I don’t understand how we have a notice of fraud when you have no injured party complaining. It seems to me that someone that doesn’t like the concept and felt that Candace had made some statements that were perhaps inflated saw the opportunity and used it. That’s why we find ourselves in this situation.”

As an early investor in the company, Stamm is left wondering who the victim is in SoMoLend’s allegedly fraudulent activities. He said, “I don’t understand how we have a notice of fraud when you have no injured party complaining. It seems to me that someone that doesn’t like the concept and felt that Candace had made some statements that were perhaps inflated saw the opportunity and used it. That’s why we find ourselves in this situation.”

DJ Paul also echoed this sentiment. “Who has been harmed here? To my knowledge and belief, and I look forward to someone correcting me on this, but have any of the investors in SoMoLend claimed fraud? Have they claimed damages? Have they claimed losses? Have they claimed to have been misrepresented to? Who is it that the State of Ohio is protecting here? Which investors have been harmed? Where’s the damage? Where’s the victim? Perhaps there is one, but I am unaware of it at this time. It seems like the State of Ohio is creating a victim where none exists.”

Crowdfund Insider has reached out to a representative of the State of Ohio and will follow up with any additional information as soon as it becomes available.

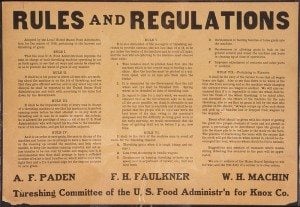

The comment letter published on behalf of Ohio Division of Securities Commissioner Andrea L. Seidt and posted on the SEC web site this past January shares the State’s concerns regarding non-accredited crowdfunding. The document is embedded in its entirety below.