The study measuring the impact of Title II of the JOBS Act, conducted for Marketing 506c, indicated that 24,000 new jobs may be created annually in Arizona. The JOBS Act makes it easier for businesses to raise capital for startups or business expansion.

The study measuring the impact of Title II of the JOBS Act, conducted for Marketing 506c, indicated that 24,000 new jobs may be created annually in Arizona. The JOBS Act makes it easier for businesses to raise capital for startups or business expansion.

Furthermore the study concluded that over $2 billion per year in additional investment capital will become available statewide as a result of the change. The $2 billion represents Arizona’s share of a predicted $180 billion in additional capital forecasted for the entire country by the SEC. At recent employment levels, as reported by the U.S. Bureau of Labor Statistics, the 24,000 jobs created by that capital represent about 10% of all new jobs in Arizona annually.

“Starting September 23 it will be significantly easier for private companies to raise money through the offering of their securities. This translates into increased Arizona employment directly attributable to the JOBS Act,” said Ross Horwitz, CEO of Tempe, Arizona based Marketing 506c.

The company assists small to medium-sized Arizona businesses with advertising under the JOBS Act to secure expansion capital.

Horwitz previewed the job creation information as a panelist at an Arizona State Bar Association sponsored seminar on the new law and SEC rules. Also participating on the panel was Congressman David Schweikert (R-AZ), one of the original co-sponsors of the enabling JOBS Act legislation.

Congressman Schweikert, commenting on the newly released study, said, “I am very pleased to hear about today’s announcement and am happy to be a part of the impressive increased job creation and capital formation for Arizona.”

“Marketing 506c was specifically organized to help Arizona businesses benefit from these landmark changes in raising capital and creating new jobs. Most experts recognize small business as the backbone of job creation,” said Horwitz.

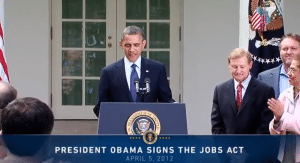

The JOBS Act, which enables this and several other key reforms for small business, was originally signed into law on April 5, 2012 with near unanimous approval by Congress. The Act mandated the SEC lift an 80-year-old Federal ban prohibiting advertising and general solicitation in raising private capital. This marks a reversal of a doctrine which has been Federal law since the time of the Great Depression. According to Congressman Schweikert, there will be additional new provisions going into effect soon that allow start-up and smaller companies to utilize crowdfunding and other previously unavailable methods of securities offerings.