The place was Washington, D.C. The occasion was the Annual Meeting of the Angel Capital Association at the Hilton Hotel in March 2014. Hundreds of attendees were gathered for lunch in the main Ballroom, the largest in the City.

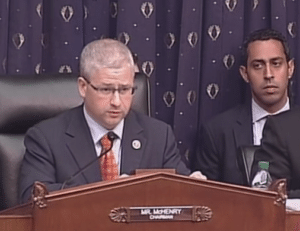

The lineup of luncheon speakers was impressive, including Keith Higgins, Director of the SEC Division of Corporation and Finance, U.S. Senator Blumenthal from Connecticut, and Congressman Patrick McHenry, Congressman from North Carolina, architect of Title III of the JOBS Act (at least before it was savaged by Democrats in the U.S. Senate) and a House sponsor of proposed 2014 legislation impacting small business. Though Congressman McHenry’s words  were inspiring to small business, the introduction was somewhat chilling. In typical fashion Congressman McHenry did not mince words: Referring to D.C. politics, he stated:

were inspiring to small business, the introduction was somewhat chilling. In typical fashion Congressman McHenry did not mince words: Referring to D.C. politics, he stated:

“It’s not where your business is made – it is where your business is destroyed.”

For those of us advocating for legislative and regulatory reform, both pre- and post-JOBS Act, these words needed no further elaboration.

After casting my ballot on Election Day 2014, where control of the Senate, and Congress, hangs in the balance, I thought it an appropriate time to put pen to paper with some hopeful observations of my own. As you might suspect, as an advocate for deregulation of small business capital formation, I am “All In on Red” when it comes to regulation of SME’s.

Like it or not, the center of the regulatory universe for small business is in D.C., both in Congress and at the SEC. Both of them historically have presented barriers to small business capital formation– ones not easily penetrated. But alas, there is life outside the Washington Beltway, and people outside are watching and listening – and voting. If the pre-election day polls are any indicator, it appears that the voting electorate is about as fed up with Washington as is Congressman McHenry. Hopefully, when the dust settles on the ballot boxes across the nation, a rejuvenated Congress will be ready to both listen more closely – and act. And so, hopefully, will the SEC.

Though final rules have yet to see the light of day on Title III and IV (Regulation A+) of the JOBS Act, if the polls hold, the folks outside the Washington Beltway may finally have something to cheer about in 2015 – perhaps sooner – at least when it comes to deregulation of small business capital formation.

The Washington Bubble is About to Burst

SEC Commissioner Daniel M. Gallagher, a vocal champion of the needs of small business, was perhaps prescient in his remarks at The Heritage Foundation in September 2014. In the midst of presenting in many broad strokes, his vision for deregulation of small business capital formation, he made the following observation:

SEC Commissioner Daniel M. Gallagher, a vocal champion of the needs of small business, was perhaps prescient in his remarks at The Heritage Foundation in September 2014. In the midst of presenting in many broad strokes, his vision for deregulation of small business capital formation, he made the following observation:

“It is important for Commissioners, as well as senior staff based in Washington, to get outside the Beltway. While I’m on the road, I like to speak directly with businesses—and particularly small businesses. That takes some extra effort to arrange, but getting outside the Washington bubble is eye-opening.”

Seems that the bubble is about to burst following Election Day. So like it or not, the time has come for those in Washington to listen with an attentive ear to those outside the Beltway – think outside the partisan box – and act.

And then – there is the trickle-down effect. With a change of control in Congress, one may expect those at the SEC – seemingly frozen in place on JOBS Act rulemaking 2 ½ years after the passage of the JOBS Act of 2012 – will see the wisdom of completing their statutory rulemaking duties – and getting ahead of the Congressional steamroller. At least that is my hope – primarily for Regulation A+ rulemaking – and perhaps even for Title III crowdfunding – where JOBS Act 2.x proposed legislation has been the order of the day in 2014 in the Republican-controlled House Financial Services Committee. Hopefully, with a new Republican Chair in the Senate counterpart to the House Financial Services Committee, the Senate Banking Committee, under the tutelage of Alabama Senator Richard Selby, bi-partisan bills aiding small business capital formation will once again see the light of day on the Senate floor.

And then – there is the trickle-down effect. With a change of control in Congress, one may expect those at the SEC – seemingly frozen in place on JOBS Act rulemaking 2 ½ years after the passage of the JOBS Act of 2012 – will see the wisdom of completing their statutory rulemaking duties – and getting ahead of the Congressional steamroller. At least that is my hope – primarily for Regulation A+ rulemaking – and perhaps even for Title III crowdfunding – where JOBS Act 2.x proposed legislation has been the order of the day in 2014 in the Republican-controlled House Financial Services Committee. Hopefully, with a new Republican Chair in the Senate counterpart to the House Financial Services Committee, the Senate Banking Committee, under the tutelage of Alabama Senator Richard Selby, bi-partisan bills aiding small business capital formation will once again see the light of day on the Senate floor.

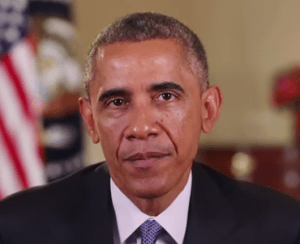

And Then There is the “L Factor”

With President Obama’s presidency in its final two years, one can expect increased attention at The White House on issues which will bolster President Obama’s legacy. Undoubtedly in a sharply partisan environment, with both parties posturing for the 2016 elections, these will not be new initiatives, but rather improving signature legislation of the Obama Administration – in areas capable of bi-partisan support. Hopefully, with a new Congress, and the White House in its closing years, Congress will be able to come together one more time, as it did with the JOBS Act in 2012, to correct some of its failings, and break new ground for further deregulation of small business capital formation.

With President Obama’s presidency in its final two years, one can expect increased attention at The White House on issues which will bolster President Obama’s legacy. Undoubtedly in a sharply partisan environment, with both parties posturing for the 2016 elections, these will not be new initiatives, but rather improving signature legislation of the Obama Administration – in areas capable of bi-partisan support. Hopefully, with a new Congress, and the White House in its closing years, Congress will be able to come together one more time, as it did with the JOBS Act in 2012, to correct some of its failings, and break new ground for further deregulation of small business capital formation.

Expected to be high on the “to-do” list of Congressional JOBS Act fix-its will undoubtedly be Regulation A+. Three areas are likely to get attention:

Pre-Emption of State Blue Sky Regulation – A critical ingredient to a successful Title IV Regulation A+ is federal pre-emption of state authority to approve or disapprove offerings under Regulation A+. The JOBS Act gave the SEC authority to pre-empt state authority for offerings limited to “Qualified Purchasers,” as defined by the SEC. And though the SEC’s proposed rules made all investors “Qualified Purchasers,” this position has been met with strong resistance by the North American Securities Administrators Association (NASAA), who have gone so far as to suggest that if the SEC’s final rules mimic the proposed rules, litigation challenging the SEC’s authority would ensue. And even the SEC’s rules, as proposed, limit the amount an investor can invest in a Regulation A+ offering to 10% of income or net worth, exclusive of principal residence, even if one is an “Accredited Investor.”

Pre-Emption of State Blue Sky Regulation – A critical ingredient to a successful Title IV Regulation A+ is federal pre-emption of state authority to approve or disapprove offerings under Regulation A+. The JOBS Act gave the SEC authority to pre-empt state authority for offerings limited to “Qualified Purchasers,” as defined by the SEC. And though the SEC’s proposed rules made all investors “Qualified Purchasers,” this position has been met with strong resistance by the North American Securities Administrators Association (NASAA), who have gone so far as to suggest that if the SEC’s final rules mimic the proposed rules, litigation challenging the SEC’s authority would ensue. And even the SEC’s rules, as proposed, limit the amount an investor can invest in a Regulation A+ offering to 10% of income or net worth, exclusive of principal residence, even if one is an “Accredited Investor.”

Exemption from SEC Periodic Reporting Requirements – One of the principal benefits to a company successfully completing a Regulation A+ offering is the attractiveness of having lighter ongoing reporting requirements than a company going public through traditional means. However, what Congress failed to address in Title IV of the JOBS Act, unlike Title III, is that it did not exempt Regulation A+ companies from events which historically would trigger full reporting obligations. Hence, if a company completes a Regulation A+ offering and subsequently has more than 500 non-Accredited shareholders of record, it will immediately lose the benefit of the lighter reporting regimen of Regulation A+. Given that companies cannot control secondary trading in their stock and the number of shareholders, some companies may forego a Regulation A+ offering entirely – fearing that Regulation A+’s promise of less burdensome ongoing reporting may be illusory.

Exemption from SEC Periodic Reporting Requirements – One of the principal benefits to a company successfully completing a Regulation A+ offering is the attractiveness of having lighter ongoing reporting requirements than a company going public through traditional means. However, what Congress failed to address in Title IV of the JOBS Act, unlike Title III, is that it did not exempt Regulation A+ companies from events which historically would trigger full reporting obligations. Hence, if a company completes a Regulation A+ offering and subsequently has more than 500 non-Accredited shareholders of record, it will immediately lose the benefit of the lighter reporting regimen of Regulation A+. Given that companies cannot control secondary trading in their stock and the number of shareholders, some companies may forego a Regulation A+ offering entirely – fearing that Regulation A+’s promise of less burdensome ongoing reporting may be illusory.

Raising the Ceiling on Offering Amounts – Title IV imposed a dollar ceiling of $50 million on the amount a company could raise in a 12 month period – and instructed the SEC to periodically revisit this amount, starting in 2014. Many have already called for this ceiling to be raised even higher, from $50 million to $100 million, including SEC Commissioner Gallagher.

Title III Crowdfunding may also be expected to benefit from the prospect of further federal legislation, though perhaps not at the same pace, or with the same vigor, as other JOBS Act fixes. Despite strong bi-partisan support in 2012, support has eroded in some corners as a result of ongoing anti-crowdfunding lobbying. And others, though supportive, may withhold support for further legislation until final SEC rules are issued and there is an opportunity to observe this new market in operation. Ironically, this could result in a “chicken and egg” type stalemate, where the SEC withholds approval of final rules until Congress makes some fixes, but many in Congress have a “wait and see” attitude before adopting new legislation.

Title III Crowdfunding may also be expected to benefit from the prospect of further federal legislation, though perhaps not at the same pace, or with the same vigor, as other JOBS Act fixes. Despite strong bi-partisan support in 2012, support has eroded in some corners as a result of ongoing anti-crowdfunding lobbying. And others, though supportive, may withhold support for further legislation until final SEC rules are issued and there is an opportunity to observe this new market in operation. Ironically, this could result in a “chicken and egg” type stalemate, where the SEC withholds approval of final rules until Congress makes some fixes, but many in Congress have a “wait and see” attitude before adopting new legislation.

So hopefully, when the dust settles on Election Day, there will be only winners, and no losers, at least insofar as small business is concerned.

___________________

Samuel S. Guzik, a Senior Contributor to Crowdfund Insider , is a corporate and securities attorney and business advisor with the law firm of Guzik & Associates, with more than 30 years of experience in private practice. A nationally recognized authority on the JOBS Act, including Regulation D private placements, investment crowdfunding and Regulation A+, he is and an advisor to legislators, researchers and private businesses, including crowdfunding issuers, service providers and platforms, on matters relating to the JOBS Act. As an advocate for small and medium sized business he has engaged with major stakeholders in the ongoing post-JOBS Act reform, including legislators, industry advocates and federal and state securities regulators. In 2014, some of his speaking engagements have included leading a Crowdfunding Roundtable in Washington, DC sponsored by the U.S. Small Business Administration Office of Advocacy, a panelist at the MIT Sloan School of Business 2014 Crowdfunding Roundtable, and a panelist at a national bar association event which included private practitioners, investor advocates and officials of NASAA. His articles on JOBS Act issues, including two published in the Harvard Law School Forum on Corporate Governance and Financial Regulation, have also served as a basis for post-JOBS Act proposed legislation. Recently he was cited by SEC Commissioner Daniel M. Gallagher in a public address for his advocacy on SEC regulatory reform for small business. He is admitted to practice before the SEC and in New York and California. Guzik has represented a number of public and privately held businesses, from startup to exit, concentrating in financing startups and emerging growth companies. He also frequent blogger on securities and corporate law issues at The Corporate Securities Lawyer Blog.

Samuel S. Guzik, a Senior Contributor to Crowdfund Insider , is a corporate and securities attorney and business advisor with the law firm of Guzik & Associates, with more than 30 years of experience in private practice. A nationally recognized authority on the JOBS Act, including Regulation D private placements, investment crowdfunding and Regulation A+, he is and an advisor to legislators, researchers and private businesses, including crowdfunding issuers, service providers and platforms, on matters relating to the JOBS Act. As an advocate for small and medium sized business he has engaged with major stakeholders in the ongoing post-JOBS Act reform, including legislators, industry advocates and federal and state securities regulators. In 2014, some of his speaking engagements have included leading a Crowdfunding Roundtable in Washington, DC sponsored by the U.S. Small Business Administration Office of Advocacy, a panelist at the MIT Sloan School of Business 2014 Crowdfunding Roundtable, and a panelist at a national bar association event which included private practitioners, investor advocates and officials of NASAA. His articles on JOBS Act issues, including two published in the Harvard Law School Forum on Corporate Governance and Financial Regulation, have also served as a basis for post-JOBS Act proposed legislation. Recently he was cited by SEC Commissioner Daniel M. Gallagher in a public address for his advocacy on SEC regulatory reform for small business. He is admitted to practice before the SEC and in New York and California. Guzik has represented a number of public and privately held businesses, from startup to exit, concentrating in financing startups and emerging growth companies. He also frequent blogger on securities and corporate law issues at The Corporate Securities Lawyer Blog.