Dr. Mia Gray opines about the recent Nesta and University of Cambridge report. To recap, Nesta, a UK based innovation charity and staunch proponent of entrepreneurship and creativity, recently published an update on the alternative finance industry in the United Kingdom. Crowdfund Insider JD Alois explains, “The report notes this new financial sector, that includes crowdfunding, peer to peer (P2P) lending, and other categories, has more than doubled over the past several years and stands to top £1.74 billion ($2.75 billion) by the end of 2014.” You may view the report in its entirety here.

Dr. Mia Gray opines about the recent Nesta and University of Cambridge report. To recap, Nesta, a UK based innovation charity and staunch proponent of entrepreneurship and creativity, recently published an update on the alternative finance industry in the United Kingdom. Crowdfund Insider JD Alois explains, “The report notes this new financial sector, that includes crowdfunding, peer to peer (P2P) lending, and other categories, has more than doubled over the past several years and stands to top £1.74 billion ($2.75 billion) by the end of 2014.” You may view the report in its entirety here.

As an academic advisor for this prescient report, the University of Cambridge Economic Geographer Dr. Gray also works on markets more broadly, such as labour, financial, and innovation. Dr. Gray is Bryan Zhang’s PhD supervisor, a co-author of the recent collaborative report; Gray and Zhang have been working on this topic for a number of years.

I recently had the opportunity to connect with the influential Dr. Gray via email. Our interview follows:

Erin: The rapid growth of the various sectors indicate that peer-to-peer lending is clearly leading the charge – yet equity crowdfunding is rather small but growing rapidly. How do you explain this phenomenon? Will P2P lending continue to lead the charge in the UK? Why or why not?

Erin: The rapid growth of the various sectors indicate that peer-to-peer lending is clearly leading the charge – yet equity crowdfunding is rather small but growing rapidly. How do you explain this phenomenon? Will P2P lending continue to lead the charge in the UK? Why or why not?

Mia: Obviously peer-to-peer lending has a lower risk profile than equity-based crowdfunding, which is a high-risk and high-return investment activity. The peer-to-peer lending funding mechanism is also a much more straightforward and less time-consuming process than equity-based crowdfunding, which can take months just to complete the due-diligence process. The UK peer-to-peer lending market has also been in development much longer than equity-based crowdfunding, with the first platform Zopa launched in 2005. Peer-to-peer lending, especially in the consumer lending model, can also be a highly automatised process with both lenders and borrowers having only need to specify the amount and duration of lending or borrowing.

Many people are also more familiar with the peer-to-peer business lending model and like the ability to choose which firms and individuals receive the loans. Sometimes, they’re attracted by the good rate of return, but the data shows that at other times, they want to support a particular firm, a sector, or a specific geographical region.

The equity-based crowdfunding model has increased by 410% year-on-year from 2012-2014, however, I think many people still have certain reservations about this model and the risks it entails. But one of the clear functions of the equity-based crowdfunding platform is to offer deal flows for investors to diversify their investments. We are also seeing a trend of hybridisation, whereby experienced angel investors, even venture capital firms, are investing alongside retail investors on equity-based crowdfunding platforms. The industry itself also has sought out appropriate regulation — because it helps create a strong, open and inclusive market, one in which individuals feel they can take part.

Erin: What can the United States learn from the UK and the information from the Nesta Report?

Mia: I think there are regulatory lessons here. The UK has led the way in regulating the alternative finance sector and we’ve seen the industry take root here. This is really important for the equity-based crowdfunding and peer-to-peer business lending part of the industry.

In general, providing that the regulatory framework is proportionate and reasonably light-touch, a diverse range of alternative finance can definitely thrive. Especially in regard to the Title III of the JOBS Act, the UK experience has proven that equity-based crowdfunding or crowd-investing can work with high level of participation from the retail investors as well as the more sophisticated/high net worth investors in a regulated environment.

Erin: How has the UK Government approach, both elected and regulatory, acted as a catalyst to propel crowdfunding & P2P?

Mia: I think you’re getting to the heart of the issue here. As I said, the FCA’s regulations on both peer-to-peer

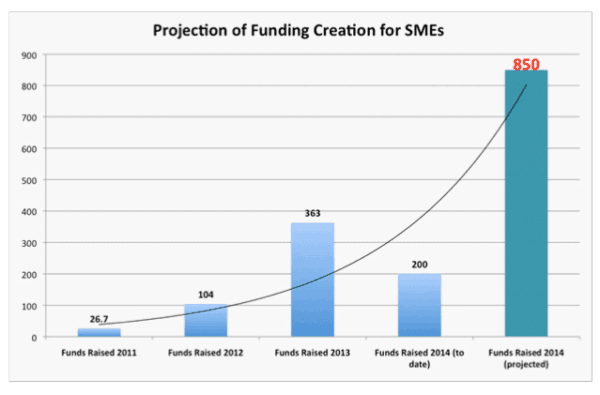

lending and investment crowdfunding have been generally well-received by the alternative finance industry in the UK. The UK government, through the British Business Bank, via the Business Financing Partnership, also have invested £85 million worth of tax-payers’ money through various peer-to-peer lending and invoice trading platforms to provide credit and capital directly to SMEs in the UK.

Erin: Nesta’s findings regarding the role of women in alternative finance, namely that Nesta states that women make up the majority of fundraisers in both donations based and rewards based crowdfunding compels me to ask: How will women move to overtake the predominantly male P2P and equity crowdfunding sector?

Mia: Alternative finance is still a very nascent industry so it will be unrealistic to expect it exhibiting a completely different funding paradigm than traditional financing models when it comes to gender. We definitely need more comprehensive as well as longitudinal data to draw any definitive conclusion on the gender dynamics of alternative finance, but we are seeing more and more women entrepreneurs fundraising on equity-based crowdfunding platforms or borrowing capital from peer-to-peer business lending platforms.

Erin: In order for alternative finance to grow, the report explicitly notes “the industry needs to continue innovating, educating users and addressing the various concerns consumers and SMEs have about alternative finance.” What will be done to engender such growth?

Mia: The UK alternative finance market is growing rapidly but so far unpinned by strong market fundamentals. However, as our national consumer and SME polls demonstrate, although the general level of awareness of alternative finance is improving, many people are still very hesitant to use it. It will take time for funders and fundraisers to discover alternative finance, understand how different models work and eventually start to give it a try.

These users will have very legitimate concerns about risks, returns and processes. The platforms need to keep addressing these concerns with customer engagement, transparency, education and most importantly a proven track-record of success and performance.

Erin: Who do you identify as the trailblazing this path?

Mia: It will be difficult to identify individual alternative finance platforms. But under the leadership of the UK Crowdfunding Association (UKCFA) and P2P Finance

Association (P2PFA), many leading platforms have been trailblazing the path of alternative finance by continually innovating, diversifying and offering more effective, efficient and transparent ways for funders to invest, lend or donate and for fundraisers to obtain credit or raise capital.