Title II of the JOBS Act allowed companies raising capital using private placements to advertise the investment opportunity. Think about it. If you were trying to sell your house but were not allowed to advertise it would be pretty hard. Well “general solicitation” as it is known, has been legalized in the United States for certain private placements as of September 2013. Online investment crowdfunding platforms have quickly positioned their platforms to leverage the power of the internet and solicit funding for companies in need of capital. There are certain requirements that companies need to adhere to – as one would expect. One of the most important is the verification of investors being “accredited” or qualified to participate in these offerings. There have been rumblings for quite some time about the SEC targeting platforms that were on the edge (or over it) regarding compliance. Recently the very first fell afoul of SEC enforcement and were subjected to an SEC Cease & Desist along with a fine.

Title II of the JOBS Act allowed companies raising capital using private placements to advertise the investment opportunity. Think about it. If you were trying to sell your house but were not allowed to advertise it would be pretty hard. Well “general solicitation” as it is known, has been legalized in the United States for certain private placements as of September 2013. Online investment crowdfunding platforms have quickly positioned their platforms to leverage the power of the internet and solicit funding for companies in need of capital. There are certain requirements that companies need to adhere to – as one would expect. One of the most important is the verification of investors being “accredited” or qualified to participate in these offerings. There have been rumblings for quite some time about the SEC targeting platforms that were on the edge (or over it) regarding compliance. Recently the very first fell afoul of SEC enforcement and were subjected to an SEC Cease & Desist along with a fine.

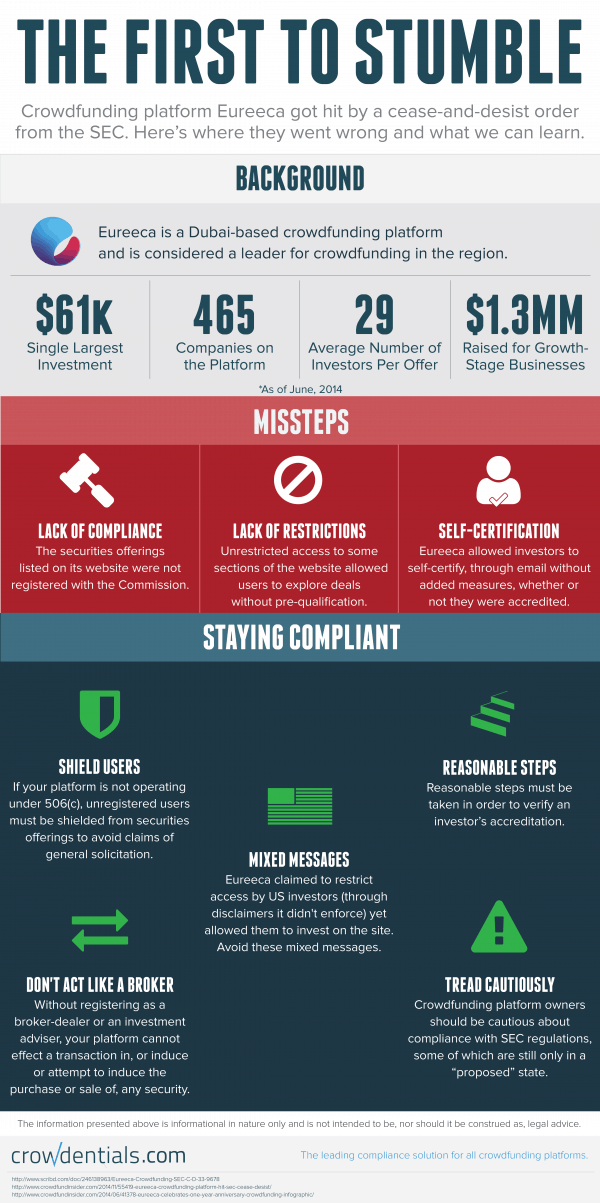

The team at Crowdentials, a compliance firm, has created a brief infographic outlining some of the errors, now rectified, on the platform that caught the attention of the SEC.

Click to enlarge.