Unbolted is an online peer to peer lending platform that is effectively a digital pawn shop. Users may secure loans with personal “high value assets” to access loans of up to £1 million according to a release from the company. For lenders Unbolted states the loans are secured against personal assets at a 70% loan to value and may earn an APR of 10.5%. There is a note on the site they are not accept new lenders now but expect to be open for new funds soon.

Unbolted is an online peer to peer lending platform that is effectively a digital pawn shop. Users may secure loans with personal “high value assets” to access loans of up to £1 million according to a release from the company. For lenders Unbolted states the loans are secured against personal assets at a 70% loan to value and may earn an APR of 10.5%. There is a note on the site they are not accept new lenders now but expect to be open for new funds soon.

Unbolted co-founder Rito Haldar described his startup;

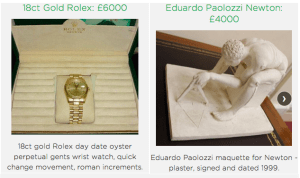

“We set up Unbolted because we want to challenge the way people can access credit through the out-dated pawn industry and other secured lenders. We’ll do that by being transparent, offering fairer terms, cheaper rates and a convenient, easy-to-use online service that puts consumers firmly in control of their borrowing. Would-be borrowers can apply for secured loans – at market leading rates – against anything from gold to fine art, antique cars to grand pianos, simply by uploading a picture of their item to Unbolted’s website.”

Unbolted states that valuation experts will offer loans against the items within three hours and, once the goods are received, consumers may have the cash in their accounts within 30 minutes. Unbolted loans accrue interest day-by-day, but borrowers may pay back their loan and reclaim their assets at any time – similar to brick and mortar pawn shops. If a borrower defaults on a loan and there is surplus from any auction proceeds, Unbolted states it will automatically return it to the borrower via a bank transfer.

“At Unbolted, we use a peer-to-peer online model which strips out many costs and ensures our customers can benefit from lower rates than typical larger loan companies or pawnbrokers, said Haldar. “For us, it’s about making short-term borrowing affordable and simple so we can help asset-rich but cash-poor individuals and business owners. We want to champion change in this industry.”

The start-up reports it has already had a “wave of enquiries” from new customers and is now offering rates of between 1.5% and 3% per month for loans taken out against luxury items. Unbolted states that “typical” lenders charge between 5% and 10% each month.

Ashwin Parameswaran, fellow co-founder of Unbolted, added:

“We have launched the service now because we know Christmas is an expensive time of year and, come January, many people are looking to consolidate their debts or look around for short-term finance options. We want to help them do that in a cost-effective and convenient way.”

“We see no reason why people should be forced to turn to expensive pawnbrokers or short-term finance lenders to do that. Using their luxury or personal assets as collateral gives them access to an affordable option through Unbolted.”

“There’s a certain stigma, probably quite rightly, attached to the pawnbroker industry, which is in real need of a shake up. We’re aiming to remove this stigma and create a new financing option that benefits more people. We certainly hope people consider us when they come to review their borrowing options this winter.”

“The reality is that in difficult times people sometimes do need extra cash and through Unbolted they now have a smarter, fairer and more sustainable way to do just that.”

Unbolted is a trading name of Open Access Finance Limited, which is authorised and regulated by the Financial Conduct Authority (FCA), with interim permission to conduct peer-to-peer lending platform activity. Unbolted presently has three locations in the UK, two in London and one in Nottingham.

Unbolted is a trading name of Open Access Finance Limited, which is authorised and regulated by the Financial Conduct Authority (FCA), with interim permission to conduct peer-to-peer lending platform activity. Unbolted presently has three locations in the UK, two in London and one in Nottingham.