When we showed up in Washington, D.C., Karen Kerrigan, of the Small Business and Entrepreneurship Council, became a champion for our cause to legalize debt and equity crowdfunding. Karen, and the SBE Council, is the closest thing small businesses and entrepreneurs have to a lobby group. Both Karen and the SBE Council have been tirelessly working on behalf of small businesses for years. (If you do not subscribe to their newsletter, this is a must). Since they represent the voice of our nation’s small businesses and have well over 100,000 members, we wanted to see what the opportunity under Title III meant to her and her members.

Below is our Q&A with Karen. We think you will find her thoughts insightful and significant.

Jason & Woodie: In the 3 years since the President signed the JOBS Act into law, what have your members been saying about access to capital?

Jason & Woodie: In the 3 years since the President signed the JOBS Act into law, what have your members been saying about access to capital?

Karen: Certainly there has been some improvement. Online financing has helped and so has Title II crowdfunding. Bank loans are not an option for all small businesses, to say the least, so big gaps linger. A stronger economy would certainly help boost investment and lending, but we have to deal with current realities. Capital needs are going unmet. Geographic, gender and race disparities remain. It’s still pretty tough out there for your typical startup or small business owner not plugged into money networks, which happen to be most of us.

Jason & Woodie: Now that the final rules for crowdfunding are here, what impact will this have on SBE Council’s members?

Karen: The impact will be significant. First, as entrepreneurs in search of start-up or growth capital, Title III crowdfunding releases an immense pool of capital that has been locked away due to archaic thinking and laws. For many of our members who are locked out of networks or don’t have access to Venture Capital networks or Angels, this next phase of investment crowdfunding blows the market wide open. For women entrepreneurs, the potential is quite significant as online platforms will continue to grow, diversify and serve niche markets. Investors will be in search of quality businesses to invest in – regardless of gender or race.

Second, small businesses will be stronger once they grasp what it takes to raise capital via equity and debt-based crowdfunding. The knowledge they will absorb by going through the fundraising process, and preparing for it – including the vetting and feedback – will make for stronger and more competitive businesses. This is not only good for the entrepreneur, but for our economy as a whole.

Third, more small business owners and entrepreneurs will become investors themselves. This will be tremendously powerful for the ecosystem.

Jason & Woodie: Why was this issue so important to you and the SBE Council? Why do you think Congress and the President were so in favor of it?

Karen: Access to capital is an enduring challenge for many of our members, and small business generally. The issue and reforms to improve capital formation are chief priorities for our organization.

Karen: Access to capital is an enduring challenge for many of our members, and small business generally. The issue and reforms to improve capital formation are chief priorities for our organization.

Obviously, during the period (2011) that we started our advocacy push with you, Jason and Zak, the capital markets were utterly broken. The situation was so dismal for entrepreneurs and our economy that members of Congress and the President became fully open to ideas and solutions. There was genuine bipartisan consensus to get something done for small businesses and our economy.

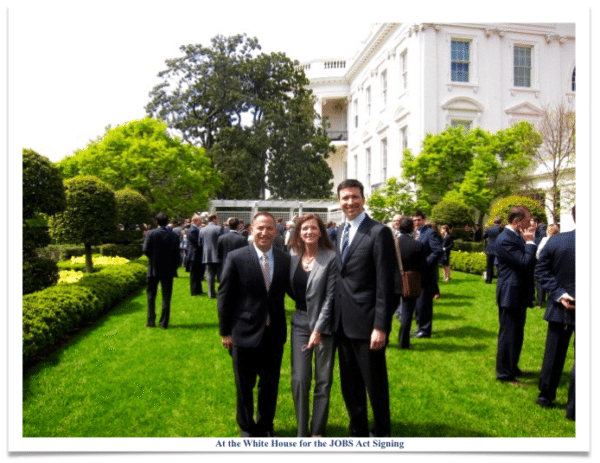

As in business, timing is everything. The framework that you brought to Washington aligned with many of the efforts that were being pursued by key members of Congress and President Obama. But make no mistake, a lot of hard work went into building traction for the issue on Capitol Hill and in the White House. Pushing the JOBS Act over the finish line was no easy task, but the focused engagement of all the players committed to making this happen and showing up in Washington when it mattered made all the difference in the world. Perseverance was key. The broad coalition and diversity of voices in favor of the JOBS Act and Title III crowdfunding –  Democrats, Independents, Republicans, women, people of color, tech startups, young entrepreneurs and established small business organizations – also made a big difference in our success. This was an authentic, organic movement. Official Washington could see that and couldn’t ignore it.

Democrats, Independents, Republicans, women, people of color, tech startups, young entrepreneurs and established small business organizations – also made a big difference in our success. This was an authentic, organic movement. Official Washington could see that and couldn’t ignore it.

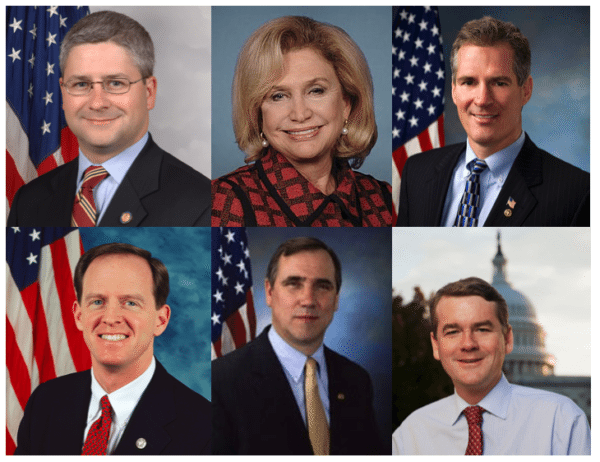

We also have to recognize that the early congressional leaders on investment crowdfunding — Congressman Patrick McHenry (R-NC) and Carolyn Maloney (D-NY) on the House side, and former Senator Scott Brown (R-MA), current Senators Pat Toomey (R-PA), Jeff Merkley (D-OR) and Michael Bennett (D-CO) on the Senate side were passionate about making investment crowdfunding happen. More importantly, they were fully bipartisan in their push to get it done. This was critical to our success. So was President Obama’s endorsement of the very first bill that passed the House with unanimous support.

Jason & Woodie: What do you think are the most important next steps for people who wish to use this new form of finance?

Karen: Learn more! Start now even though you may not need capital, or be considering a capital raise at this time. Organize and build your network. View all your contacts as potential investors, because they are! And don’t forget your customers! Identify key people who can validate your success, commitment to excellence and your ethics. Bone up on what it takes to be successful in raising investment capital and be investment ready before you take the plunge. Thankfully, there are so many great resources to turn to. If you want to crowdfund at this time, choose a platform with a track record of experience and success in the industry. They will have the know-how, the networks and the technical expertise to help you navigate the legal and compliance pieces and all other components to prepare for fundraising. Finally, consider joining a platform as an investor. See what it is like on the “other side,” which will help to better prepare you and your business when and if you decide to seek investment crowdfunding.

Oh, and here is my final, final plug. Please stay educated and active about our efforts to help strengthen investment crowdfunding and capital formation in America, and across the globe. The more engaged entrepreneurs become in the legislative and policy-making process, the more successful all of us will be.

Jason Best is co-founder and Principal of Crowdfund Capital Advisors (CCA), Jason Best co-authored the crowdfund investing framework used in the JOBS Act to legalize equity and debt-based crowdfunding in the USA. He has provided congressional testimony on crowdfunding and was honored to attend the White House ceremony when President Obama signed the JOBS Act into law on April 5, 2012. Jason co-founded the crowdfunding industry trade group that works with the Securities and Exchange Commission and FINRA as they create the rules for crowdfund investing. Jason also works with angel groups, PE/VC firms as well as governments and NGOs, including The World Bank, to understand the crowdfunding ecosystem and create successful crowdfund investing strategies. He was instrumental in the successful effort to have CCA selected by the US State Department’s Global Entrepreneurship Program as a Key Partner.

Jason Best is co-founder and Principal of Crowdfund Capital Advisors (CCA), Jason Best co-authored the crowdfund investing framework used in the JOBS Act to legalize equity and debt-based crowdfunding in the USA. He has provided congressional testimony on crowdfunding and was honored to attend the White House ceremony when President Obama signed the JOBS Act into law on April 5, 2012. Jason co-founded the crowdfunding industry trade group that works with the Securities and Exchange Commission and FINRA as they create the rules for crowdfund investing. Jason also works with angel groups, PE/VC firms as well as governments and NGOs, including The World Bank, to understand the crowdfunding ecosystem and create successful crowdfund investing strategies. He was instrumental in the successful effort to have CCA selected by the US State Department’s Global Entrepreneurship Program as a Key Partner.

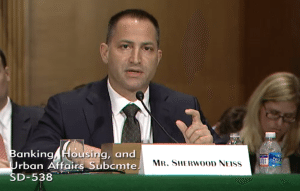

Sherwood “Woodie” Neiss, is co-founder and Principal of Crowdfund Capital Advisors, is an expert at building successful businesses. As a 3-time INC500 winner whose company won E&Y’s Entrepreneur of the Year, Sherwood understands the keys to entrepreneurial success from concept to company to sale. As a serial entrepreneur and investor during the credit crunch, Sherwood saw a need for a change in outdated securities laws and did something about it—as a co-founding member of Startup Exemption, Sherwood co-authored the Crowdfunding Framework used in the JOBS Act that was signed into law by President Obama on April 5, 2012. Within Crowdfund Capital Advisors (CCA), Sherwood works with clients ranging from governments and banks that are looking for ways to boost economic development in their countries to investment firms looking for access to increased deal flow that crowdfunding creates. Sherwood serves as an advisor to several crowdfunding platforms and crowdfunding technologies giving him a unique understanding and view of the industry and market. As an industry leader, Sherwood contributes to several publications including VentureBeat and TechCrunch. He additionally wrote Crowdfund Investing for Dummies through Wiley & Son’s.

Sherwood “Woodie” Neiss, is co-founder and Principal of Crowdfund Capital Advisors, is an expert at building successful businesses. As a 3-time INC500 winner whose company won E&Y’s Entrepreneur of the Year, Sherwood understands the keys to entrepreneurial success from concept to company to sale. As a serial entrepreneur and investor during the credit crunch, Sherwood saw a need for a change in outdated securities laws and did something about it—as a co-founding member of Startup Exemption, Sherwood co-authored the Crowdfunding Framework used in the JOBS Act that was signed into law by President Obama on April 5, 2012. Within Crowdfund Capital Advisors (CCA), Sherwood works with clients ranging from governments and banks that are looking for ways to boost economic development in their countries to investment firms looking for access to increased deal flow that crowdfunding creates. Sherwood serves as an advisor to several crowdfunding platforms and crowdfunding technologies giving him a unique understanding and view of the industry and market. As an industry leader, Sherwood contributes to several publications including VentureBeat and TechCrunch. He additionally wrote Crowdfund Investing for Dummies through Wiley & Son’s.