The Bank of England (BOE) announced the extension of the Funding for Lending Scheme (FLS) that was designed to provide easier access to capital for SMEs. The BoE stated the program will provide lenders with continued certainty over the availability of cheap funding to support lending to small and medium-sized enterprises (SMEs) during 2015, even in the event of stress in bank funding markets. According to the BOE, the FLS has contributed to a significant reduction in the cost of banks providing credit. The program is said to be “complementary” to a panoply of programs intended to boost the economy.

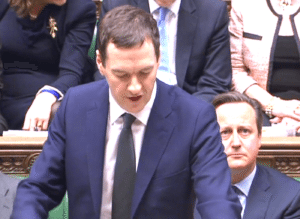

Chancellor of the Exchequer George Osborne commented on the news;

Chancellor of the Exchequer George Osborne commented on the news;

“The government’s long-term economic plan is working with the Funding for Lending Scheme playing a vital role in supporting the recovery. Now that credit conditions for households and large businesses have improved, it is right that we focus the scheme’s firepower on small businesses, which are the lifeblood of our economy. That’s also why we’ve reformed the banks, introduced the British Business Bank and are now focussing the Funding for Lending Scheme on supporting them.”

GLI Finance, an alternative finance provider operating in the UK, posted a different perspective;

“The latest figures released by the Bank of England today highlight that SMEs are not getting access to the finance they need to thrive. The extension of the Funding for Lending scheme does not go anywhere near to solving the problem. The scheme has failed in its aim to encourage more SMEs to consider alternative finance as a way to meet their needs. Indeed, lack of awareness amongst SMEs of the financing options available to them remains a huge issue. More must be done to raise SMEs’ awareness of the finance options available to them, and to change SME behaviours when it comes to consideration of alternative sources of finance. We must think less about individual policies and much more about the bigger picture – after all, SMEs are one of the main drivers of the UK economy.”

The Governor of the BOE, Mark Carney characterized FLS as a backstop. The program has been refocused to the sector that needs it most – SMEs.

The Governor of the BOE, Mark Carney characterized FLS as a backstop. The program has been refocused to the sector that needs it most – SMEs.

“By providing a backstop for funding for banks, the FLS has supported access to credit across the economy during an exceptional period. As the banking system has been returned to health, the need for that backstop has been reduced,” stated Carney. “The Scheme is not permanent so, as access to credit has returned to the mortgage market and large corporations, the Scheme has been tapered appropriately. The extension announced today concentrates the FLS on the one area where support remains warranted: the supply of credit to SMEs.”

The FLS extension will remain open until 29 January 2016.