Is there more to the current blockchain hype than there was to the Bitcoin hype of the past? 7 myths debunked. 7 reasons to be skeptical.

Two years ago, Bitcoin was at the peak of its hype cycle. The digital currency’s value skyrocketed. Increasing tenfold in 4 months, it passed the $1,200 mark, the price of an ounce of gold at the time.

Two years ago, Bitcoin was at the peak of its hype cycle. The digital currency’s value skyrocketed. Increasing tenfold in 4 months, it passed the $1,200 mark, the price of an ounce of gold at the time.

Then, after a couple of security breaches and scandals such as the collapse of the largest exchange Mt. Gox in 2014, Bitcoin’s value fell down to $200. The speculation frenzy came to a halt. So did the VC’s enthusiasm for Bitcoin-based business models.

In 2015, the hype machine started humming again. The new hype revolves around the idea that Bitcoin may not be viable as a currency, but the blockchain, the distributed ledger technology that records bitcoin transactions would have a formidable potential on its own. As research reported on by Coindesk shows:

“On the question of whether “the blockchain can thrive without bitcoin”, 73% of the 55 respondents asked this question said they believe it can.”

The dream is that of an open self-administered transaction network in which multiple processors are forced to collaborate and validate transactions –eliminating any risk of double spend or reversal- without central supervision. Such a system could be used to manage any type of asset transaction or contract history in a decentralized fashion, without a central authority. It could apply to stock trading, property title registry, voting, crowdfunding…

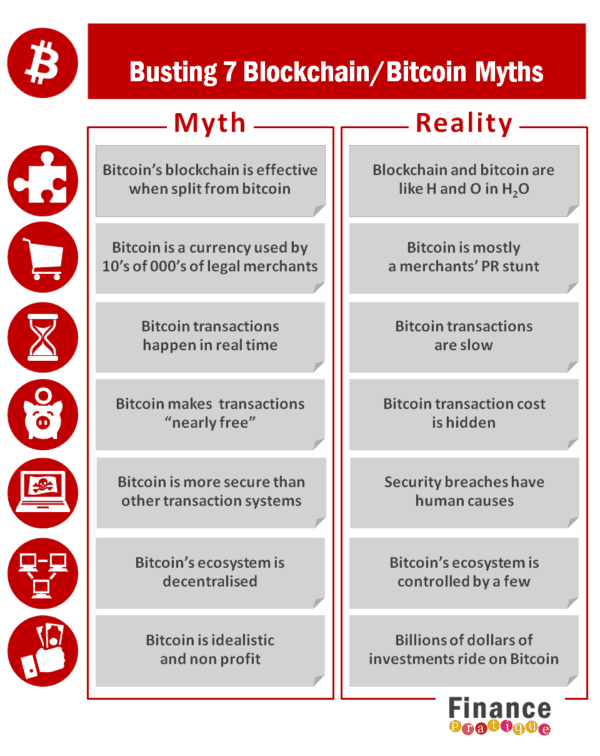

7 Myths Debunked & 7 Reasons to be Skeptical

As stated above the idea of blockchain has a great appeal and seems worth investigating. However, there are major reasons to be skeptical.

One suspicion would be that a blockchain-based system, if at all workable, would be a downgraded version of the Bitcoin’s blockchain and, as such, would require as many safeguards and controls as current regulated systems.

I’ve singled out 7 myths about blockchain and bitcoin, the debunking of which should inform a healthy skepticism.

Myth Number 1 : Blockchain as a decentralized ledger can be split from bitcoin in the Bitcoin system

Most people who say this argue something along the lines that bitcoin failed as a currency but the blockchain worked. From there, they jump to the conclusion that the blockchain in isolation of the bitcoin could build a decentralized transaction system. This is quite as absurd as saying that we could get water from oxygen alone because we can isolate oxygen from hydrogen in H20.

In reality what makes Bitcoin’s blockchain strongly decentralized is the specific bitcoin encryption algorithm and bitcoin network protocol which determine the way bitcoin processors (“miners”) compete to verify and validate (“hash”) bitcoin transactions.

There are other distributed ledger systems than Bitcoin’s, such a Ripple Lab’s and Ethereum’s. Ethereum develops its own “blockchain”, but the Bitcoin blockchain is, to this day, the only one that is truly decentralized without the need for consensus or supervision.

Myth Number 2: Bitcoin is a currency used by 10’s of 1,000’s of legal merchants.

One heard this two years ago when it was even less true than today. I remember a presentation by a Bitcoin vendor showing beautiful pictures of Afghan weavers who allegedly were using bitcoin to sell their carpets worldwide! Magic carpets, for sure.

In reality, ignoring illegal business which has dramatically declined since Silk Road was busted:

Bitcoin as a currency was and is probably still used to over 80% for speculative hoarding.

The legal merchants listed as “accepting bitcoins” don’t. At best, they allow you to spend your bitcoins at a partnering facility which converts them into dollars – exchange costs and risks are on you.

Merchants started to “accept bitcoin” just to check how it works, to look cool, or to get media exposure.

Myth Number 3 Bitcoin transactions are processed in real time

In reality, Bitcoin transactions are processed in blocks and it takes more than 10 minutes between blocks. The Bitcoin network currently handles less than 2 transactions per second, against several thousands for Visa. You can check the stats on blockchain.info.

Myth Number 4 Bitcoin transactions are “nearly free”

In reality, the true cost of Bitcoin processing is not charged to users. It’s invisible to users, and, for the most part, not charged to merchants either –for now. Here is why:

Miners who process transactions are currently making over 99% of their revenue (currently around $1.3 million a day) from generating (“mining”) new bitcoins. This will last until the planned 21 million bitcoins have been mined – which should happen in 2140. It is unclear how the bitcoin transaction cost will evolve after that.

Transaction processing per se is minimally rewarded by the network with a small amounts of bitcoins that currently represents less than 1% of the miners’ revenue.

But only the total miner rewards can justify the high $ investment and operating costs of mining (see myth Nr 6 below). Hence, the real cost of transaction should take the total mining cost into account, i.e. $7.64 per transaction, for an average transaction of $824.

When exchange commissions are added, this cost is not negligible.

Myth Number 5 Bitcoin is more secure than other transaction systems

Bitcoin’s protocol has been highly resilient against attacks.

However, like in any transaction system, security breaches have been caused by human failure and fraud. In 2015 alone:

- Bitpay lost nearly $2 million in a phishing attack.

- Before that, a Canadian bitcoin exchange was forced to shut down because its databases had been compromised.

- Hong Kong-based bitcoin exchange MyCoin disappeared with $387 million in client funds

- Bitstamp temporarily stopped trading because of one of its operational wallets was compromised.

Myth Number 6 Bitcoin’s ecosystem is decentralized

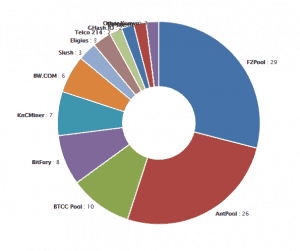

Bitcoin Hashrate Distribution Source Blockchain.info Dec 3, 2015

Bitcoin Hashrate Distribution Source Blockchain.info Dec 3, 2015

In fact, bitcoin mining is increasingly concentrated in the hands of a few mining pools. The four leading ones, including 3 from China, control nearly 75% of the hashing. Large mining farms artificially limit themselves so as not to ruin the illusion of democracy. But smaller miners and mining pools, such as DigitBTC earlier this year, are driven out of business.

The reason for this oligopolistic dominance is that, by design, generating Bitcoins through mining becomes harder as the number of bitcoins increases. Only larger players can afford the higher capital investment (specialized hardware) and operating costs (e.g. electricity) that mining requires. Bitcoin is de facto controlled by a handful of quite opaque players who would, if they wanted to, have the 51% majority that would enable them to modify transaction rules.

Note that the wallet market is also very concentrated with Coinbase and Blockchain.info the largest operators claiming together more than 50% market share.

Myth Number 7 Bitcoin is idealistic and non-profit

In reality, billions of dollars of investments are riding on Bitcoin. Firstly, there is a cumulated $5 billion worth of bitcoin currency. Secondly, there are billions of dollars invested in mining, exchanges and wallet operators.

In reality, billions of dollars of investments are riding on Bitcoin. Firstly, there is a cumulated $5 billion worth of bitcoin currency. Secondly, there are billions of dollars invested in mining, exchanges and wallet operators.

Recent examples:

- Coinbase raised more than $100 million.

- Goldman Sachs invested $50 million in a bitcoin start up call Circle.

- Another bitcoin startup hardly out of stealth mode, 21 Inc, raised $116 million from the best VCs in Silicon Valley.

Even if only to rescue their Bitcoin investment, most investors want their Bitcoin business to “pivot” to blockchain.

In conclusion

Bitcoin is undoubtedly a brilliant, extraordinary invention and currently has the only truly decentralized ledger technology, i.e. blockchain. But what makes it so strong seems to make it also impractical. When reality hits, the Bitcoin network appears less efficient, more easily centrally controlled and more opaque than many regulated transaction and payment systems.

Whether another version of the blockchain or decentralized ledger could do better without adding layers of consensus or regulation that would put them of a par with competing technologies remains to be seen.

It’s not going to be easy – they’ve already tried for quite some time.

Therese Torris is an entrepreneur and consultant in eFinance and eCommerce based in Paris. She has covered crowdfunding and P2P lending since the early days when Zopa was created in the United Kingdom. She was a director of research and consulting at Gartner Group Europe, Senior VP at Forrester Research and Content VP at Twenga. She publishes a French personal finance blog, Le Blog Finance Pratique

Therese Torris is an entrepreneur and consultant in eFinance and eCommerce based in Paris. She has covered crowdfunding and P2P lending since the early days when Zopa was created in the United Kingdom. She was a director of research and consulting at Gartner Group Europe, Senior VP at Forrester Research and Content VP at Twenga. She publishes a French personal finance blog, Le Blog Finance Pratique

(Editors Note: a version of this article previously ran on Return on Clicks)