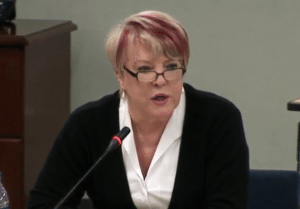

Sara Hanks is one of the most recognizable and vocal leaders in the investment crowdfunding sector. A securities attorney by training, Hanks has spent many years in and around Capitol Hill working on important policy issues. Hanks is also a longstanding board member of the Crowdfund Intermediary Regulatory Association (CFIRA). At one point in time, Hanks was Chief of the Office of International Corporate Finance at the Securities and Exchange Commission Division of Corporate Finance. The experience has provided a unique and helpful perspective on the inner workings or rulemaking under the JOBS Act and the various forms of investment crowdfunding.

Today Hanks is the founder and CEO of CrowdCheck – a legal compliance and diligence firm that helps investment platforms and issuers navigate through the process of selling securities online. Hanks balances this role with her leadership on the SEC’s Advisory Committee on Small and Emerging Companies (ACSEC). This Committee advises the Commission on fostering a more conducive regulatory environment to provide access to capital for SMEs.

Crowdfund Insider recently caught up with Hank’s to inquire about her expectations for the forthcoming launch of Title III retail crowdfunding.

Crowdfund Insider: Can you explain the type of service Crowdcheck is providing for Title III issuers / platforms?

Sara Hanks: We are providing disclosure and due diligence services. If you are an issuer, we can help you write the Form C disclosure so you can be sure you have complied with all of its requirements.We can also provide our “Compliance Check”, which is assurance that all the other requirements of the rules are met, and our “Verified Check”, which includes fact-checking of the disclosure so that you are sure there are no misleading statements in what you have said. The same services are also being used by platforms.Most of our platform clients are going for the “Verified Check”, which protects platforms from liability for misleading statements as well as ensuring that all the requirements of Regulation CF are met.

Crowdfund Insider: What do you expect to occur on May 16th (the first day Title III is actionable)?

Crowdfund Insider: What do you expect to occur on May 16th (the first day Title III is actionable)?

Sara Hanks: On May 16, I think there might be some manageable level of chaos. Not all the platforms who have applied to be funding portals will have received SEC and FINRA approval by then, so we won’t be starting with a full field. But if the companies we are working with are any indication, there will be many companies who haven’t got their SEC codes, or who realize at the last minute that their financial statements are not GAAP compliant. Over the last week or two, we’ve seen some companies accept that they won’t get their financial statements reviewed by an accountant in time, so they are going to file for an offering of less than $100,000 (which doesn’t require financial statements to be reviewed) and then amend the offering (and file an amendment) when their financials are ready. The trouble is, even when the offering is less than $100,000 the financials have to be GAAP compliant, and the company’s officers have to certify that they are. They shouldn’t be doing that unless they are sure they have met the requirements of GAAP. So no QuickBooks!

The other area of chaos may be in the filing process at the SEC. The SEC’s EDGAR system is old and can be cranky. The Form C is new and permits an unlimited number of pdfs to be used as exhibits. I’m crossing my fingers!

Crowdfund Insider: You have mentioned previously you believe the Reg CF sector will grow slowly. Can you elaborate?

Sara Hanks: All of the various sorts of online capital formation facilitated by the JOBS Act have grown slowly. Rule 506(c) offerings grew slowly and may actually be decreasing as a percentage of the overall market. Regulation A filings have grown slowly as the industry works out what sort of issuers this works best for. Intrastate crowdfunding has been slow to take off. So why would Regulation CF be any different? I’m seeing the same competition for issuers among platforms that we saw three years ago as Rule 506(c) market developed, which doesn’t suggest an unlimited supply of securities.

You also have to take into account that there is a limited supply of money. Most households in the US would struggle to come up with $1,000 for an emergency expenditure, we saw in a recent study. Those guys aren’t going to be investing in Regulation CF securities.

Crowdfund Insider: What about the possibility of fraud?

Crowdfund Insider: What about the possibility of fraud?

Sara Hanks: I think the “f” word has always been a distraction and it’s never been the focus of the regulators. Fraud in the sense of running-away-with-all-the-money was never what the regulators were worried about. It will happen; it’s always happened and it’s always been relatively limited in volume and that’s not what some of the critics of this market have been trying to protect against.

The real issue here is “misleading statements of material facts”, which is what “fraud” is in securities law world. When a company says it’s confident it can ship product in December and it has no basis for making that statement other than wishful thinking, that’s a misleading statement covered by the anti-fraud provisions of the securities law. So you need companies to understand what they can’t say, which means they need professional advice of the kind provided by CrowdCheck.

Crowdfund Insider: You are co-chair of the SEC Advisory Committee on Small and Emerging Companies (ACSEC). How does this Committee interact with SEC Staff and Commissioners?

Sara Hanks: ACSEC gives advice and input on how the SEC’s rules work in real life. The SEC Staff has been tremendously helpful in setting up briefings from the SEC and outside.We are able to set our own agenda, which means we can focus on the things that really matter to small and emerging companies.

Crowdfund Insider: What are some of the most important topics ACSEC has addressed or will address going forward?

Crowdfund Insider: What are some of the most important topics ACSEC has addressed or will address going forward?

Sara Hanks: The definition of “accredited” investor has been a focus of ACSEC in the past and will be one of this year’s biggies. ACSEC was instrumental in encouraging the SEC to modernize Rule 147 to facilitate intrastate crowdfunding, and I wouldn’t be surprised to see those rules finalized this year. With respect to full SEC registration and reporting, I think we can expect to see a big focus on the burdens of reporting for smaller companies, especially with the current initiative on modernizing Regulation SK, the playbook for disclosure.

Crowdfund Insider: Regarding JOBS ACT Titles II, III & IV, how do you see online capital formation evolving over the next 24 months? What about any benefit to the economy?

Sara Hanks: It’s not the next industrial revolution, but increased access to capital has to have an overall beneficial effect.