“Since the Enlightenment there has been a very simple but widely held assumption that we are a species of thinking individuals and human behaviour is best understood by examining the psychology of individuals. It appears, however, that this insight is plain wrong. The evidence from a number of leading behavioural and neuroscientists suggests that our species is designed as a herd or group animal.” – Mark Earls, author of Herd.

Why do we rely on the decisions of others when making investments?

Imagine we couldn’t rely on the opinions of others. To get an objective handle on an investment requires would require investors to read a company’s detailed business plan which explains the market, the competitors and the risks involved. Reading such a business plan is time-consuming, and frankly, not very enjoyable for most people. Then they need to decide whether they believe in the team, and trust what they’re saying. And then there’s the matter of valuation – trying to determine a fair value for a company whose prospects are based on the unknowable future.

Imagine we couldn’t rely on the opinions of others. To get an objective handle on an investment requires would require investors to read a company’s detailed business plan which explains the market, the competitors and the risks involved. Reading such a business plan is time-consuming, and frankly, not very enjoyable for most people. Then they need to decide whether they believe in the team, and trust what they’re saying. And then there’s the matter of valuation – trying to determine a fair value for a company whose prospects are based on the unknowable future.

To make matters worse, this incredibly difficult exercise is not something we are asked to do just once. We are faced with dozens of potential investments to evaluate. We need to choose between them. And let’s not forget, people are busy – they have fulltime jobs to hold down, and lives to live. The vast majority of people making direct investments are doing so in their spare time.

Faced with this kind of challenge, investors do a very natural, very human thing – they look for a shortcut. They look for the opinions of others, effectively outsourcing the mental work that they don’t want to do themselves.

How does this manifest itself in equity crowdfunding?

Investors look for companies that others are backing. If a new investor sees that others have already have decided a company is worthy of their hard-earned money, then they assume there must be a good reason for that momentum. “Thank goodness others have decided which of these options are worthy of backing, so that I don’t need to”, is the relieved cry of the subconscious mind.

Investors look for companies that others are backing. If a new investor sees that others have already have decided a company is worthy of their hard-earned money, then they assume there must be a good reason for that momentum. “Thank goodness others have decided which of these options are worthy of backing, so that I don’t need to”, is the relieved cry of the subconscious mind.

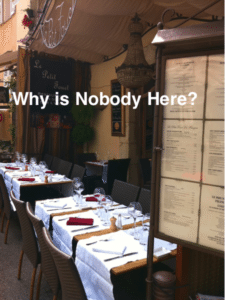

Think of arriving in a new town, where you find two cafes side-by-side – one all but empty, with a bunch of bored baristas hunched over the counter, with nothing to do but check their phones – the other bursting with the chatter of patrons, cups of coffee being imbibed at every table and a line of people waiting to be served by the frantic staff.

Without needing to even check the menus or step foot inside, our instinct is to assume that the empty café must be inferior… and best of all, we don’t even need to expend mental energy to figure out why. Most people will be inclined to follow the crowd and join the line at the busy café.

This same act of “following the crowd” happens in every area of finance. We may like to think of ourselves as individuals, unaffected by the opinions of others, especially when it comes to something so important as where to put our money, but herd behaviour is a deep and enduring part of our human nature. History is littered by bank runs, bubbles in real-estate, and stock market speculation. As Michael Lewis famously said, “Investors do not fear losing money as much as they fear solitude.”

This same act of “following the crowd” happens in every area of finance. We may like to think of ourselves as individuals, unaffected by the opinions of others, especially when it comes to something so important as where to put our money, but herd behaviour is a deep and enduring part of our human nature. History is littered by bank runs, bubbles in real-estate, and stock market speculation. As Michael Lewis famously said, “Investors do not fear losing money as much as they fear solitude.”

In equity crowdfunding, momentum manifests itself through a seemingly minor part of a campaign page: the progress bar. This little tool shows how much a company intends to raise, and how far they’ve already got committed. Would-be investors get complete transparency over how the crowd is moving. This sort of information is irresistible for human minds hungry for shortcuts.

Is this a good thing or a bad thing?

At an emotional level, no-one likes the idea of being prone to moving in a herd-like manner. The word “herd” brings up visions of farm animals like sheep – and we consider sheep very stupid. This was the take of Extraordinary Popular Delusions and the Madness of Crowds, the 1841 memoirs of Scottish journalist Charles Mackay; that humans unquestioningly copying other humans has led to irrational manias throughout history.

At an emotional level, no-one likes the idea of being prone to moving in a herd-like manner. The word “herd” brings up visions of farm animals like sheep – and we consider sheep very stupid. This was the take of Extraordinary Popular Delusions and the Madness of Crowds, the 1841 memoirs of Scottish journalist Charles Mackay; that humans unquestioningly copying other humans has led to irrational manias throughout history.

On the other hand, crowds may have wisdom. The entire crowdfunding industry is predicated on this notion – that we can take investment choices out of the hands of the professional investor classes such as venture capitalists and portfolio managers, and instead turn this authority over to the masses to invest directly in projects they consider worthy.

The Wisdom of Crowds, published in 2004 by James Surowiecki, is frequently cited in support of the “wise crowd” point of view. However, one of the central requirements for a wise crowd in Surowiecki’s view is independence – that people’s opinions aren’t determined by the opinions of those around them. The fact anyone can easily see, via the progress bar, whether a crowdfunding campaign is already well-backed or poorly-backed means investors are not making decisions in isolation.

But just because decisions aren’t being made in isolation doesn’t necessarily mean decisions are being made irrationally. Whether crowds are wise or foolish depends on whether the crowd is following smart initial backers.

If the initial backers:

- Are skilled investors;

- Have exercised their minds, and decided to invest for rational reasons;

- And have done so on an arms-length basis

Then the new investors will be following a rational decision. In this case, the fact a project has had past backers has real information content, which investors can indeed put some reliance on.

What does all this mean for my campaign?

There always needs to be a first backer of an equity crowdfunding campaign – someone who will take the leap of faith in an entrepreneur’s idea, even when no-one else has yet. That special person who will stand up and say;

“Yes. I will support you, because I believe in what you’re doing”.

Once the first investors stand up, it becomes easier and easier to secure new ones. Momentum kicks in. A recent UK study by Saul Estrin and Susanna Khavul estimated that every £1 of investment begets a further 76 pence of investment, from signaling to other investors. Therefore, so much depends on the momentum generated from those first backers. The initial backers give the offer not just money, but they give confidence to those that follow in their footsteps.

To use human psychology to your advantage in equity crowdfunding, you need to build momentum.

The 80/20 rule applies. Spend 80% of your energy getting those initial 20% of investors on board. Launch with as much of the offer already done as possible. Make it look like reaching your target is a fait d’accompli, and that momentum is already in your favour.

If there’s a heavy-hitter in the investment world among these initial backers, so much the better. Investors will naturally follow a known thought leader even more willingly. Make sure everybody knows who has already backed you (with their permission, of course).

If there’s a heavy-hitter in the investment world among these initial backers, so much the better. Investors will naturally follow a known thought leader even more willingly. Make sure everybody knows who has already backed you (with their permission, of course).

Provide frequent updates that show your rapid progress towards your target. Of course, the only way to do this is to actually have rapid progress towards your target. Investors need to feel a sense of urgency and scarcity – powerful emotions in their own right.

To convince those crucial first backers is the hard part. It requires you to actually have a good, investment-worthy company. Once you’ve done that, and can show that critical momentum, your offer will be working with the tide of human nature.

Nathan Rose is the Director of Assemble Advisory, a finance agency for companies wishing to pursue equity crowdfunding. Assemble Advisory assists with picking the right platform, putting together offer content and financial models, and campaign management – allowing companies to raise money sooner.

Nathan Rose is the Director of Assemble Advisory, a finance agency for companies wishing to pursue equity crowdfunding. Assemble Advisory assists with picking the right platform, putting together offer content and financial models, and campaign management – allowing companies to raise money sooner.