Orchard platform in their weekly report addressed the most recent ABS East conference – a hot Wall Street gathering on all things securitization. This year opening remarks were delivered by Steve Eisman who was made famous by his depiction in the Hollywood film the Big Short. The speech was described as being quite popular. According to Bloomberg, he took the online lending sector to task with harsh criticism. Eisman was quoted saying;

Orchard platform in their weekly report addressed the most recent ABS East conference – a hot Wall Street gathering on all things securitization. This year opening remarks were delivered by Steve Eisman who was made famous by his depiction in the Hollywood film the Big Short. The speech was described as being quite popular. According to Bloomberg, he took the online lending sector to task with harsh criticism. Eisman was quoted saying;

“The central problem is that these lending startups, their founders and backers in particular, don’t have a lot of experience making loans to consumers, and some of them approach loan-making as they would retail sales…When you go to Amazon and buy a book, you buy it and the transaction is over. But when you take out a loan, that is just the beginning of the transaction — it’s like a relationship.”

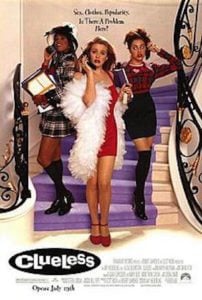

“Silicon Valley, I think, is clueless”Eisman reportedly said.

Nat Hoopes, of the relatively young Marketplace Lending Association and a veteran bank lobbyist, was ready to respond. Hoopes explained (via an email to Bloomberg) that;

Nat Hoopes, of the relatively young Marketplace Lending Association and a veteran bank lobbyist, was ready to respond. Hoopes explained (via an email to Bloomberg) that;

“Traditional Wall Street occasionally forgets that online lending has a long track record and that these platforms have been built by people with deep financial markets experience. Borrowers and investors are turning to these online products because they are delivering enormous value compared to the traditional alternatives.”

Orchard, who was in attendance, said slow down, not so fast. From their perspective, Eisman did not “single out online loans, nor any particular asset, as ‘The Next Big Short.’ “

The Orchard team stated;

“The sentiment towards our industry in the ABS space has been largely positive, and this year’s conference was no exception. Our big takeaways for the week are that the ‘headline ice’ from the negative events that affected the industry earlier this year seems to have thawed, and standardization of data and secondary sales of loan pools appear to be on everyone’s mind.”

So Who is Clueless?

So Who is Clueless?

As Hoopes asserts the hunt for yield and a compelling risk-adjusted return drives sector growth for online lenders. It does not really matter whether, or not, the loan is originated online, or in some cube on Main Street, it is all about total returns. While Crowdfund Insider was not hanging out at the Fountainbleu in Miami last week – our money is on the Orchard opinion. They have been spot on in recent years and continue to capture the pulse of online lending.

So Who is

So Who is