Managing short-term cash needs is one of the top challenges faced by SMEs everywhere in the world. However, the problem is more acute in some regions than in others. A European Payment Directive that came into force three years ago tried to tackle the issue, with little positive effect so far. Southern European countries such as France, Spain, and Italy still exhibit twice as long payment durations as those observed in Northern Europe. SMEs still suffer most from late payments, too often at the hands of large corporations.

The French AR Financing Opportunity

To overcome their cash shortages, businesses use account receivable financing (AR financing), selling their invoices for cash to a factor or to secure a line of credit from an invoice discounting firm.

To overcome their cash shortages, businesses use account receivable financing (AR financing), selling their invoices for cash to a factor or to secure a line of credit from an invoice discounting firm.

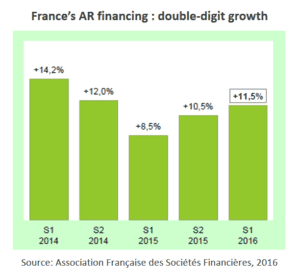

According to the Association des Sociétés Financières, France’s AR financing is a €250 billion market that is growing at a double-digit rate, i.e. much faster than long-term lending. This makes it a very attractive business for Fintech startups and their investors. But is it ripe for disruption? Two French startups are betting on it.

Online AR Financing platforms Finexkap and Creancio see a major opportunity in that the divisions of large banks who currently dominate AR financing, such as BNP Paribas factor, Crédit Agricole’s Eurofactor, and Natixis Factor, have not made it easy for small and medium size enterprises (SMEs) to access their services. According to Finexkap, less than 3% of French SMEs currently resort to AR financing. As Internet-based businesses often do, the two Fintech firms claim that “democratize” AR financing, making it much more accessible to SMEs by radically improving on the following dimensions:

Online AR Financing platforms Finexkap and Creancio see a major opportunity in that the divisions of large banks who currently dominate AR financing, such as BNP Paribas factor, Crédit Agricole’s Eurofactor, and Natixis Factor, have not made it easy for small and medium size enterprises (SMEs) to access their services. According to Finexkap, less than 3% of French SMEs currently resort to AR financing. As Internet-based businesses often do, the two Fintech firms claim that “democratize” AR financing, making it much more accessible to SMEs by radically improving on the following dimensions:

- Flexibility: Where traditional factors require that their clients commit their whole business to them, assigning all their invoices over a one-year or longer period, new entrants allow businesses to sell their invoices in a piecemeal fashion, picking the ones they want to keep and the ones they want to dispose of against instant cash.

- Convenience: All processes from registration to payment transactions over risk assessment are digitalized and completed online.

- Speed: Where traditional factors take four to six weeks to approve an account and deliver the cash, online startups respond to an AR financing requests within a few days, 24h to 72h.

Financing Through AR Securitization Funds

French AR financing startups operate through AR Securitization. Unlike the well-known UK factoring and invoice discounting marketplace MarketInvoice, they do not claim an affiliation with P2P lending or crowdlending. The legal simplifications and exemptions provided to crowdlending platforms by the current French crowdfunding regulation do not apply to this form of asset-backed financing. AR financing startups thus must go through an asset management entity and set-up dedicated investment funds in form of Fonds Commun de Titrisation (FCTs) under the supervision of the AMF, the French financial markets and securities regulator. The FCTs are the legal vehicles which acquire the ARs, securitize them and sell the securities to institutional investors and other qualified investors.

French AR financing startups operate through AR Securitization. Unlike the well-known UK factoring and invoice discounting marketplace MarketInvoice, they do not claim an affiliation with P2P lending or crowdlending. The legal simplifications and exemptions provided to crowdlending platforms by the current French crowdfunding regulation do not apply to this form of asset-backed financing. AR financing startups thus must go through an asset management entity and set-up dedicated investment funds in form of Fonds Commun de Titrisation (FCTs) under the supervision of the AMF, the French financial markets and securities regulator. The FCTs are the legal vehicles which acquire the ARs, securitize them and sell the securities to institutional investors and other qualified investors.

Founded in 2012, French Finexkap calls itself a factor 2.0. Next to the above-mentioned benefits of flexibility, convenience, and speed, the company claims two major advantages over incumbent factors. The first one is pricing transparency: a simpler pricing model makes it easier for businesses to keep the total cost of factoring between 1.4% to 4.8% of the total AR value. The second advantage claimed by Finexkap is that its big data expertise makes its risk management model more and more accurate over time.

Cedric Teissier, Finexkap’s co-founder and CEO, is a well-known figure of the French and the international Fintech scenes. Since 2012, the company has raised €25 million from investors, including well-known alternative finance investor GLI Finance, to fine-tune its business model and kickstart the lending operations. In January 2015, the company’s asset management arm Finexkap AM launched its first AR securitization fund. Earlier this month, Finexkap announced its second fund, a €100 million fund launched in partnership with asset management firm ACOFI Gestion.

Cedric Teissier, Finexkap’s co-founder and CEO, is a well-known figure of the French and the international Fintech scenes. Since 2012, the company has raised €25 million from investors, including well-known alternative finance investor GLI Finance, to fine-tune its business model and kickstart the lending operations. In January 2015, the company’s asset management arm Finexkap AM launched its first AR securitization fund. Earlier this month, Finexkap announced its second fund, a €100 million fund launched in partnership with asset management firm ACOFI Gestion.

To recruit SME clients, Finexkap relies on online advertising and partners such as the French subsidiary of the international consulting and auditing firm BDO. More importantly, the startup is expanding its digital network thanks to its open API strategy that allows software publishers to directly integrate Finexkap services into their software solutions. To date, Finexkap has financed more than €45 million worth of invoices. The company enjoys a double-digit growth month-on-month and 60% of its customers are recurrent.

Founded in 2015, Créancio is a newer entrant in this market. However, as a spin-off from Groupe GTI, Creancio has a leg up in AR financing. Group GTI is namely a structured finance expert and a pioneer in the field of AR securitization with currently over €2 billion assets under management.

Founded in 2015, Créancio is a newer entrant in this market. However, as a spin-off from Groupe GTI, Creancio has a leg up in AR financing. Group GTI is namely a structured finance expert and a pioneer in the field of AR securitization with currently over €2 billion assets under management.

Créancio specifically targets SMEs with a turnover of under €10 million, a segment least well served by banks. The company’s business model is one of invoice discounting rather than factoring in that the platform does not take over its clients’ sales ledger and does not manage their invoice collection. This model suits SMEs who often prefer that their debtors are not notified of the invoices’ assignment. Créancio does provide much needed cash management advice and tools along with its financing services.

Much like Bluevine in the US, Créancio offers to SMEs invoice cash advances and AR-secured lines of credit from which they can draw as long as corresponding invoices are transferred. To recruit SME clients, Créancio relies, among others, on partners such as auditing and accounting firm Baker Tilly. In 18 months of existence, Créancio has financed €20 million worth of invoices.

Outlook as acquisition targets

The French market presents strong growth opportunities for AR financing startups who can both take market share from incumbent factors and open new market segments among SMEs. In addition, one of the most attractive aspects of AR financing as a business is its strong potential for repeat business.

The French market presents strong growth opportunities for AR financing startups who can both take market share from incumbent factors and open new market segments among SMEs. In addition, one of the most attractive aspects of AR financing as a business is its strong potential for repeat business.

However, as it stands in France, the market has high barriers to entry. It is not an easy and inexpensive market to penetrate and to operate in. Setting up an AR securitization fund is a difficult and expensive process, operating it requires working with multiple operators in the ecosystem such as credit insurers, custodian banks and investment services providers, and not necessarily on equal terms with those enjoyed by incumbents. In addition, incumbent factors are not standing idly by as they see new competitors emerge. For instance, BNP Paribas Factor proposes mobile factoring and Crédit Agricole’s Eurofactor offers flexible “à la carte” invoice financing.

But Finexkap and Créancio have faith in their superior agility, their ability to seize technology opportunities and to deliver added value to underserved market segments. Banks may indeed not be ready at the organizational level to disrupt their relatively captive AR financing business by transforming it into a more digital one. They might prefer to acquire one of the upcoming startups and to operate it as a separate online pureplay brand – much in the way French retail banks are operating separate pure-play online and mobile banks today.

Therese Torris, PhD, is a Senior Contributor to Crowdfund Insider. She is an entrepreneur and consultant in eFinance and eCommerce based in Paris. She has covered crowdfunding and P2P lending since the early days when Zopa was created in the United Kingdom. She was a director of research and consulting at Gartner Group Europe, Senior VP at Forrester Research and Content VP at Twenga. She publishes a French personal finance blog, Le Blog Finance Pratique.

Therese Torris, PhD, is a Senior Contributor to Crowdfund Insider. She is an entrepreneur and consultant in eFinance and eCommerce based in Paris. She has covered crowdfunding and P2P lending since the early days when Zopa was created in the United Kingdom. She was a director of research and consulting at Gartner Group Europe, Senior VP at Forrester Research and Content VP at Twenga. She publishes a French personal finance blog, Le Blog Finance Pratique.