LendIt Europe gathered over 900 attendees from 50 countries on the banks of the Thames river to network and hear about the latest trends in online direct lending. The tone of the conference was clearly set by the UK keynote speakers. The UK being 4 times bigger than the sum of all Continental European markets taken together, everybody was keen to hear these forerunners’ thoughts about where the market is going.

Bumps in the Road

Bumps in the Road

Samir Desai, co-founder and CEO of Funding Circle, and Jaidev Janardana, CEO of Zopa, referred to the past twelve months as challenging. The Lending Club tarnish, issues such as fraud cases in China and Sweden, and, finally, the Brexit, have temporarily slowed down the growth of marketplace lending in the first half of 2016.

But the incidents were taxed as mere “bumps in the road”. The market is picking up again. The hype is gone in the UK as well in the US, but now is the time for serious business, for the “Golden Age” of marketplace lending, as Samir Desai put it.

Lending Marketplaces versus Banks

The UK financial services regulator, the Financial Conduct Authority (FCA) is preparing a review of the P2P sector’s performance under the current regulatory framework. That prospect probably influenced many speakers to spend time contrasting marketplaces with banks. Margaret Doyle, Partner at Deloitte and author of the report “Marketplace Lending, A Temporary Phenomenon?” was one of the few critics of the marketplace model on stage. She argued that lending marketplaces lack sustainable competitive advantages over banks as they, among others, do not have a lower cost of funding and use the same risk analysis tools as banks. Cormac Leech, Partner at Victory Park Capital, later retorted that marketplaces will gain these advantage as they grow and reach the economies of scale and experience curve – that banks currently have.

The UK financial services regulator, the Financial Conduct Authority (FCA) is preparing a review of the P2P sector’s performance under the current regulatory framework. That prospect probably influenced many speakers to spend time contrasting marketplaces with banks. Margaret Doyle, Partner at Deloitte and author of the report “Marketplace Lending, A Temporary Phenomenon?” was one of the few critics of the marketplace model on stage. She argued that lending marketplaces lack sustainable competitive advantages over banks as they, among others, do not have a lower cost of funding and use the same risk analysis tools as banks. Cormac Leech, Partner at Victory Park Capital, later retorted that marketplaces will gain these advantage as they grow and reach the economies of scale and experience curve – that banks currently have.

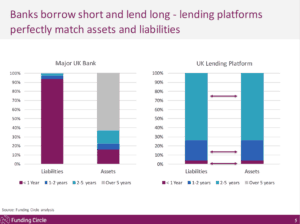

Many speakers, along with Samir Desai and Rhydian Lewis, founder and CEO of RateSetter, stressed that marketplace lending eschews the systemic risk posed by banks because they directly match assets and liabilities, loans with funding ‒without any maturity transformation and without holding any inventory. Banks, by contrast, take short-term deposit to provide long-term loans. Hence the bank run risk.

Many speakers, along with Samir Desai and Rhydian Lewis, founder and CEO of RateSetter, stressed that marketplace lending eschews the systemic risk posed by banks because they directly match assets and liabilities, loans with funding ‒without any maturity transformation and without holding any inventory. Banks, by contrast, take short-term deposit to provide long-term loans. Hence the bank run risk.

Lord Adair Turner, Senior Fellow of the Institute for New Economic Thinking and former head of the UK Financial Services Authority, was more cautious in saying that marketplace lending “might” make the financial system more stable because of the absence of balance sheet risk. By contrast “banks are always in danger of magnifying the credit crunch in economic downtime” he said.

Fighting Entropy

In and outside the UK, many direct lending platforms such as Future Finance, Kabbage and Ondeck are balance sheet lenders. Other platforms use hybrid models to have skin in the game, to jumpstart the business, or to accelerate it. International platforms Mintos and Twino work as marketplace channels for banks. French “P2P lender” YounitedCredit is a bank because there was no alternative when it launched. As online direct lending continues to rapidly evolve, competition and innovation makes it a more and more diverse sector.

In and outside the UK, many direct lending platforms such as Future Finance, Kabbage and Ondeck are balance sheet lenders. Other platforms use hybrid models to have skin in the game, to jumpstart the business, or to accelerate it. International platforms Mintos and Twino work as marketplace channels for banks. French “P2P lender” YounitedCredit is a bank because there was no alternative when it launched. As online direct lending continues to rapidly evolve, competition and innovation makes it a more and more diverse sector.

There is much diversity even within the ranks of the 8 members of the UK P2P Finance Association (P2PFA) who self-impose the operating rules and standards of transparency of the association. Funding Circle, Landbay, Lending Works, Lendinvest, Market Invoice, RateSetter, Thin Cats and Zopa show a great diversity in terms of asset classes (asset-backed by invoices, real estate, or unsecured loans) and borrowers (consumer, SME). They also have more and more diverse sources of funding (retail investors, institutional investors, government, own investment funds) with Funding Circle and Zopa recently adding securitization. Finally, some maintain provision funds, although it could be regarded as a breach of the direct asset-liability matching principle.

There is much diversity even within the ranks of the 8 members of the UK P2P Finance Association (P2PFA) who self-impose the operating rules and standards of transparency of the association. Funding Circle, Landbay, Lending Works, Lendinvest, Market Invoice, RateSetter, Thin Cats and Zopa show a great diversity in terms of asset classes (asset-backed by invoices, real estate, or unsecured loans) and borrowers (consumer, SME). They also have more and more diverse sources of funding (retail investors, institutional investors, government, own investment funds) with Funding Circle and Zopa recently adding securitization. Finally, some maintain provision funds, although it could be regarded as a breach of the direct asset-liability matching principle.

For Christopher Woolard, Director of Strategy & Competition at the FCA, the growing diversity of the sector is an important part of what makes it challenging to get regulation right.

For Christopher Woolard, Director of Strategy & Competition at the FCA, the growing diversity of the sector is an important part of what makes it challenging to get regulation right.

In conclusion to his speech, Lord Adair Turner recommended to platforms to “Keep it simple, Keep it transparent” in order to avoid reproducing the errors that led to the banking crisis. Simplicity seems to go against the natural tendency of the sector, like any market, to create more differentiated products and complex value chains.

Transparency is hard work, but it seems to pay off, as seen from the success of the members of the UK P2PFA.

Therese Torris, PhD, is a Senior Contributor to Crowdfund Insider. She is an entrepreneur and consultant in eFinance and eCommerce based in Paris. She has covered crowdfunding and P2P lending since the early days when Zopa was created in the United Kingdom. She was a director of research and consulting at Gartner Group Europe, Senior VP at Forrester Research and Content VP at Twenga. She publishes a French personal finance blog, Le Blog Finance Pratique.

Therese Torris, PhD, is a Senior Contributor to Crowdfund Insider. She is an entrepreneur and consultant in eFinance and eCommerce based in Paris. She has covered crowdfunding and P2P lending since the early days when Zopa was created in the United Kingdom. She was a director of research and consulting at Gartner Group Europe, Senior VP at Forrester Research and Content VP at Twenga. She publishes a French personal finance blog, Le Blog Finance Pratique.

Bumps in the Road

Bumps in the Road