Short-term working capital provider KredX, which helps small businesses get short-term working capital by discounting their unpaid invoices, has raised $6.25 Million in Series A round of funding. The funding round was led by Sequoia Capital India and the company’s existing investor, Prime Venture Partners. The fresh funds will be utilized to strengthen the technology, data and sales functions within the company. Founded in 2015 by IIT & Stanford alumni Manish Kumar, Anurag Jain & Puneet Agarwal, KredX was formerly known as Mandii.

Short-term working capital provider KredX, which helps small businesses get short-term working capital by discounting their unpaid invoices, has raised $6.25 Million in Series A round of funding. The funding round was led by Sequoia Capital India and the company’s existing investor, Prime Venture Partners. The fresh funds will be utilized to strengthen the technology, data and sales functions within the company. Founded in 2015 by IIT & Stanford alumni Manish Kumar, Anurag Jain & Puneet Agarwal, KredX was formerly known as Mandii.

“We see Kredx as a marketplace enabling trade finance, and we love the fact that the team is narrowly focused on solving one problem very keenly and clearly,” stated Sequoia Capital MD Shailendra Singh. “The company is transforming the informal lending market to a new invoice discounting marketplace for enabling institutional credit to small and medium sized businesses.”

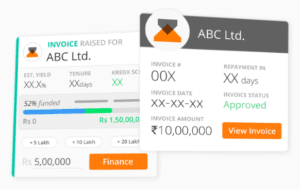

The startup has built a technology marketplace which connects SMEs with investors willing to buy the unpaid receivables to help them with their working capital cycles. To date, KredX has enabled around 3,000 transactions ranging from Rs 1 lakh to Rs 1 crore, with a focus on unpaid invoices from “blue-chip companies.” KredX sees the invoice discounting market as a $100 billion opportunity.

“Access to working capital for sustained growth and production is critical to businesses and late payments are often a huge bottleneck,” KredX CEO and Co-Founder Manish Kumar. “Last year, almost 97 percent of the Indian SMEs reported having experienced late payment of their invoices, while 56 percent dealt with working capital issues due to late payment or unavailability of credit.”

“We see Kredx as a marketplace enabling trade finance, and we love the fact that the team is narrowly focused on solving one problem very keenly and clearly,” stated Sequoia Capital MD

“We see Kredx as a marketplace enabling trade finance, and we love the fact that the team is narrowly focused on solving one problem very keenly and clearly,” stated Sequoia Capital MD  “Access to working capital for sustained growth and production is critical to businesses and late payments are often a huge bottleneck,” KredX CEO and Co-Founder

“Access to working capital for sustained growth and production is critical to businesses and late payments are often a huge bottleneck,” KredX CEO and Co-Founder