Top Online Lender SoFi Acquires Digital Only Bank Zenbanx

SoFi has announced the acquisition of Zenbanx, a Delaware-based Fintech firm providing multi-currency mobile banking services in the U.S. and Canada. SoFi revealed it intends to leverage Zenbanx’s platform and underlying technology to expand its growing suite of online personal finance offerings.Terms of the acquisition were not disclosed. The acquisition is expected to close in mid-February.

SoFi has announced the acquisition of Zenbanx, a Delaware-based Fintech firm providing multi-currency mobile banking services in the U.S. and Canada. SoFi revealed it intends to leverage Zenbanx’s platform and underlying technology to expand its growing suite of online personal finance offerings.Terms of the acquisition were not disclosed. The acquisition is expected to close in mid-February.

Zenbanx, which was founded in 2012 by former ING Direct CEO Arkadi Kuhlmann, currently offers a mobile banking account that lets people save, send and spend money in multiple currencies both domestically and internationally. The company’s mobile application was designed to eliminate the complexities of international banking and provide ease of use and security for customers.

Mike Cagney, co-founder and CEO of SoFi, commented on the acquisition on the SoFi blog stating;

Mike Cagney, co-founder and CEO of SoFi, commented on the acquisition on the SoFi blog stating;

“We have never been shy about SoFi’s ambitions to become the center of our member’s financial lives. Offering deposits, credit cards, and payment solutions is key to that ambition, and we think we can offer something better than incumbent players with the same kind of innovation we’ve brought to other areas of finance, like student loan refinancing, personal loans, and mortgages.”

The purchase of Zenbanx is designed to get SoFi closer to becoming the one and only financial application anyone would ever need. SoFi has been quite vocal in the past about its intent to replace the antiquated banking system with something better and more robust. Following a $1 billion investment by SoftBank into SoFi, the company clearly has the

SoFi has been quite vocal in the past about its intent to replace the antiquated banking system with something better and more robust. Following a $1 billion investment by SoftBank into SoFi, the company clearly has the firepower to purchase Zenbanx and more.

SoFi has been quite vocal in the past about its intent to replace the antiquated banking system with something better and more robust. Following a $1 billion investment by SoftBank into SoFi, the company clearly has the firepower to purchase Zenbanx and more.

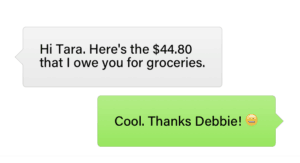

Cagney said that Zenbanx’s focus on a simple mobile experience on top of solid banking technology made them a natural fit for SoFi. Zenbanx is also described as being at the forefront of conversational banking built into popular messaging apps, an area core to SoFi’s current development.

Cagney said that Zenbanx’s focus on a simple mobile experience on top of solid banking technology made them a natural fit for SoFi. Zenbanx is also described as being at the forefront of conversational banking built into popular messaging apps, an area core to SoFi’s current development.

Cagney said that SoFi and Zenbanx share a similar vision of the future of finance that banking needs to improve;

“With Zenbanx joining SoFi, we’re moving one step closer to becoming the center of our members’ financial lives by adding SoFi deposit, money transfer, and credit card products to our offerings for members.”

Kuhlmann added;

Kuhlmann added;

“SoFi and Zenbanx are well aligned to create an unparalleled financial experience for customers. I am absolutely delighted that we are merging our visions and our talented teams.”

SoFi stated that the majority of Zenbanx staff will be joining their company, and Kuhlmann will join my management team leading the development of new banking services. Zenbanx customers will be able to continue using their accounts until the new SoFi personal finance products are launched in a few months, at which point they’ll be transferred onto the SoFi platform. Zenbanx’s Claymont, Delaware, and Toronto, Canada locations will remain open as SoFi offices.