First off, we all owe Tony a debt of gratitude for actually drafting this set of regulations. Legislative drafting is yeoman’s work especially when it comes to tax law. This new legislation solves for two extremely important problems in the U.S. economy and society. The first is the lack of capital being allocated to small and startup businesses, which are the largest driver of economic growth and job creation. The second is the exclusive nature of private investments and the basic shutting out of everyday Americans from participating in high growth startups.

The Small Business Administration reports that small businesses account for 99.7% of U.S. employer firms, 64% of net new private-sector jobs, 49.2% of private-sector employment, and 43% of high-tech employment.

Importantly, when one thinks about small business, it is also a bit of a false distinction between jobs and economic growth created from small versus large businesses since all large enterprises were once start-ups, so in a sense, all job creation comes from small and start-up companies.

It is thus imperative that we support these vital economic drivers.

Despite this truism, chief economist for the Small Business and Entrepreneurship Council found that:

chief economist for the Small Business and Entrepreneurship Council found that:

“Compared to the average growth rates prevailing over the past six decades, the U.S. has experienced a historic private investment gap or shortfall during this current recovery/expansion period. This amounts to a lost decade when it comes to private-sector investment…Real gross private domestic investment grew at an average annual rate of 1.8% from 2007 to 2016, compared to the 4.9% average growth rate from 1956 to 2016. This difference leaves a real gross private domestic investment gap of at least $1.4 trillion (in 2009 dollars) in 2016.”

With data like this, it is astounding that our economy has grown at all.

In addition to decreased private investment, bank loans, the traditional source of capital for small business has dried up over time.

In 2015 the Wall Street Journal reported that;

“[t]ogether, 10 of the largest banks issuing small loans to business lent $44.7 billion in 2014, down 38% from a peak of $72.5 billion in 2006, according to an analysis of the banks’ federal regulatory filings.”

And due to consolidation, many of the small community-based lenders have been amalgamated into the larger institutions leaving no outlet for small and startup businesses.

What is causing this?—several factors, including an economic crisis, but also and just as importantly, the reaction to that crisis bears much of the blame.

The Dodd-Frank Act constrained banks and their lending practices and made the smaller and often higher risk loans unprofitable or illegal to make. Over-regulation in the area of securities law and other regulatory agencies, as well as high tax rates, have also had a chilling effect.

Leveling the Playing Field

The other issue addressed by the Invest in America Act is the inability of average citizens to participate in private investment.

Except in very limited situations, the securities laws of this country prevent anyone who makes less than $200,000 a year, or has a net worth of less than $1 million, from investing in private companies. And as anyone who has followed the recent tech boom in this country knows, it is the private investments that have the greatest upside potential (think Uber, AirBnB, Oculus, etc.). The SEC, in its paternalistic wisdom, has long deemed these type of investments too risky and off limits to 93% of the population.

Except in very limited situations, the securities laws of this country prevent anyone who makes less than $200,000 a year, or has a net worth of less than $1 million, from investing in private companies. And as anyone who has followed the recent tech boom in this country knows, it is the private investments that have the greatest upside potential (think Uber, AirBnB, Oculus, etc.). The SEC, in its paternalistic wisdom, has long deemed these type of investments too risky and off limits to 93% of the population.

One bright spot, however, has been the JOBS Act of 2012, which took a long time to become effective but is now showing real promise by allowing average Americans to invest (in capped amounts) in small and startup businesses and utilizing technology to reduce transaction costs. Add to it the Invest in America Act and there might be hope for us yet.

The Act, with its two-pronged approach, not only incentivizes all investors to invest in small and start-up businesses which bear more risk but ultimately more opportunity for reward but also incentivizes the big players such as VC firms to open up their exclusive deals the average citizen so they may participate. It is truly an elegant solution, which piggybacks off of the SEC’s and various state crowdfunding rules to incorporate all of the necessary safeguards and protections without being overly paternalistic.

The beauty of this proposal is that it works.

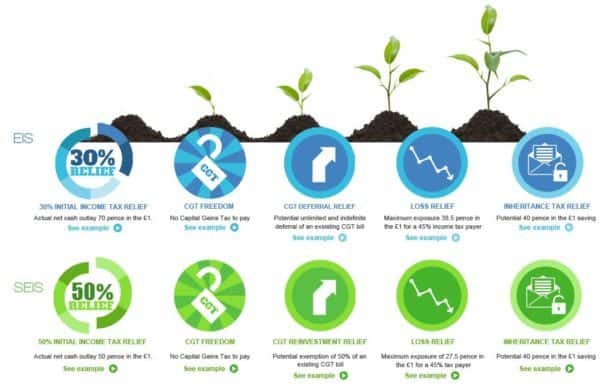

It is often difficult to know if potential legislation will have the intended effect and unintended consequence are all too familiar when it comes to government regulation, however with the Invest in America Act, all we need to do is look to our allies across the Atlantic who have had a similar tax initiative in place called the Enterprise Investment Scheme (EIS) for over 13 years and the more recent Small Enterprise Investment Scheme (SEIS) with great success.

In fact, in 2015 the UK Treasury reported that;

“[t]he tax- advantaged venture capital schemes continue to be an important part of meeting [our] aim, providing valuable support to small and growing businesses seeking finance to develop and grow. To date they have supported over 22,000 businesses to gain access to finance, with over £17.5 billion of funding provided.”

While this may seem like small numbers, don’t forget that the US economy is roughly 8 times the size of the UK, which equates to $175 billion with the current exchange rate of potential for the US market.

The British government further stated that;

The British government further stated that;

“[it] is committed to ensuring continued support for small and growing businesses that are key to the UK economy. The tax-advantaged venture capital schemes are an important part of the government’s growth strategy, facilitating access to finance and providing support for smaller companies, which would otherwise have difficulty finding the necessary finance to develop and grow.”

One of the remarkable things about the success of the UK tax schemes is that it has not just benefitted the urban tech center of London, but 63% of the money was raised by companies outside of London, many in more rural areas of the UK. In addition, although the maximum amount of money that can be raised by a company utilizing the Enterprise Investment Scheme is £5,000,000, the vast majority of transactions utilizing the tax schemes are for £250,000 or less, so true startups and small businesses.

The UK system is very similar to proposed Invest In America Act. You can find the details here and here.

The UK system is very similar to proposed Invest In America Act. You can find the details here and here.

In summary, it allows small business to conduct qualifying capital raises for which investors can deduct a portion of their investment from their taxable income. In the event the investment goes belly up, the investor can deduct the full amount of the investment.

The UK plan goes even further than the Invest in America Act in that it also eliminates the cap gains tax on the eventual exit after a certain holding period of the investment. It does not, however, have the equalizing feature of allowing the “sophisticated” investors to receive a tax benefit if they bootstrap a crowdfunding transaction to their deal and open up investment opportunities to average Americans.

In both plans the offering amounts are capped as are the investment amounts to reduce risk to both investors and taxpayers.

And should those taxpayers be concerned?

The economic insight to these regulations is that by financing small business, you actually create new revenue streams from an increase in the payroll tax and sales tax attributable to those enterprises. This is not a pure redistribution of the tax burden, however, because these businesses eventually generate revenue and actually grow the economy.

The economic insight to these regulations is that by financing small business, you actually create new revenue streams from an increase in the payroll tax and sales tax attributable to those enterprises. This is not a pure redistribution of the tax burden, however, because these businesses eventually generate revenue and actually grow the economy.

In a nutshell, this proposal could unleash capital to small business while taking a step to equalize the playing field when it comes to investment opportunity; it is like a win win win. In addition, rarely do we have such a clear example of successful legislation, which should alleviate the hesitation of any skeptics.

Georgia P. Quinn is a Senior Contributor for Crowdfund Insider. She is also the CEO and co-founder of iDisclose, an adaptive web-based application that enables entrepreneurs to prepare customized institutional grade private placement documents for a fraction of the time and cost. Georgia also serves as of counsel at a leading law firm in crowdfunding, Ellenoff, Grossman & Schole, specializing in facilitating financial transactions and compliance with JOBS Act regulations.

Georgia P. Quinn is a Senior Contributor for Crowdfund Insider. She is also the CEO and co-founder of iDisclose, an adaptive web-based application that enables entrepreneurs to prepare customized institutional grade private placement documents for a fraction of the time and cost. Georgia also serves as of counsel at a leading law firm in crowdfunding, Ellenoff, Grossman & Schole, specializing in facilitating financial transactions and compliance with JOBS Act regulations.