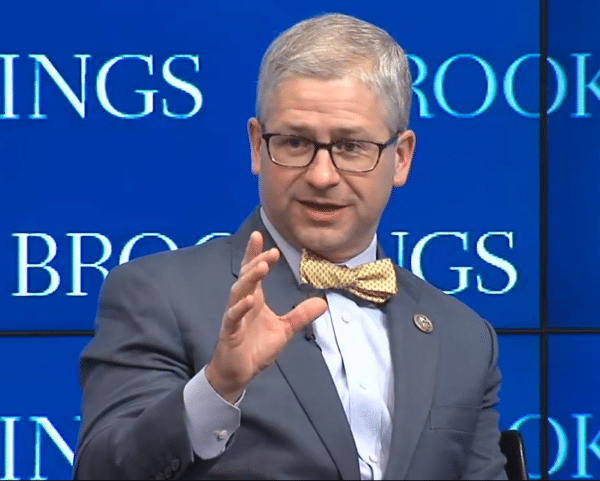

Once again, crowdfunding’s white knight rides into action. Congressman Patrick McHenry sent a letter to the newly sworn in Chairman of the U.S. Securities and Exchange Commission Jay Clayton outlining certain provisions of the regulations relating to Title III of the JOBS Act that need to be amended in order for investment crowdfunding to reach its full potential. For those of you unfamiliar with Congressman McHenry, he was a champion of the JOBS Act, which was passed in April of 2012 and in particular Title III which legalized retail investment crowdfunding. The SEC promulgated regulations to effect Title III called Regulation CF (Reg CF). With perfect timing, Congressman McHenry’s letter is dated May 15, 2017, almost exactly one year to the date of the enactment of Regulation CF and sets forth certain problems that the current rules have created in practice.

The letter discusses 13 provisions, which require amendment to improve the efficient operation of the nascent crowdfunding industry. Importantly, Congressman McHenry and his staff derived these issues from discussions with actual industry practitioners, meaning platforms, issuers, attorneys and other service providers who are doing deals and raising (or at least attempting to raise) capital, and not from academics or economic theorists. This list was developed from “in the trenches” experience and out of a belief that this path to small business finance is crucial to the U.S. economy as a whole.

The thirteen policy changes are summarized below:

Testing the Waters

This provision would allow companies to advertise their potential offerings prior to officially launching their deals and filing their Forms C. This could save companies a significant amount of money if their testing for “indications of interest” informs that a potential raise would not be successful. Allowing companies to test their ideas and the viability of a financing before incurring the legal, accounting and other fees upfront is crucial not only to assisting startup companies raising capital, but also to screening out deals that are not ready for the investing public.

Special Purpose Vehicles (SPVs)

This fix allows for the use of an entity to collect all of the investors in a crowdfunding offering. Rather than invest directly into the operating company, investors invest into a limited liability company (LLC) or other entity that then invests into the operating company. This makes the entire crowdfunded investment one line on the capitalization table and makes it much easier for a small business to administer its investors.

Section 12(g) Reporting Requirements

Currently, once certain revenue or asset tests are met, crowdfunded companies could have to provide full Securities Act of 1934 reports, such as 10-Ks, 10-Qs and 8-Ks. This type of reporting is completely out of scale to a small business conducting a crowdfunding. This fix would ensure that the reporting requirements would not apply to crowdfunded companies.

Offering Limit

This request to raise the limit highlights the benefits to both companies seeking funds and investors by brining a higher caliber of issuer to the table. Many state crowdfunding laws have already raised the limit to $2-$5 million annually.

Accredited Investors Limit

This fix would eliminate the investment caps on accredited investors who arguably do not need the protections limiting the amount of money they can invest.

Accounting Disclosure Requirements

Accounting Disclosure Requirements

Currently the accounting disclosure requirements require financial statements to be in GAAP format and in most cases at least “reviewed” by an independent accountant, depending on the amount of money being raised. Most small businesses do not use GAAP accounting, so changing their books to GAAP compliance adds expense as well as having the statement then reviewed by an additional accountant, who must necessarily be independent. All of this additional expense leads to very little pertinent information for a potential investor, who could glean necessary information from tax returns or cash accounting statements.

Advertising Guidelines

The advertising guidelines limit the type of information that can be presented about an offering. This fix would allow for companies to more freely communicate about the company and the offering to then direct a potential interested investor to the funding portal or other intermediary where full information can be found. This would also allow companies to interact with third party media outlets that are producing stories or other content about the industry.

Multiple Posting (Fee Splitting) For Portals

This would allow multiple funding portals or other intermediaries to list offerings and share in the transaction fees. The thought is to allow companies to utilize multiple channels to raise funds as long as they are coordinated and provide the same information. This also serves to protect investors by having multiple intermediaries review the particular offering.

Multiple Closings

While this is already arguably allowed to a certain extent under current regulations, this would clarify that companies can close their offerings in stages as money is received from investors once the target amount has been received.

Reconfirmation Time for Material Change

This would extend the amount of time an issuer has to receive reconfirmations after initiating a material change to its offering. The current requirement of five days is often not enough time to get a response from an investor and leads to unnecessary attrition.

Credit Card Payments

This is currently allowed but confirmation is requested to ensure that funding portals, who are trying to modernize the transaction process for all parties.

Warrants as Compensation

Allowing funding portals to receive warrants as compensation in addition to the underlying securities being offered in a transaction is essential. While this is already arguably contemplated in the regulations, receiving warrants is much more efficient for the funding portal as there are no initial tax consequences. IN contrast the payment in the underlying securities is a taxable event even though such securities may ultimately be worthless.

Secondary Market

This request is really for an extension of the current regulations to go the next step and provide a secondary market for crowdfunded securities. This would provide liquidity, which is a form of investor protection in itself, and provides legitimacy and transparency to the industry.

This list does not fix all of the problems with crowdfunding, but it does represent a practical approach to remedy several hurdles that have arisen under these new regulations. Many of which were unintended consequences and fortunately like all beta versions can now be thoughtfully debugged.

The letter is embedded below.

Georgia P. Quinn is a Senior Contributor for Crowdfund Insider. She is also the CEO and co-founder of iDisclose, an adaptive web-based application that enables entrepreneurs to prepare customized institutional grade private placement documents for a fraction of the time and cost. iDisclose users may file Form C’s and Form C-AR automatically with the SEC. Georgia also serves as of counsel at a leading law firm in crowdfunding, Ellenoff, Grossman & Schole, specializing in facilitating financial transactions and compliance with JOBS Act regulations.

Georgia P. Quinn is a Senior Contributor for Crowdfund Insider. She is also the CEO and co-founder of iDisclose, an adaptive web-based application that enables entrepreneurs to prepare customized institutional grade private placement documents for a fraction of the time and cost. iDisclose users may file Form C’s and Form C-AR automatically with the SEC. Georgia also serves as of counsel at a leading law firm in crowdfunding, Ellenoff, Grossman & Schole, specializing in facilitating financial transactions and compliance with JOBS Act regulations.

Accounting Disclosure Requirements

Accounting Disclosure Requirements