SEC’s Small Business Committee to Discuss Crowdfunding (Reg CF), Angel Investing Trends in Upcoming Meeting

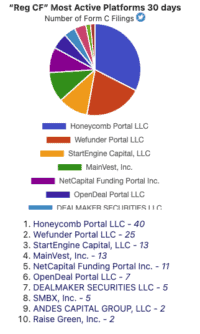

The Securities and Exchange Commission’s Small Business Capital Formation Advisory Committee (SBCFAC) is set to convene on Monday, May 6, 2024, to discuss key topics in small business financing, including the state of Regulation Crowdfunding (Reg CF) and trends in angel investing. The meeting, accessible… Read More

Read more in: Politics, Legal & Regulation | Tagged reg cf, regulation cf, sbcfac, sec, securities and exchange commission, small business capital formation advisory committee