Adena Friedman, CEO of NASDAQ, has published an Op-Ed on WSJ.com. Her topic of discussion is the challenging IPO market in the US. This is a frequent issue of debate as the decline of IPOs has been going on for years. Both elected and appointed officials have been slow to act and address the nagging problem. In fact, policymakers appear to be more inclined to exacerbate the enigma by saddling public companies with a growing number of rules and regulations that make little sense. Friedman says there is reason to worry as the bull market has camouflaged systemic challenges;

Adena Friedman, CEO of NASDAQ, has published an Op-Ed on WSJ.com. Her topic of discussion is the challenging IPO market in the US. This is a frequent issue of debate as the decline of IPOs has been going on for years. Both elected and appointed officials have been slow to act and address the nagging problem. In fact, policymakers appear to be more inclined to exacerbate the enigma by saddling public companies with a growing number of rules and regulations that make little sense. Friedman says there is reason to worry as the bull market has camouflaged systemic challenges;

“… years of tranquility have masked growing structural problems. Businesses that would traditionally have gone public increasingly choose private financing instead … 2016 was the slowest year for initial public offerings in more than a decade. It isn’t difficult to envision the ramifications if this continues.”

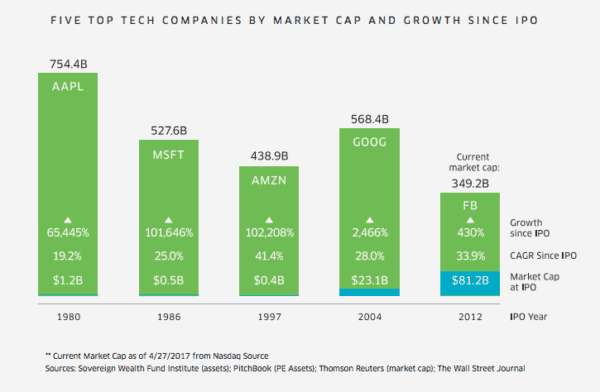

Freidman notes that 92% of job creation comes after a young company goes public.

So what’s going on?

The cost associated with going public has risen dramatically in recent years. Back in the day, going public was viewed as a right of passage for successful firms. A validation of sorts that a company had matured to a point where all investors had an opportunity to participate in the business growth. Wealth creation was thus shared.

Today, going public has become more of an exit than an entry. Bumbling politicians have saddled the process with so many rules and regulations – it simply does not make sense to go public. Conventional wisdom is to delay going public as long as possible. Private money has rushed in to fill the vast gap seeing opportunity to generate outsized capital gains. And it is working too. You can’t really blame them either. Growing firms need equity capital to grow and VCs and Angels are providing it. Smaller investors are, unfortunately, cut out.

Friedman is hopeful on the future of IPOs and she has published a “Blueprint” explaining her vision as to how the public markets may be reinvigorated. She believes;

“American equities markets are built on timeless principles, but they must be driven by modern, evolving practices. Their continued strength hinges on the willingness of lawmakers, public companies, investors, exchanges and other stakeholders to find common ground.”

Politicians need to steer clear of their personal agendas pursuing social engineering with silly compliance items they stretch to justify. Their goal should be to remove unnecessary and duplicative processes and mandates. Not make more.

If policymakers embrace this basic concept, perhaps we can get back to a place where there is “balance between public and private markets.” We, as a country, need to to provide access to capital for promising businesses and investment growth opportunity for all.

[scribd id=347300248 key=key-5HvoHGXeuVi4XzWgRrz1 mode=scroll]