The Financial Stability Board (FSB) has weighed in on the burgeoning Fintech sector of finance. The FSB has been analyzing “financial stability implications” potentially created by Fintech innovation. The FSB says it is specifically seeking to identify “supervisory and regulatory issues that merit authorities’ attention”.

The FSB is currently chaired by Mark Carney, Governor of the Bank of England, a noted advocate of the potential benefits of Fintech. The FSB was created in the wake of the financial crises to coordinate at the international level the work of national financial authorities to promote financial stability.

The FSB is currently chaired by Mark Carney, Governor of the Bank of England, a noted advocate of the potential benefits of Fintech. The FSB was created in the wake of the financial crises to coordinate at the international level the work of national financial authorities to promote financial stability.

The FSB stated there are currently no compelling financial stability risks from emerging Fintech innovations. This is perhaps due in part to the relatively small size of the Fintech in comparison to the overall financial system. The FSB added that experience shows that risk can emerge quickly if left unchecked.

In November of 2016, Svein Andresen, Secretary General, Financial Stability Board, commented on innovations in finance;

“Financial innovation enabled by the use of new technology, or Fintech, is already a driver of change in the financial system and its importance will inevitably increase. Understanding these innovations, therefore, is important for a full understanding of the structure and functioning of the financial system. Given its mandate to promote international financial stability, the FSB has a role to play as Fintech continues to develop. Our work is focused on new and emerging risks. We have seen many interesting trends over last few years in Fintech. However, it is quite possible that a number of the changes either do not pose new risks or my pose risks that are already effectively regulated.”

Andresen continued to explain the FSB did not want to bias their work against Fintech. The FSB was taking a position of monitoring Fintech and acting upon any risks as they emerge. Andresen added that the FSB has considered the financial stability implications of distributed ledger technology (DLT or Blockchain), and they were in the midst of an in depth study of the financial stability implications of peer to peer lending.

According to the FSB, ten areas of interest have been identified of which the following three are seen as priorities for international collaboration. These three priorities are viewed as “essential” to supporting financial stability “while fostering more inclusive and sustainable finance.” The three priorities are:

- The need to manage operational risk from third-party service providers;

- Mitigating cyber risks; and

- Monitoring macro financial risks that could emerge as Fintech activities increase.

The other areas that merit attention include:

- Cross-border legal issues and regulatory arrangements.

- Governance and disclosure frameworks for big data analytics.

- Assessing the regulatory perimeter and updating it on a timely basis.

- Shared learning with a diverse set of private sector parties.

- Further developing open lines of communication across relevant authorities.

- Building staff capacity in new areas of required expertise.

- Studying alternative configurations of digital currencies.

Carolyn A. Wilkins, Senior Deputy Governor at the Bank of Canada and chair of the FSB’s FinTech Issues Group, said;

Carolyn A. Wilkins, Senior Deputy Governor at the Bank of Canada and chair of the FSB’s FinTech Issues Group, said;

“Regulators need to understand the impact that developments in FinTech can have on financial stability, especially given the rapid rise of innovation in this space. Our report today sets out a clear picture of supervisory and regulatory issues, which the FSB will continue to monitor and discuss going forward.”

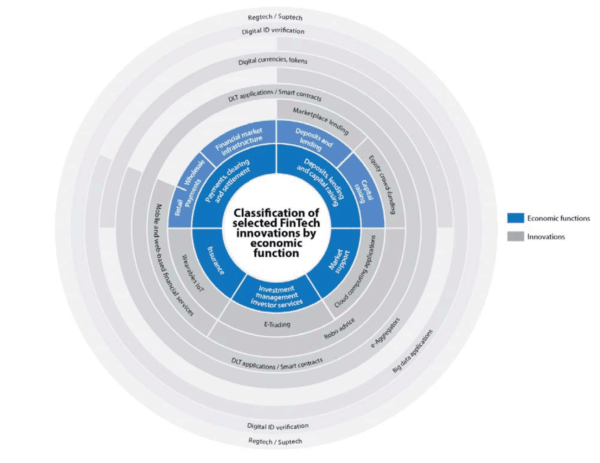

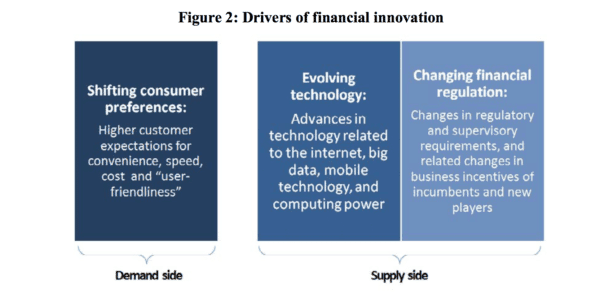

The FSB report has developed a framework that defines the scope of Fintech activities to be covered and classifies them by their primary economic function. The FSB says this enables the analysis to be technology neutral.

The FSB said that potential benefits of Fintech identified in the report include:

- Decentralisation and increased intermediation by non-financial entities;

- Greater efficiency, transparency, competition and resilience of the financial system;

- Greater financial inclusion and economic growth.

The FSB said the potential risks include:

- Institution-specific micro-financial risks that could emerge

- System-wide macro-financial risks, for instance increased connectedness and correlation risk.

The FSB says there is a need for the official and private sectors to improve data on Fintech applications, and for regulators to understand how businesses and the market structure are changing. In particular, international bodies and national authorities should take Fintech into account in their risk assessments and regulatory frameworks.

The FSB report has a brief synopsis of the different sub-sectors of Fintech including capital formation (IE equity crowdfunding / peer to peer lending), Insurtech and more.

The FSB said it intends on delivering this report at the Hamburg G20 Summit on July 7 & 8.

The report, A Financial Stability Implications from FinTech, is embedded below.