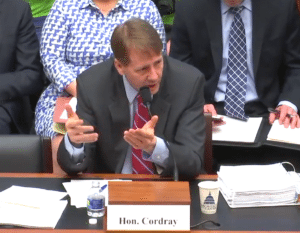

Keith Noreika, acting Comptroller of the Currency, published an Op-Ed in the Hill on Friday that hammered the Consumer Financial Protection Bureau’s (CFPB) decision to push forward an updated rule on arbitration clauses for financial service firms. At the time the ruling was announced, CFPB Director Richard Cordray stated;

“Arbitration clauses in contracts for products like bank accounts and credit cards make it nearly impossible for people to take companies to court when things go wrong.”

Yet this statement stands in stark contrast to the facts. And the facts, in question, come from the CFPB’s own research.

When the CFPB announcement was made, the rule was described as “[transferring] wealth from consumers to wealthy attorneys,” thus the CFPB was providing diminished protection to the consumers the agency is ostensibly tasked with aiding. The CFPBs own data indicated that arbitration rulings tend to generate more favorable outcomes, more quickly, when consumers file disputes with financial firms. The alternative, class action lawsuits, are notorious for generating huge financial payments to attorneys that feed on these types of disputes.

Noreika states;

Noreika states;

“The CFPB’s own data also show that when consumers turn to arbitration, they receive higher settlements more quickly than when they are forced to rely on class action lawyers to fight their case. Class action lawsuits often involve more claimants and may generate big headline settlement figures, but the people making millions are the lawyers when the average individual payout of such suits is just $32. But the likely increase in cost to consumers and the failure to improve settlements are only two concerns.”

And what are these increased costs to consumers?

Noreika explains the OCC did their own review and found that allowing for class action suits may increase the cost of credit by 3.5%.

“The CFPB failed to disclose that observed effect that was apparent in its data. For an agency that demands transparency from the companies it supervises, the omission is an appalling abdication of the bureau’s responsibility to consumers,” says Noreika.

So why would the CFPB take such an action that blatantly harms consumers? Hard to tell. But the revolving door of political appointees to big law firms that tend to benefit from class action lawsuits spins with increasing velocity.

Noreika has asked the Senate to vacate the Arb rule. It will be interesting to see if they have the votes to do so.