HR 3903 or the “Encouraging Public Offerings Act of 2017″ may boost the moribund Initial Public Offering (IPO) market in the US. Passed by the US House of Representatives last week by a solid bipartisan vote of 419 to 0, the bill has three provisions designed to improve the IPO market:

- HR 3903 would expand the JOBS Act’s confidential registration provisions beyond emerging growth companies to all issuers.

- Second, it would allow confidential registration for follow-on offerings for all issuers. Current law provides this capacity only to emerging growth companies. Both of these provisions would codify into law actions undertaken by the Securities Exchange Commission earlier this year.

- the legislation would expand the testing the waters provision in the JOBS Act to all issuers, allowing companies in the initial public offerings process to gauge accredited and institutional investor interest in a securities offering.

The IPO market has sagged in recent years as the cost of issuing public securities has risen dramatically driven by excessive regulations. Private money has moved in to fill the void making IPOs more of an exit than an entry.

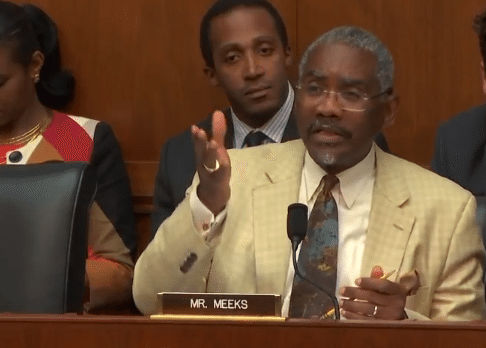

The bipartisan bill was co-sponsored by Representative Gregory Meeks who stated;

The bipartisan bill was co-sponsored by Representative Gregory Meeks who stated;

“Taking a company public is a crucial option for entrepreneurs, allowing them to access funding, build on their ideas, and create jobs. Yet, inherent in the current framework are barriers and costs, which should be minimized to allow companies to grow sustainably. In addition to protecting investors by maintaining reasonable safeguards, Congress should help create a streamlined process that keeps IPOs viable for budding businesses. I am glad that my colleagues in the House agree with Congressman Budd and me and have unanimously supported our bill.”

The bill has now moved over to the Senate Committee on Banking, Housing and Urban Affairs before it heads to a full Senate vote.