EquityZen, a New York-based Fintech firm that operates a secondary marketplace for company-approved transactions in pre-IPO stock, has a mission: to improve the way startup employees are paid by unlocking the value of their equity compensation in a way that benefits all key players, including the shareholder, the company, and the investor, EquityZen launched.

The platform, cofounded by Atish Davda, Shriram Bhashyam and Phil Haslett, believes that employees should have the opportunity to share in the value they create for their company’s shareholders and the company growth. EquityZen also enables investors to invest in private growth companies. Readers likely recognize the (household) names of some of EquityZen’s investments: Spotify, 23 and Me and Lyft. Backed by leading venture capital investors including Dave McClure’s 500 Startups and WorldQuant Ventures, sovereign wealth funds and family offices, EquityZen aims to provide access and liquidity.

In a recent blog, EquityZen posted that the platform had doubled its team in 2017 and, since launching in 2014, had “closed over 2,850 investments in over 80 companies and support a platform that serves over 15,000 qualified investors from more than 40 countries.” In addition to announced the successful new financing round led by Draper Associates, EquityZen hosted liquidity events in a few companies, including Nutanix, AppDynamics, Veracode, Cloudera, Redfin, and Tintri.

In a recent blog, EquityZen posted that the platform had doubled its team in 2017 and, since launching in 2014, had “closed over 2,850 investments in over 80 companies and support a platform that serves over 15,000 qualified investors from more than 40 countries.” In addition to announced the successful new financing round led by Draper Associates, EquityZen hosted liquidity events in a few companies, including Nutanix, AppDynamics, Veracode, Cloudera, Redfin, and Tintri.

I recently had the opportunity to connect with EquityZen CEO Atish Davda to learn more about his views on its $6.5 million financing round, Fintech, PennPAC and mentorship. Our interview follows.

Erin: This past July, EquityZen secured a very zen $6.5 million during its latest financing round. How much funding have you secured to date? How did you sync with Draper Associates and what role, if any, does the firm continue to play?

Atish Davda: EquityZen is a company-approved platform for buying and selling private company equity. We have raised a total of $6.5M in outside capital. This year we closed the outside financing of $3M led by Tim Draper’s firm, who is a big supporter of EquityZen’s mission: bringing private markets to the public.

Atish Davda: EquityZen is a company-approved platform for buying and selling private company equity. We have raised a total of $6.5M in outside capital. This year we closed the outside financing of $3M led by Tim Draper’s firm, who is a big supporter of EquityZen’s mission: bringing private markets to the public.

Last summer, Tim reached out to learn more about EquityZen. He had been following the work we are doing in the space since 2013, and while we were not planning on raising capital at the time, bringing on an investor whose name is synonymous with innovative investing globally just made sense.

[clickToTweet tweet=”Q&A @equityzen CEO Atish Davda #fintech @fintechinsider_ @crowdfundinside #invest” quote=”‘This year we closed the outside financing of $3M led by Tim Draper’s firm, who is a big supporter of EquityZen’s mission: bringing private markets to the public,’ discussed CEO Atish Davda.”]

Erin: How will you use this funding to grow EquityZen? Do you have any other rounds planned in the near future?

Atish Davda: Private markets are less understood than public ones. We plan to educate folks on the risk-adjusted return opportunities private markets offer, while continuing to grow our marketplace, a company-approved venue where those who want to buy and sell the equity of private companies can transact safely. We do not have plans to raise additional capital in the immediate future.

Erin: What is your lowest investment amount? Fee structure? How have you targeted and secured investors? Please share some current stats showing your platform’s growth since 2013.

Atish: Having closed roughly 3,000 private placement transactions in over 80 leading private companies, EquityZen has built a platform trusted by nearly 10,000 shareholders, and over 15,000 suitable accredited investors from 40+ countries.

Atish: Having closed roughly 3,000 private placement transactions in over 80 leading private companies, EquityZen has built a platform trusted by nearly 10,000 shareholders, and over 15,000 suitable accredited investors from 40+ countries.

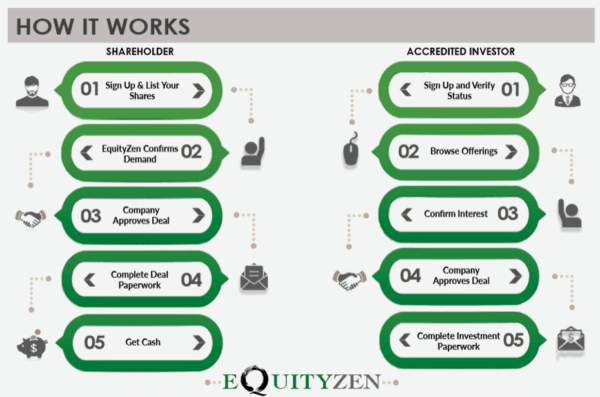

EquityZen’s platform facilitates investments in mature, private companies—with company approval—2-4 years before they exit. The platform serves buyers who are accredited investors and their representatives (e.g. HNWIs, family offices, financial advisors) and sellers who have private company shares (e.g. employees, early investors).

The key insight we had was to realize that while $20 million check-writing investors already have had access to this asset class, we can serve the $20,000 check-writer by building a technology-driven platform. Investors can pay a flat fee of 5% for investments below $500,000 and not worry about any of the hidden fees that some brokers can get away with charging.

[clickToTweet tweet=”Interview @equityzen CEO Atish Anada #fintech @fintechinsider_ @crowdfundinside #invest @Penn @Wharton” quote=”‘The key insight we had was to realize that while $20 million check-writing investors already have had access to this asset class, we can serve the $20,000 check-writer by building a technology-driven platform.'”]

Erin: How have you reduced EquityZen investors’ risk of joining a growing private firm and addressed liquidity and other risk concerns? Tell us about EquityZen’s vetting process.

Atish: Imagine you were only allowed to invest in penny stocks. Now, assume any stock you did buy you were forced to hold for a decade. That sounds crazy. Yet, that’s how broken private markets are: you can either invest $20,000 as an angel investor in a 2-person company with a pitch deck, or wait until a company is public to get another bite at the apple. There’s a massive gap in between when a company has demonstrated they have product market fit, staying power, and execution ability.

Atish: Imagine you were only allowed to invest in penny stocks. Now, assume any stock you did buy you were forced to hold for a decade. That sounds crazy. Yet, that’s how broken private markets are: you can either invest $20,000 as an angel investor in a 2-person company with a pitch deck, or wait until a company is public to get another bite at the apple. There’s a massive gap in between when a company has demonstrated they have product market fit, staying power, and execution ability.

EquityZen’s platform bridges this gap by providing investment access to invest in (and liquidity to sell out of) companies once they are mature and have a path to IPO, but currently are still private. Thus, we open up entry to a different and attractive risk-adjusted return opportunity, previously unavailable.

Without EquityZen, private markets would remain out of reach for most qualified investors who do not have $20 million dollars to invest, which is millions of people.

Erin: What did your Penn engineering, economics and math background fortify the foundation for your career? What advice would you give to current students serious about entering the wonderful world of fintech?

Atish: Here’s what I would say about FinTech: I might forgive Instagram for losing one of my photos; I’ll never forgive my bank for losing one of my dollars.

Atish: Here’s what I would say about FinTech: I might forgive Instagram for losing one of my photos; I’ll never forgive my bank for losing one of my dollars.

FinTech is tricky and interesting for two reasons not shared by most industries. First, it is heavily regulated, and regulations, no matter how you feel about them, are in place for a reason. One can choose to view them as an opportunity, not just an impediment. Second, you are touching people’s money; heavy emphasis on privacy, security, and reporting need to be air-tight.

I always had a passion for numbers, and my academic training helped me discover how smart investing relies on understanding the power and pitfalls of numbers. I started my career at AQR Capital Management, a quantitative hedge fund which used a mix of computers and humans to invest. One of the first projects of my career was to take a sophisticated investment strategy only accessible to institutional investors (min. $50 million) and make it available to the retail investor (min. $2,500). In a way, the simplicity of leveling the playing field regardless of your check-size is just what we’re doing at EquityZen.

[clickToTweet tweet=”On #fintech: @equityzen CEO Atish Anada @fintechinsider_ @crowdfundinside #invest @wharton” quote=”EquityZen CEO Atish Anada on Fintech: ‘I might forgive Instagram for losing one of my photos; I’ll never forgive my bank for losing one of my dollars.'”]

Erin: What are you reading now?

Atish: I just finished Ray Dalio’s Principles, his philosophy on life and management. While I do not agree with many of his principles, he is a quant and he built Bridgewater (AQR competitor), so as I build EquityZen, I can at least relate to the circumstances he faced.

Erin: Why did you decide to become a mentor in the PennPac program? What have you learned during this pro bono work?

Atish: PennPAC (Penn Pro bono Alumni Consulting) is a phenomenal organization: it is a non-profit whose mission is to help other non-profits. Being able to serve on its Board has been a humbling experience as I am surrounded by folks with full-time jobs moonlighting to do good in the world. In fact, in the past five years, PennPAC has delivered $3 million of consulting pro bono to over 50 non-profits.

Atish: PennPAC (Penn Pro bono Alumni Consulting) is a phenomenal organization: it is a non-profit whose mission is to help other non-profits. Being able to serve on its Board has been a humbling experience as I am surrounded by folks with full-time jobs moonlighting to do good in the world. In fact, in the past five years, PennPAC has delivered $3 million of consulting pro bono to over 50 non-profits.

Erin: What’s in store for EquityZen?

Atish: It took the public markets nearly a century to mature and develop to where they are now. EquityZen is trying to ensure private markets mature in a fraction of the time.