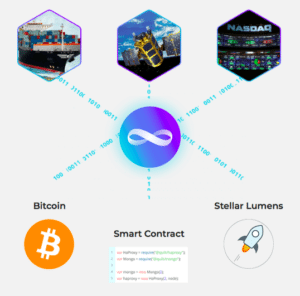

Mobius, described as a “turn-key blockchain-enabling platform” using patent-pending technology, offers a range of products, including a free, universal API that allows non-blockchain developers to connect resources to smart contracts and the blockchain ecosystem. Existing web properties, apps, devices and data streams can utilize the API to integrate and accept any blockchain token.

Stanford alum, Harvard Law grad and Mobius Co-founder CEO David Gobaud is quickly moving toward realizing its goal of connecting every developer, device and data stream to the blockchain ecosystem.

In November 2017 the Silicon Valley-based Venture Capital firm Camp  One Ventures backed Mobius with a pre-ICO $500,000 investment.

One Ventures backed Mobius with a pre-ICO $500,000 investment.

In January 2018, the company reportedly raised $35 million, claiming the “largest pre-sale of 2018.” Then came the record MOBI initial coin offering public sale. Originally scheduled to close on 18 February, the MOBI ICO sold out in just over two hours. Participants included Jed McCaleb, Chandler Guo and Jackson Palmer, each of whom sits on Mobius’ Advisory Board.

What is the MOBI token? Designed to enable companies and consumers to exchange data by smart contracts and plug into the blockchain ecosystem, Mobius describes itself as integrating the old internet with the new decentralized internet similar to how Stripe integrates payment processing into Apps. Mobius noted that over 55,000 people registered for the public token sale, which was the first to be built on and supported by Stellar, not Ethereum.

So why did Gobaud and his team opt for Stellar? Gobaud discusses this decision, Mobius’ proof-of-stake oracle system, opting for a Cayman Island HQ, the platform’s future and more in the interview that follows:

Why did you opt for Stellar, the protocol created by Ripple co-founder Jed McCaleb, instead of Ethereum for the sale?

David Gobaud: We chose Stellar instead of Ethereum because we realized Ethereum could not handle the Mobius DApp Store transaction volume. Ethereum only runs at ~7 token transactions per second and transactions can cost more than $0.30 (sometimes multiple dollars!), which is significantly greater than credit card fees! Ethereum is also very insecure because it does not natively support multi-sig wallets and beyond that has an insecure Turing complete scripting language built in — both problems have contributed to the loss of hundreds of millions of dollars worth of Ether.

Stellar, on the other hand, runs at ~1,000 transactions per second today and costs fractions of a cent per transaction. Stellar also natively supports multi-sig wallets and has smart contracting capabilities without a Turing complete programming language, so its attack surface is much smaller. We also really liked that Stellar has the Stellar Distributed Exchange which makes it easy for our DApp Store users to acquire MOBI without relying on any centralized system.

[clickToTweet tweet=”.@mobius_network chose @StellarLumens over #Ethereum…Ethereum could not handle the Mobius DApp Store transaction volume. ” quote=”.@mobius_network chose @StellarLumens over Ethereum…Ethereum could not handle the Mobius DApp Store transaction volume.”]

Erin: What innovations would you suggest for Stellar going forward?

David: Some ideas for making Stellar better and easier to use for customers are:

David: Some ideas for making Stellar better and easier to use for customers are:

- Having the option for an issuer to remove the trustline requirement of its asset to facilitate airdrops.

- Allowing an account to reject incoming payments that don’t have a memo.

- Allowing an account to reject XLM payments (this can already be done with other assets by not having a trustline).

- Allowing an issuing account to be configured to reject its own assets (thinking about a locked issuer).

Erin: Did you run into any problems using blockchain during the sale? How did you remedy any issues?

David: As the first big Stellar token sale we had some bugs and learned a lot through the process, but the MOBI sold out so quickly we didn’t have time to fix the issues. We are going to write a blog post with an explanation of the bugs and suggestions for future Stellar token sales so they don’t have the same issues.

[clickToTweet tweet=”.@mobius_network @davidgobaud: ‘Mobius PSOP allows companies to securely put data up for sale on the #blockchain based Mobius DDM, thus allowing fast and secure global data commerce to take place.'” quote=”.@mobius_network @davidgobaud: ‘Mobius PSOP allows companies to securely put data up for sale on the #blockchain based Mobius DDM, thus allowing fast and secure global data commerce to take place.'”]

Erin: How can blockchain be effectively used by Mobius as a data marketplace? Any spinoff ideas?

David: Data is the new oil and the Mobius Proof of Stake Oracle Protocol (PSOP) enables global data commerce through the Mobius Decentralized Data Marketplace (DDM) which is analogous to a NASDAQ for data. Specifically, the Mobius PSOP allows companies to securely put data up for sale on the blockchain based Mobius DDM, thus allowing fast and secure global data commerce to take place.

Erin: Please comment on Mobius’ proof-of-stake oracle system.

David: LESS TECHNICAL ANSWER/SHORTER ANSWER: Mobius’ Patent Pending Proof of Stake Oracle Protocol reduces the Blockchain Oracle Problem into an oracle-arbiter consensus & coordination protocol. Our Proof of Stake Oracle Protocol is designed using a federated byzantine agreement system to minimize the trust that end users require and allows for the coordination of chains of events & transfers of data unlike current solutions which are akin to internet certification authorities and only coordinate single transfers of data drastically limiting the use case of such oracles. Another important feature is asymptotic fault tolerance & security which guarantees ease of scaling. In fact our decentralized network of oracles become safer to use, with ever lower levels of trust as we scale up.

LONGER/MORE TECHNICAL ANSWER: Mobius’ Patent Pending Proof of Stake Oracle Protocol reduces the Blockchain Oracle Problem into an oracle-arbiter consensus & coordination protocol. Our Proof of Stake Oracle Protocol is designed using a tiered federated byzantine agreement system that minimize trust and allows for the coordination of chains of events (data transfers) between multiple parties unlike current solutions which are akin to internet certification authorities and only coordinate single events between two fixed end users drastically limiting the use cases of such implementations. Mobius’ protocol allows participants to select trusted oracles from indexed listings in our market of competing oracles and then automatically builds tiered slices attaining quorum that are capable of attaining consensus while minimizing trust. Oracles compete on quality and are segmented into tiered levels in order to overcome the market for lemons problem and provide a transcendental quality differential. Consensus solutions at equilibrium exist inside the Shapley-Shubik core and limit collusion amongst oracles. The protocol is designed to protect against Sybil attacks and functions even under a coordinated 51% attack. The most important feature of the protocol is this asymptotic fault tolerance & security which guarantees ease of scaling due to Metcalfe’s law. In fact our decentralized network of oracles become safer to use, with ever lower levels of trust as we scale up.

LONGER/MORE TECHNICAL ANSWER: Mobius’ Patent Pending Proof of Stake Oracle Protocol reduces the Blockchain Oracle Problem into an oracle-arbiter consensus & coordination protocol. Our Proof of Stake Oracle Protocol is designed using a tiered federated byzantine agreement system that minimize trust and allows for the coordination of chains of events (data transfers) between multiple parties unlike current solutions which are akin to internet certification authorities and only coordinate single events between two fixed end users drastically limiting the use cases of such implementations. Mobius’ protocol allows participants to select trusted oracles from indexed listings in our market of competing oracles and then automatically builds tiered slices attaining quorum that are capable of attaining consensus while minimizing trust. Oracles compete on quality and are segmented into tiered levels in order to overcome the market for lemons problem and provide a transcendental quality differential. Consensus solutions at equilibrium exist inside the Shapley-Shubik core and limit collusion amongst oracles. The protocol is designed to protect against Sybil attacks and functions even under a coordinated 51% attack. The most important feature of the protocol is this asymptotic fault tolerance & security which guarantees ease of scaling due to Metcalfe’s law. In fact our decentralized network of oracles become safer to use, with ever lower levels of trust as we scale up.

Erin: How is Mobius enabling a safer, faster and secure blockchain community? What issues has Mobius confronted since launching and how will this affect the platform’s push for innovation?

David: As the first big Stellar token sale we learned a lot and introduced thousands of people to the Stellar ecosystem. As Mobius and Stellar are new platforms to consumers there were some hiccups that we are resolving.

For example, some people sent XLM and MOBI to the MOBI issuer account – we are working on reversing these transactions to refund people. People did this probably because of a combination of 1) Stellar user-facing software has not been widely used yet so it is confusing and 2) the people thought the Mobius issuer was somehow similar to an Ethereum token’s contract address but it is not. No one should send assets to the Mobius issuer account!

Erin: How are Jed McCaleb, Chandler Guo, and Jackson Palmer involved in Mobius. How have you connected with investors, including Y Combinator, Angel Chain Capital and Waltonchain? How did you source your team?

Erin: How are Jed McCaleb, Chandler Guo, and Jackson Palmer involved in Mobius. How have you connected with investors, including Y Combinator, Angel Chain Capital and Waltonchain? How did you source your team?

David: Jed, Chandler, and Jackson are amazing advisors and big token buyers – they are not investors. Y Combinator is not involved. I was a part of the YC S17 batch as part of a different company. Angel Chain Capital did invest via the YC SAFE document we used for our investment round. Cyrus met Waltonchain in China and formed a great partnership that will combine their blockchain hardware technology with our patent pending PSOP and DDM-enabling IoT data commerce in the blockchain ecosystem. Waltonchain has also invested in Mobius via the YC SAFE.

Erin: Why did you choose a Cayman Island base?

David: We chose Cayman Islands for tax reasons – the US tax code was outdated and did not support small companies like Mobius with massive revenue. If we were in the US, last year taxes would have taken around ~45% of our revenue because we are a small company with outsize revenue compared to our employee count and related deductions that companies with as much revenue as us usually have. The situation improved a bit with the new tax code and had it been in effect last year we probably would have stayed in the US.

[clickToTweet tweet=”For the consumer #crypto-revolution to happen the technology needs to become easier and more secure for customers to use @mobius_network” quote=”For the consumer #crypto-revolution to happen the technology needs to become easier and more secure for customers to use @mobius_network”]

Erin: Do you think global companies will begin to accept crypto more readily? What needs to happen for a crypto-revolution?

David: Yes! This is one of the things we are working on. For the consumer crypto-revolution to happen the technology needs to become easier and more secure for customers to use. Mobius is working on both of these things with its DApp Store, which is the #1 result on Google when searching “DApp Store”. The DApp Store helps solve the consumer adoption problem by solving both sides of the adoption equation: 1) we make it easy for developers to accept crypto payments and 2) we make it easy for consumers to acquire and spend crypto.

What’s next for Mobius?

David: Mobius is currently focused on signing partnerships with Mobius Network Ecosystem Onramp Partners so consumers have more options to acquire MOBI than the SDX. On the technology side Mobius is focusing on launching its PSOP and DDM and signing up large international businesses to use it.

Have a crowdfunding offering you'd like to share? Submit an offering for consideration using our Submit a Tip form and we may share it on our site!