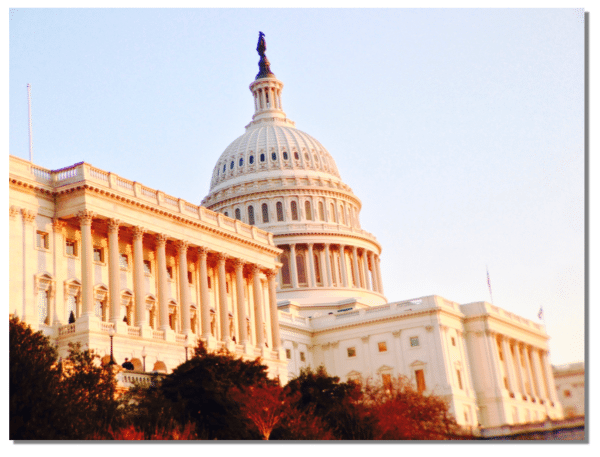

Today, the House of Representatives passed HR 3299, “the Protecting Consumer’s Access to Credit Act of 2017.” The Bill was approved mainly along party lines as Republicans supported the measure and Democrats voted against it but 16 Democrats crossed over in support of the legislation.

The Bill largely impacts online lenders and a legal case known as Madden v. Midland Funding LLC. The law suit stems around allowable interest rates as to which state a loan is originated and who ends up holding the loan as state laws are different regarding rates charged on loans.

HR 3299 was sponsored by Chief Deputy Whip Patrick McHenry, a known advocate of Fintech, small business and the little guy in general, whose office said the bill supported financial inclusion for all Americans that can help consumers and small business. But the legislation caught the ire of multiple special interest groups, some who labeled the legislation a “Rent a Bank Scheme” or fueling “predatory payday lending.”

[clickToTweet tweet=”this multilayered regulatory regime has become a field of landmines for all #Fintech firms, not just online lenders” quote=”this multilayered regulatory regime has become a field of landmines for all #Fintech firms, not just online lenders”]

So the question is – which is it? Is this Bill bad for consumers or does it address a problematic regulatory idiosyncrasy?

First of all, let’s not shoot the messenger here, but the real problem is the obtuse financial regulatory environment of the United States. Federal financial regulators and state regulators are not always on the same page. If financial regulations across all 50 states were harmonized – there would not be any need for this discussion. Yet, state based regulators will never, ever, relinquish any authority without a fight because that is what they are paid to do (with your tax dollars no less). But this multilayered regulatory regime has become a field of landmines for all Fintech firms, not just online lenders.

So back to HR 3299.

The fulcrum of the Madden case was whether the National Bank Act, which preempts state usury laws regulating the interest a national bank may charge on a loan, continues to have preemptive effect after the national bank has sold or otherwise assigned the loan to another entity. Before Madden came along, loans were subject only to usury laws of a single state but the court’s decision raised the risk of multiple jurisdictions being brought into the mix creating a challenge for online lending platforms such as LendingClub or Prosper. These are online lenders that allow borrowers to consolidate high credit card debt into less expensive loans. Enabling borrowers to reduce high interest rates is largely viewed as a positive thing. So why the claim by detractors that the bill “will expand unchecked predatory lending and allow lenders to make high-cost loans.” Good question.

The fulcrum of the Madden case was whether the National Bank Act, which preempts state usury laws regulating the interest a national bank may charge on a loan, continues to have preemptive effect after the national bank has sold or otherwise assigned the loan to another entity. Before Madden came along, loans were subject only to usury laws of a single state but the court’s decision raised the risk of multiple jurisdictions being brought into the mix creating a challenge for online lending platforms such as LendingClub or Prosper. These are online lenders that allow borrowers to consolidate high credit card debt into less expensive loans. Enabling borrowers to reduce high interest rates is largely viewed as a positive thing. So why the claim by detractors that the bill “will expand unchecked predatory lending and allow lenders to make high-cost loans.” Good question.

Let’s go back to the states once again.

Different states have different rules regarding interest rate caps. According to LectricLaw, in the District of Columbia, the interest rate cap is 24%. In Colorado it is 45%. Why is that? Call the state and ask. That is just a single example.

If opponents of HR 3299 do not want predatory loans to occur why don’t they address the issue at the state level where the problem originated? Or simply lobby to fix the state based regulatory morass and remove state regulators from the equation?

A vote against HR 3299 was move to throw the baby out with the bathwater.

Reversing the Madden decision will provide certainty to market participants that partner with banks, not to payday lenders. Fintech lenders need this clarity to provide alternatives to payday lending for consumers that deserve a better option of getting access to credit.

Reversing the Madden decision will provide certainty to market participants that partner with banks, not to payday lenders. Fintech lenders need this clarity to provide alternatives to payday lending for consumers that deserve a better option of getting access to credit.

As Nat Hoopes, Executive Director of the Marketplace Lending Association, stated;

“Over the past decade, borrowers across America have used marketplace loans to start new businesses and save billions of dollars through lower interest rates and more transparent products. Today’s action by the House will help ensure that small businesses and consumers can continue to access these affordable credit products online. This legislation simply restores the law of the land as it stood as recently as 2015, providing greater certainty for responsible, well-regulated and supervised partnerships between traditional banks and their fintech partners.”

Timothy Li, a Fintech entrepreneur and Crowdfund Insider Contributor, called passage of the bill a big win for Fintech;

“The House’s pivotal decision is a milestone enabling many more Fintech partnerships with federally chartered banks. This is certainty a victory for many Fintech players in the lurch holding off their partnership aspirations in payment, digital wallet, lending and crypto space.”

[clickToTweet tweet=”The House’s pivotal decision is a milestone enabling many more Fintech partnerships with federally chartered banks. This is certainty a victory for many #Fintech players” quote=”The House’s pivotal decision is a milestone enabling many more Fintech partnerships with federally chartered banks. This is certainty a victory for many #Fintech players”]

Li added that the Bill was another nail in the coffin for the OCC’s proposed Fintech charter but overall, this was good for Fintech innovation.

“We will see additional confidence from the investor community with certainty on the horizon.”

Congressman McHenry released statement explaining the bill can have an “outsized impact on American families and small businesses.”

Congressman McHenry released statement explaining the bill can have an “outsized impact on American families and small businesses.”

“This legislation merely restores consistency to our nation’s banking laws after activist judges upended nearly 200 years of legal precedent,” said McHenry. “The practical effect of this bipartisan bill is much more significant. Its passage marks an important step towards modernizing our financial system and ensuring financial inclusion for all Americans”

The key here is the Bill being a step towards modernizing our financial system. While just a single step, more of this is needed. If consumer advocates want the little guy to have a chance at financial inclusion and access to better financial services, Congress needs to enact this bill and then keep going further.