On Tuesday, Ripple announced that the Japanese Bank Consortium will release MoneyTap mobile app, which is powered by the company’s blockchain technology, to allow customers of the bank consortium to settle transactions instantly, 24 hours a day, seven days a week.

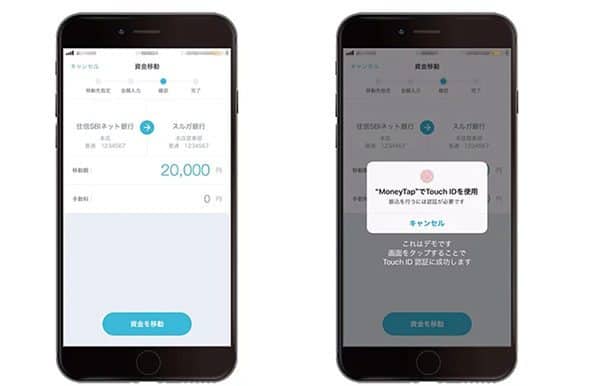

According to Ripple, MoneyTap is a mobile app that is used by multiple banks in Japan. Three members of the Japan bank consortium, SBI Net Sumishin Bank, Suruga Bank and Resona Bank, will be the first to go live on the mobile app in autumn of 2018. This will be followed by a staggered roll out to the rest of consortium. The app will notably allow the bank consortium customers to make instant domestic payments and only requires a bank account, phone number, or QR code.

Ripple also noted that MoneyTap helps shed the costs associated with existing banking and ATM fees that are currently applied to domestic money transfers in Japan, making those payments not just faster, but cost less overall. Takashi Okita, CEO of SBI Ripple Asia, stated:

“We are proud to leverage Ripple’s blockchain technology through our new mobile app, MoneyTap, to improve the payments infrastructure in Japan. Together with the trust, reliability and reach of the bank consortium, we can remove friction from payments and create a faster, safer, and more efficient domestic payments experience for our customers.”

Emi Yoshikawa, Director of Joint Venture Partnerships at Ripple, added:

“The release of the MoneyTap mobile app shows Ripple’s continued commitment to provide its partners across Asia and the world with blockchain-powered solutions that dramatically improve the customer payments journey. We’re proud to provide this production-ready technology that not only improves the international payments experience, but also have applications for domestic payments infrastructure.”