Entersekt, a South African-based fintech, announced this week it is launching a digital payments enablement product, Connekt, which will add new payment services to banking apps notably quickly and easily.

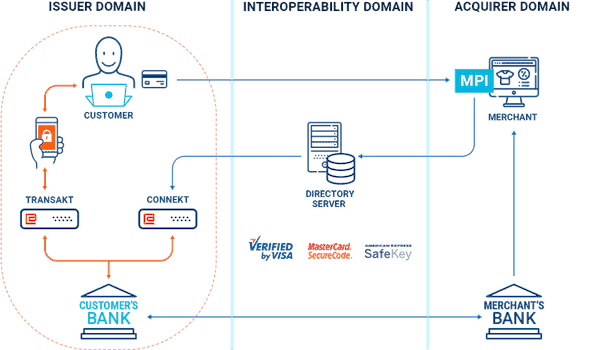

According to the company, Connekt helps financial institutions resolve this quandary. It puts at their disposal a secure service platform and menu of on-the-go digital payments functionality and third-party products, including tokenization and HCE wallets for tap to pay, QR-based scan to pay, and 3-D Secure 1.0 and 2.0. These new payments services can be switched on within their existing banking apps quickly and easily, no matter the underlying technology, payment endpoint, or merchant network involved.

“Whether shopping online, using a third-party wallet, using a payment initiation service provider, scanning a QR code, or using a contactless payment method, your account holders want a consistent experience. It saves them time and inspires confidence in the safety and reliability of the services you provide them. Connekt delivers a converged, predictable user experience for card-on-file and tokenized use cases across all digital channels, quickly and painlessly.”

Entersekt noted that with Connekt it will add a new suite of services to its digital platform. Schalk Nolte, Entersekt CEO, stated:

“We are applying that we have learned in digital banking security over the last decade to a broader set of problems affecting providers of digital services. Entersekt has always seen itself as a fintech partner to banks, and our institutional customers remain our biggest source of inspiration.By listening to them closely and responding with creativity, we continue to make good on our commitment to enable the best in mobile-first innovation.”

Founded in 2008, Entersekt describes itself as an innovator in push-based authentication and app security. The company reported that its patented security products protect millions of devices and transactions daily while complying with the world’s most stringent regulatory guidelines.