In a morning talk Monday at the massive cryptocurrency conference Consensus, economist James Bullard, President and CEO of the Federal Reserve Bank of St. Louis, challenged the vision of a muliti-coin paradise espoused by ICO (Initial Coin Offering) marketers.

His thesis in a nutshell: Many currencies, many headaches.

“Kind of feel like I’m walking into the Lion’s den, here,” Bullard joked as he strode on stage.

In his talk, “Non-Uniform Currencies and Exchange Rate Chaos,” Bullard asserted that too many cryptocurrencies would likely complicate and slow market-based exchange processes and create hassles for users, just as multiple bank-issued currencies did in pre-civil war America.

“Historically the profusion of privately-issued currencies created an unsatisfactory system,” said Bullard. “In the 1830’s 90% of currencies were privately-issued…by different banks.”

Those currencies were not only inconvenient to convert, “they traded at a premium” and lost value to currency traders when exchanged.

Those currencies were not only inconvenient to convert, “they traded at a premium” and lost value to currency traders when exchanged.

Citizens travelling across the country, said Bullard, “had to check in a book what their notes were worth in this new place. People didn’t like that, so there were lots of calls for a uniform currency in the US….(and) we got a uniform currency into the US.”

In the contemporary global economy, said Bullard, multiple global currencies and concurrent, “volatile exchange rates have not been popular…among economists and policy makers.”

Bullard paused to define a currency as an essentially worthless item that nonetheless people agree will be “taken in future trades.”

These currencies coexist in “equilibrium,” and are granted perceived validity based on a country’s reputation and that of its monetary policies. The goal of central bankers is to keep a national currency attractive: “In my world,” said Bullard, “there is a good equilibrium where everyone wants to hold the money and a bad…where nobody wants to hold the money.”

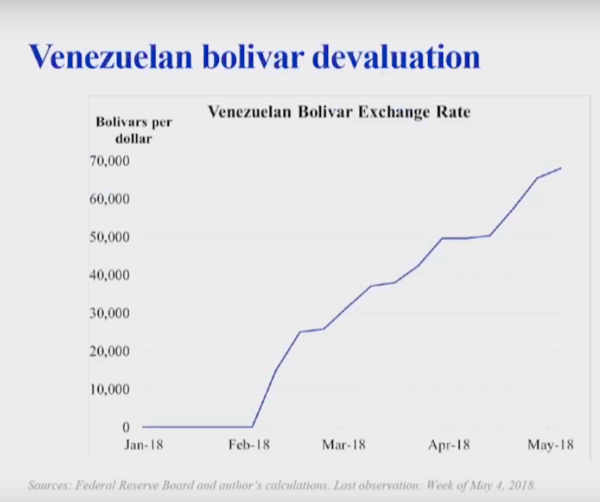

Poor policies lead to poor confidence and examples of ‘currency competition’ in the real world where national currencies like the US dollar and the Venezuelan Bolivar compete for validity, said Bullard.

“Unstable” Venezuelan monetary policy, said Bullard, has caused the Bolivar to hyper-inflate and fail to compete against the US dollar. Citizens have dumped the currency.

“Unstable” Venezuelan monetary policy, said Bullard, has caused the Bolivar to hyper-inflate and fail to compete against the US dollar. Citizens have dumped the currency.

“If you were holding…Bolivars,” he said, “you might have been wiped out almost completely.”

Inflations have also led to a demonstrated increase in demand for Bitcoin abroad. “So the promise of cryptocurrencies,” said Bullard,”is they might be able to protect us against the vagaries of Venezuelan-type monetary policy.”

“Private currency can enter this competition and that is exactly what’s happening today.”

Bullard stated that he thinks both national currencies and cryptocurrencies are required in the new equilibrium because “privately-issued money facilitates trade that would not otherwise occur.”

[clickToTweet tweet=”both national currencies and #cryptocurrencies are required in the new equilibrium because ‘privately-issued money facilitates trade that would not otherwise occur.'” quote=”both national currencies and #cryptocurrencies are required in the new equilibrium because ‘privately-issued money facilitates trade that would not otherwise occur.'”]

Still, cryptocurrencies pose the problem of “illegal or quasi-legal” transactions, such as drug trades or circumvention of Chinese capital controls, and also suffer exchange rate volatility.

Bullard said the currency theories of economists Friedman and Mundel are prevailing in the modern milieu:

“Milton Friedman’s mantra on the subject…(is) everyone who wants to issue a private currency could do so and would…” and all would be accepted as a medium of exchange.

Bullard cited a statistic from Investing.com stating that 1800 cryptocurrencies have been launched. “Exactly what Friedman predicted,” he said. Many cryptocurrencies are “trading now minute by minute at different rates.”

“The only reason that is not a bigger issue,” said Bullard, “is because the total volume of cryptocurrency trades is not that large in comparison to the total economy, yet…But if it gets bigger, this’ll become a bigger issue.”

Bullard said the current situation could be described as “a drift” towards non-uniform currencies in the US. Rather than being a boom of “value” for customers as marketers claim, the multi coin universe may be more about fees and clutter.

“One has to suspect that consumers will not like a situation of multiple currencies trading simultaneously at different prices,” said Bullard. (Currency traders, on the other hand…)

“Maybe there’s a technological solution to that,” he offered. “Maybe you could get it so that people will like it. But one suspects, based on the history, that they will not like it.”

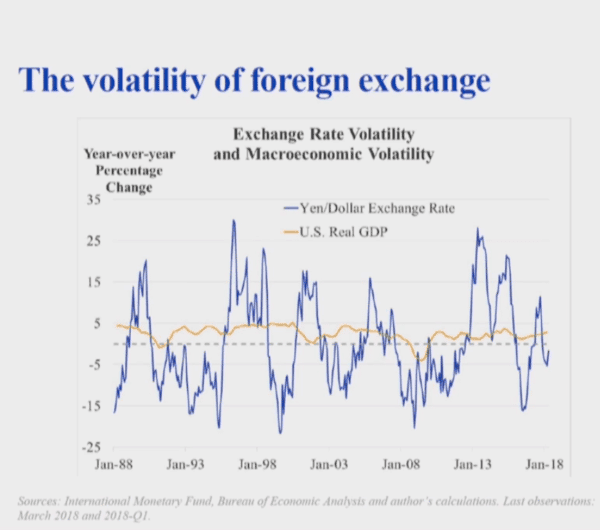

Volatility, too, interferes with a currency’s utility, said Bullard. Currencies “have to hold their value. That’s one of the reasons that government-backed currency historically, combined with a stable monetary policy,” has led to the acceptance of state-issued currencies.

Tethering a crypto to a real world asset or imposing a limited supply in a crypto’s coded monetary policy, said Bullard, will not necessarily create the same stable value that ongoing central management does. The problem of currency-instability, said Bullard, is “not mitigated, in my opinion, by a commodity-based money nor by cryptocurrency.”

One issue to Bullard is blockchain forks.

“With cryptocurrencies you have monetary policy embedded in the code and…a system of fixed volumes of coins, but the system can still bifurcate, creating two fixed volumes of coins, so now what’s determining…the future value of those coins?”

“So you still have this issue of what is the credible promise on limits of future issuance?”

Some crypto pundits have pointed that many forked blockchain currencies die out and do not substantially dilute the main supply. However, there is also the issue of multiple private cryptocurrencies and their native blockchains diluting the total supply of all cryptos.

Bullard recommended Tom Sargent’s book, “The Ends of Four Big Inflations,” in which Sargent looked at hyperinflation in four countries following WWI, and, “found that they all ended with credible commitments to monetary policies…They ended on a day by making a credible promise (with regard to future issuance)…believed by the private sector…”

“This is the core issue behind all currencies. How credible are the promises for limits on future issuance?”

Bullard ended on “the chaos of exchange rates.” Societies have generally disliked the complexities of trading in multiple currencies at multiple exchange rates, a problem that was resolved by a uniform currency.

Panama, said Bullard, is “dollarized- they got rid of this problem totally. They are accepting US monetary policy and…the dollar. And that’s the way it is in Panama.”

Just like the “dollarized” Panamanians, a country accepting a cryptocurrency, “would be accepting the monetary policy embedded in the code (and) exchange rates associated.”

People want stable price signals so they can determine value, said Bullard.

Even two countries with “stable monetary policies (inflation rates)” like the US and Japan can see their currencies oscillate “excessively” relative to each other. Bullard showed this chart. “The red line is US GDP…kind of the fundamental (line)”:

Even two countries with “stable monetary policies (inflation rates)” like the US and Japan can see their currencies oscillate “excessively” relative to each other. Bullard showed this chart. “The red line is US GDP…kind of the fundamental (line)”:

“A local non-uniform currency system (of multiple cryptocurrencies) might have the same volatility”

The other prevailing economist now is the Canadian Mundell, “(whose) ideas lead to the creation of the Euro, a uniform currency for the Euro area” and “whose chart shows a dead weight loss from non-uniform currency arrangements.”