Earlier this year, the Deloitte Center for Financial Services (DCFS) and LendIt Fintech joined together to publish a survey on online lending and the current state of the ecosystem. The numbers were highlighted this past April during the LendIt Fintech conference but Deloitte has recently shared the complete report.

According to the document, the cost of capital is key for online lenders. A statement that should come as no surprise. The authors state that when it comes to lowering this cost – size matters.

The survey covered 34 different online lenders. Most survey participants had loan portfolios of under $50 million and half a dozen had portfolios of more than US$500 million. Just four registered over $1 billion. The report states:

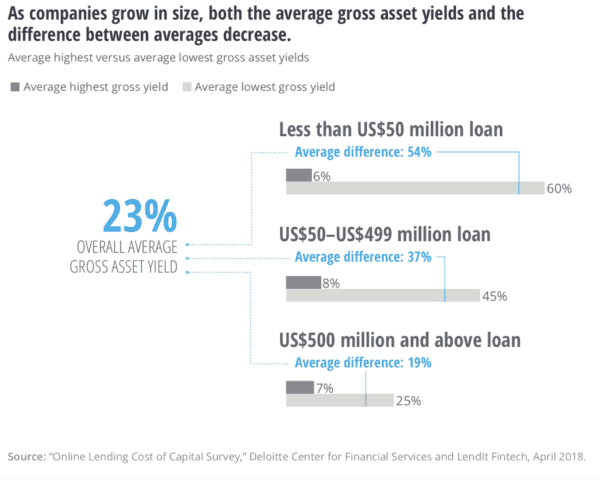

“… the results of the survey also suggest that a company’s scale affects its ability to competitively offer products at a discount in the market. With their lower cost of funding, larger companies seem to be able to operate with lower gross asset yields, which translates into lower rates for customers. Not only do the yields decrease by company size, but also the difference between their lowest and highest gross yields shrinks by size as well.”

The data indicates:

- As companies grow in size, both the average gross asset yields and the difference between averages decrease.

- Larger companies are increasingly able to move to the lowest cost of financing: securitization

- For unsecured consumer lending the weighted average cost of financing was 14% for lenders that did not have third-party backup servicers and 5.8% for those that had them; for small business lending, the percentages were 10.7% and 6.5%, respectively.

- online lenders with the most scale, given their access to a wider diversity of capital sources and at lower costs than competitors, would be best positioned to weather a credit down cycle.

- The number of online lending startups dropped from 100 in 2014 to 63 in 2015 to 30 in 2016 to only four in 2017 which appears to indicate a maturing market

In looking closely at the report, it appears not to reference Marcus, the Fintech money center bank launched by Goldman Sachs. Marcus has access to the cheapest cost of capital of them all. Consumer deposits. Can the big securitization guys compete with billions in deposits that paying out less than 2%?

So is bigger better? Perhaps. Scale obviously counts but, in reality, the market is still quite young and evolving rapidly. Just wait until the next round of digital challenger banks go global. And what about those blockchain based lending sites?