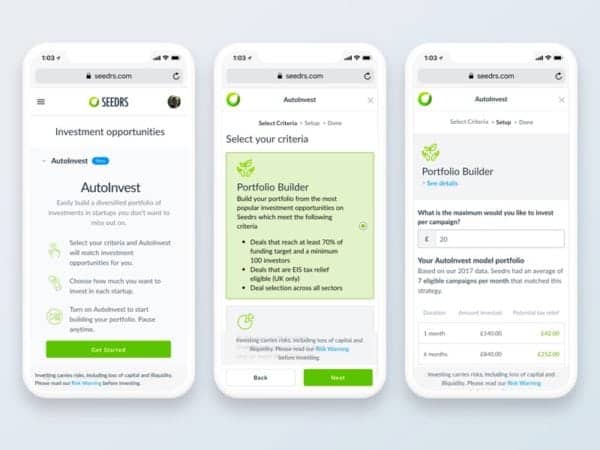

Investment crowdfunding platform Seedrs has announced a new feature. AutoInvest will now enable a robo-investing type service for individuals to gain access to early stage private equity while facilitating a diverse portfolio for risk mitigation.

For the past six years, investments on equity crowdfunding platforms have largely been entirely on a self-directed basis, with investors hand picking every campaign to invest in individually. AutoInvest will allow investors to set criteria and build investment strategies based on characteristics like industry sector, stage of businesses, tax eligibility or more.

Seedrs says that they believe the majority of their investors enjoy surfing the site and reviewing which investments that they want to invest in, they have had a lot of feedback that some investors simply don’t have the time to do this. But these individuals are interested in backing promising young firms and may have a preference, for example, inversting in any campaign that is EIS or SEIS eligible. Seedrs states that it will roll out further customisable features in the coming weeks.

Seedrs’ AutoInvest is the first of its kind in the equity crowdfunding sector and follows recent trends in the robo-investment space. The launch today sees the first iteration of AutoInvest with set criteria, however Seedrs will roll out further customisable features, allowing investors to select from criteria such as S/EIS tax eligibility, sector or stage of business, over the coming weeks.

“Seedrs is leading the way with new developments in the online early-stage investment sector and we are always striving to further innovate,” said Jeff Kelisky, CEO of Seedrs. “After launching our pioneering secondary market, we expanded our focus over to advances in automation and AI, and we’re thrilled to be launching another sector first with Seedrs’ AutoInvest. This exciting new feature opens up the asset class to more people than ever before.”

The launch of AutoInvest follows Seedrs’ £10 million funding round in October 2017 that was led by Neil Woodford. Seedrs said it would use funds raised for advances in AI and automation. Last year, Seedrs launched an “IRR tool,” giving investors 24-hour, year-round online access to their portfolio, enabling them to monitor investments and view their Internal Rate of Return on both a tax adjusted and non-tax adjusted basis.

Joel Ippoliti, Chief Product Officer at Seedrs, said that understanding what their customers want is core to what they do. Investors will now have a quicker option to invest to build a diversified early stage portfolio.

“ Bringing customisation and transparency to an auto invest tool such as this is a real game changer; there’s nobody else doing anything quite like it.”

Seedrs has funded 650 deals to date. All investments made through Seedrs offer voting shares to investors and use a nominee structure that provides a professional grade subscription agreements. This means investors get the same level of protection that angel investors and VCs demand.