With tech titans the most valuable companies on the planet, the notion of self-regulation is no longer appropriate or fit for purpose. Is now the time for governments to step in to protect consumers and ensure a more competitive environment?

The role of the technology firms in the economy has changed dramatically over the last two decades. Seven out of 10 of the largest companies in the world – by market capitalisation – are tech businesses (vs three only seven years ago) although remarkably none of these companies are European. As the dust settles on this new normal, institutionalisation follows.

The tech firms have typically been of the view that self-regulation is best and government intervention is by definition bureaucratic and reactionary. However, the tech giants are falling foul of their self-regulatory responsibilities and continue to come under fire for a host of misdemeanors from privacy failures and tax evasion to spreading fake news and stifling competition.

Most recently the Facebook-Cambridge Analytica scandal involving the collection and misuse of 87m Facebook profiles amplified calls for a crackdown on the tech giants for formal oversight, effective regulation, governance and accountability.

Regulation and governance

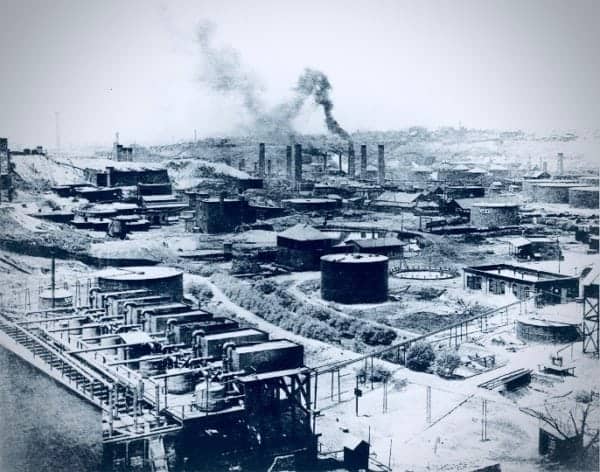

When thinking about regulating the big tech firms, one can draw a parallel to Rockefeller’s Standard Oil. It grew from a single refinery in Cleveland, Ohio in 1863 to become the largest oil refinery in the world. In 1911, the US Supreme Court ruled that Standard Oil was in breach of anti-trust legislation, declared the company an unreasonable monopoly and ordered the company be broken up.

Although the analogy to Standard Oil may appear broad-brushed, it provides a reasonable comparison. Only the oil has now been replaced with data which is now the lifeblood of today’s digital economy.

The emergence of client data as an asset – resold for advertising purposes by the likes of Google and Facebook or used to upsell or cross-sell by Alibaba, Amazon and Tencent for instance – has turned siloed client information across all sectors into a seemingly unlimited source of untapped riches.

[clickToTweet tweet=”The emergence of client data as an asset by the likes of Google and Facebook or used to upsell or cross-sell by Alibaba, Amazon and Tencent has turned siloed client information into a seemingly unlimited source of untapped riches” quote=”The emergence of client data as an asset by the likes of Google and Facebook or used to upsell or cross-sell by Alibaba, Amazon and Tencent has turned siloed client information into a seemingly unlimited source of untapped riches”]

Preserving the market from an anti-trust and data misuse perspective is clearly paramount, as is the preservation and promotion of innovation and international competitiveness. The fact that none of the seven largest firms previously mentioned are European only serves to highlight the importance of ensuring a more competitive environment.

Data management and empowering the consumer

In considering a framework for regulating the tech giants, one can look to the recent EU General Data Protection Regulation (GDPR) which came into effect in May with the goal of restoring consumers’ online privacy by empowering users to control their personal data.

The roll-out of GDPR and implementation of PSD2 is forcing companies to review the flow and use of data. Both are built on the principle that individuals own their personal data and should be able to choose how it is used and with whom it is shared. However, in order to be effective, the practice has to be supplemented through proactively empowering the consumer and the ecosystem around it.

The roll-out of GDPR and implementation of PSD2 is forcing companies to review the flow and use of data. Both are built on the principle that individuals own their personal data and should be able to choose how it is used and with whom it is shared. However, in order to be effective, the practice has to be supplemented through proactively empowering the consumer and the ecosystem around it.

To take another analogy, this time from the energy market. Greenhouse gases can’t be painlessly reduced by the simple curbs of conventional non-renewable sources. The established solution involved subsidies to the challenger solar, wind and geothermal energy providers. Restrictions are not an end-game. One has to provide and grow an alternative deemed to have a social public good.

The same should apply in the case of data-management. Active encouragement of self-sovereign identity systems, most likely using blockchain, will go a long way to preserving competitiveness while relentlessly driving innovation and stripping down the barriers to entry across consumer verticals.

The threat of the winner-takes-all mentality

Without the necessary oversight, the economic might of the winner-takes-all tech behemoths will likely grow even stronger as they continue to push the limits of traditional finance. The meteoric rise of Ant Financial – the financial services arm of Alibaba and the world’s highest valued Fintech company – has in part been attributed to the fact that China’s financial regulatory architecture has not (as yet) been reformed to adapt to the Fintech era with existing laws lagging behind the pace of technology.

Without the necessary oversight, the economic might of the winner-takes-all tech behemoths will likely grow even stronger as they continue to push the limits of traditional finance. The meteoric rise of Ant Financial – the financial services arm of Alibaba and the world’s highest valued Fintech company – has in part been attributed to the fact that China’s financial regulatory architecture has not (as yet) been reformed to adapt to the Fintech era with existing laws lagging behind the pace of technology.

It is beyond doubt that the banks in Asia are victims of technology inertia, consumers aren’t forced to download Alipay – it’s simply a great product which sells itself. However, while the Asian banks are subject to stringent anti-money laundering (AML) and know-your client (KYC) regulation, tech firms like Tencent circumvent that by offering a non-financial service (e.g. WeChat messaging), harnessing the client data and targeting the customer with a financial product offering. This tactic has spread like wildfire in Asia and has led in a slew of services currently upending the financial services sector.

The shift of the consumer away from the banks to the tech firms is not the issue per se, as consumers are themselves actively making this choice. However, the issue may arise further down the line if tech giants are given free rein to continue maximising customer data, blurring the lines between industries in their quest to be all things to all consumers. The result – further entrenching their superpower status and posing an ever-increasing threat to both incumbents and fintech startups alike.

A tiered approach to regulation

Bearing in mind that regulatory compliance tends to become a serious overhead it’s important to tread lightly to avoid over-reach. Looking at the current banking regulation – institutions deemed systemically important by the Federal Reserve in the US are subject to a different system of rules than their smaller counterparts.

And given that opening up the customer data on demand requires careful API management, most likely requiring significant resource allocation, it makes sense to enforce any new regulation to institutions of a certain size.

To encourage innovation and a flourishing Fintech industry, smaller firms and Fintech startups should initially be allowed to focus on perfecting product-market fit before being asked to comply with more stringent data handing requirements. Such a reprieve will enable Fintechs to thrive and become better positioned to effectively fulfill their regulatory responsibility.

Hence, the tiered approach to regulation is relevant. Enable the firms to grow and innovate, and then prevent anti-competitive practices further down the line. Any regulation should not favour the Fintechs or the banks but should be applied ubiquitously across industries. Importantly, regulation should act in favour of competition and innovation while also representing the best interests of consumers.

[clickToTweet tweet=”regulation should act in favour of competition and innovation while also representing the best interests of consumers #Fintech” quote=”regulation should act in favour of competition and innovation while also representing the best interests of consumers #Fintech”]

Alexander Dunaev is co-founder and COO, of ID Finance. Alexander leads technology, R&D, product development, scoring models engineering and data science. He also oversees business development and the overall strategy for the business in partnership with his CEO. Alexander has over nine years’ experience in banking and finance, having previously worked at Deutsche Bank. He holds a Masters in Finance from Imperial College London and the Chartered Financial Analyst designation.

Alexander Dunaev is co-founder and COO, of ID Finance. Alexander leads technology, R&D, product development, scoring models engineering and data science. He also oversees business development and the overall strategy for the business in partnership with his CEO. Alexander has over nine years’ experience in banking and finance, having previously worked at Deutsche Bank. He holds a Masters in Finance from Imperial College London and the Chartered Financial Analyst designation.