Smiling former PayPal CEO Bill Harris returned to the CNBC talkshow Fast Money in August to slam Bitcoin use cases, characterize the network and its proponents as “a cult” and predict the eventual devaluation of Bitcoin to “close to zero.”

Smiling former PayPal CEO Bill Harris returned to the CNBC talkshow Fast Money in August to slam Bitcoin use cases, characterize the network and its proponents as “a cult” and predict the eventual devaluation of Bitcoin to “close to zero.”

But the veteran payments businessperson was met with lively counterarguments from CNBC Fast Money “trader” Brian Kelly, who extolled Bitcoin’s virtues as an attractively volatile and fresh investment, as well as a hedge in “broken financial systems.”

Harris began by teasing CNBC’s panelists:

“You know, I’m delighted that you like buying into weakness cuz I think you’ll have a lot of opportunity to do that.”

Everyone laughed, then Harris began in earnest.

Bitcoin is an illusion, he said. “There’s just no value there.” He then challenged the central tenets of Bitcoin:

“The cult of Bitcoin make(s) many claims: that it’s instant, free, scalable, efficient, secure, globally-accepted and useful. It is none of these things.”

Brian Kelly then responded that Bitcoin had worked “just fine” helping Russian hackers buy election-intereferring ads in secret, adding that scalability and rapidity are being worked on, as a matter of necessity, “otherwise it is going to go to zero.”

“But the idea that Bitcoin and other cryptocurrencies are a software program that allows you to dis-intermediate parts of financial services, do you find any value in that?” asked Kelly.

“No…you don’t need Bitcoin, you don’t need XRP…(to resolve slowness and expense in international remittances). What you need is faster networks.”

People are “hardly ever,” using Bitcoin for remittances now in terms of percentage of “global flows,” he said.

But Bitcoin’s fringe appeal is exactly what makes it an interesting investment, said Kelly. If Bitcoin factored into a huge percentage of global capital flows, “it’s less interesting to me,” as an investor, he said. “If its old and boring, it’s not interesting to me.”

Kelly then added that Bitcoin has also found real utility in environments with poor economic stability and in places with limited economic infrastructure:

“In the United States, we don’t have a broken financial system, but if you’re in a country that does…that’s certainly an advantage (of a decentralized payment system like Bitcoin)…It could be the Internet of money if you’re going across borders…there’s actually multiple use cases.”

Harris countered, “The largest countries out there- China, now India- they have much better real-time payment systems than we do in the US, so does the EU, so does the UK…It’s not like we have something functioning and the rest of the world doesn’t. Actually they’re ahead of us,” he said.

“(But) that doesn’t mean that Bitcoin doesn’t have a use case and it’s going to zero,” argued Kelly. “Nobody uses gold anymore and it’s at $1200 an ounce. There’s more to this thing than just this payment system globally…this is a way that you can have digital goods go from one place to another. I mean when Amazon started, nobody thought that you’d be streaming movies from a hand-held computer. It was an online bookstore!”

“We’ve got digital payment currencies…that are more stable, more widely-accepted and that have intrinsic value…It’s called the dollar, the yen, you name it,” countered Harris, adding:

“Yes I believe there’s a lot of investment potential within financial technology. I’ve been doing financial technology for twenty-five years. But what we do is we build things that are… better than the alternatives, and I see absolutely no reason why (Bitcoin) is useful. I mean, listen: Its volatility alone makes it useless as a payment mechanism and ridiculous as a store of value.”

“But again, I’ll go back to the investment opportunity,” replied Kelly. “If you look at oil, oil’s speculation to use case is about 96-1. Bitcoin’s speculation to use case is 2.5-1, so as that speculation increases, the volatility will decrease, just like every commodity…(and) currency out there.”

“I’m not saying that there aren’t some fabulous visions in the world that should be funded and have staying power and legs,” said Harris in his closing remarks, “but you can point to use cases and why they’re competitively superior to the alternative.”

“In Bitcoin’s case I can’t come up with a single one with the exception of criminal activity,” he said.

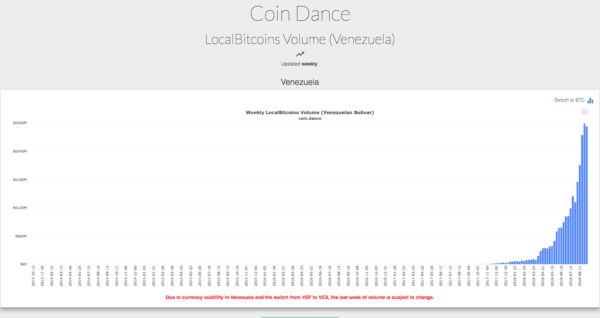

According to Coindance, Bitcoin trading volumes in Venezuela, where authorities have been cracking down on Bitcoin mining and so-called criminal use, reached all time highs last week as the country plunged further into economic crisis.