Wadiz, the largest crowdfunding platform in South Korea, has shared a recent report on equity crowdfunding that indicates a growing marketplace.

Online capital formation was first legalized in Korea in January 2016 by legislation that created amendments to the Capital Markets Act. Presently, there are 14 crowdfunding platforms registered with the Korean Financial Services Commission (FSC). Out of the 14 platforms, Wadiz claims a 68% share of the market in funding, 89% in the number of participants, and 58% in the number of companies using crowdfunding..

Originally, the annual cap per company for crowdfunding was pegged at Krw 2 million – about USD $ 623,000. That was deemed too low by the FSC and has since been increased in 2018 to Krw 2 billion or USD $ 1.8 million.

Additional tweaks were incorporated where individual investor limits were increased and a trading lock was changed from one year to 6 months. Each of these adjustment have had its intended impact to improve the investment crowdfunding ecosystem.

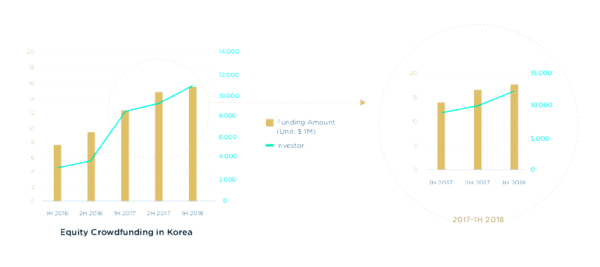

According to Wadiz and a report published for the first 6 months of 2018, to date the amount of funding in equity crowdfunding shows double growth compared to that in the first half of 2016. Additionally, investors in equity crowdfunding have quadrupled in growth and increased by 17% compared to the second half of 2017.

Since inception, 70% of companies that raised capital via crowdfunding have been valued at USD $4.4 million or less. But as limits have increased, larger companies are said to be looking to use crowdfunding as vehicle to raise growth capital.

The report indicates that:

- 80% of the companies who successfully raised investment in 1H 2018 have a valuation that is under $ 4.4 million

- Of these companies valued less than $ 4.4 million, 59% successfully raise money, whereas, companies over $ 4.4 million in valuation showed 100% successful rate.

- 81% of the companies raised less than $260,000.

Wadiz believes that investment crowdfunding is having an impact in providing access to capital for early stage firms. A regulatory agency that is willing to adjust and improve the regulatory environment has clearly been beneficial to the South Korean ecosystem.

It will be interesting to see how the rest of year evolves and whether a greater number of more mature firms pursue raising capital online.